Page 218 - Annual Report 2020

P. 218

24 Employee share ownership plans continued

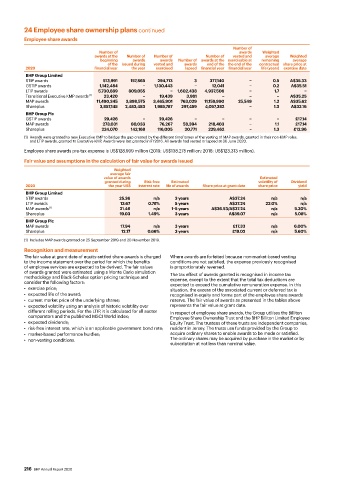

Employee share awards

Number of

Number of awards Weighted

awards at the Number of Number of Number of vested and average Weighted

beginning awards awards Number of awards at the exercisable at remaining average

of the issued during vested and awards end of the the end of the contractual share price at

2020 financial year the year exercised lapsed financial year financial year life (years) exercise date

BHP Group Limited

STIP awards 513,991 157,865 294,713 3 377,140 − 0.5 A$35.33

GSTIP awards 1,142,484 − 1,130,443 − 12,041 − 0.2 A$35.51

LTIP awards 5,730,889 809,055 − 1,602,438 4,937,506 − 1.7 −

Transitional Executive KMP awards (1) 23,420 − 19,439 3,981 − − − A$35.25

MAP awards 11,490,345 3,898,575 3,465,901 763,029 11,159,990 25,549 1.2 A$35.62

Shareplus 3,857,145 2,483,483 1,985,787 297,459 4,057,382 − 1.3 A$32.16

BHP Group Plc

GSTIP awards 29,426 − 29,426 − − − − £17.14

MAP awards 273,031 80,033 76,267 58,394 218,403 − 1.1 £17.14

Shareplus 224,070 142,168 116,005 20,771 229,462 − 1.3 £12.96

(1) Awards were granted to new Executive KMP to bridge the gap created by the different timeframes of the vesting of MAP awards, granted in their non-KMP roles,

and LTIP awards, granted to Executive KMP. Awards were last granted in FY2016. All awards had vested or lapsed at 30 June 2020.

Employee share awards pre-tax expense is US$128.999 million (2019: US$138.275 million; 2018: US$123.313 million).

Fair value and assumptions in the calculation of fair value for awards issued

Weighted

average fair

value of awards Estimated

granted during Risk-free Estimated volatility of Dividend

2020 the year US$ interest rate life of awards Share price at grant date share price yield

BHP Group Limited

STIP awards 25.36 n/a 3 years A$37.24 n/a n/a

LTIP awards 13.67 0.78% 5 years A$37.24 22.0% n/a

MAP awards (1) 21.46 n/a 1-5 years A$36.53/A$37.24 n/a 5.30%

Shareplus 19.03 1.49% 3 years A$39.07 n/a 5.08%

BHP Group Plc

MAP awards 17.94 n/a 3 years £17.33 n/a 6.00%

Shareplus 12.17 0.66% 3 years £19.02 n/a 5.60%

(1) Includes MAP awards granted on 25 September 2019 and 20 November 2019.

Recognition and measurement

The fair value at grant date of equity-settled share awards is charged Where awards are forfeited because non-market-based vesting

to the income statement over the period for which the benefits conditions are not satisfied, the expense previously recognised

of employee services are expected to be derived. The fair values is proportionately reversed.

of awards granted were estimated using a Monte Carlo simulation The tax effect of awards granted is recognised in income tax

methodology and Black-Scholes option pricing technique and expense, except to the extent that the total tax deductions are

consider the following factors: expected to exceed the cumulative remuneration expense. In this

• exercise price; situation, the excess of the associated current or deferred tax is

• expected life of the award; recognised in equity and forms part of the employee share awards

• current market price of the underlying shares; reserve. The fair value of awards as presented in the tables above

• expected volatility using an analysis of historic volatility over represents the fair value at grant date.

different rolling periods. For the LTIP, it is calculated for all sector In respect of employee share awards, the Group utilises the Billiton

comparators and the published MSCI World index; Employee Share Ownership Trust and the BHP Billiton Limited Employee

• expected dividends; Equity Trust. The trustees of these trusts are independent companies,

• risk-free interest rate, which is an applicable government bond rate; resident in Jersey. The trusts use funds provided by the Group to

• market-based performance hurdles; acquire ordinary shares to enable awards to be made or satisfied.

• non-vesting conditions. The ordinary shares may be acquired by purchase in the market or by

subscription at not less than nominal value.

216 BHP Annual Report 2020