Page 221 - Annual Report 2020

P. 221

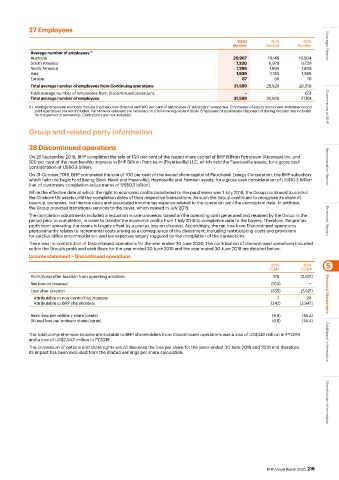

27 Employees

2020 2019 2018

Number Number Number Strategic Report

Average number of employees (1)

Australia 20,967 18,146 16,504

South America 7,330 6,979 6,729

North America 1,296 1,999 1,839

Asia 1,939 1,743 1,368

Europe 57 59 70

Total average number of employees from Continuing operations 31,589 28,926 26,510

Total average number of employees from Discontinued operations − − 651

Total average number of employees 31,589 28,926 27,161

(1) Average employee numbers include the Executive Director and 100 per cent of employees of subsidiary companies. Employees of equity accounted investments and Governance at BHP

joint operations are not included. Part-time employees are included on a full-time equivalent basis. Employees of businesses disposed of during the year are included

for the period of ownership. Contractors are not included.

Group and related party information

28 Discontinued operations

On 28 September 2018, BHP completed the sale of 100 per cent of the issued share capital of BHP Billiton Petroleum (Arkansas) Inc. and

100 per cent of the membership interests in BHP Billiton Petroleum (Fayetteville) LLC, which held the Fayetteville assets, for a gross cash

consideration of US$0.3 billion. Remuneration Report

On 31 October 2018, BHP completed the sale of 100 per cent of the issued share capital of Petrohawk Energy Corporation, the BHP subsidiary

which held the Eagle Ford (being Black Hawk and Hawkville), Haynesville and Permian assets, for a gross cash consideration of US$10.3 billion

(net of customary completion adjustments of US$0.2 billion).

While the effective date at which the right to economic profits transferred to the purchasers was 1 July 2018, the Group continued to control

the Onshore US assets until the completion dates of their respective transactions. As such the Group continued to recognise its share of

revenue, expenses, net finance costs and associated income tax expense related to the operation until the completion date. In addition,

the Group provided transitional services to the buyer, which ceased in July 2019.

The completion adjustments included a reduction in sale proceeds, based on the operating cash generated and retained by the Group in the

period prior to completion, in order to transfer the economic profits from 1 July 2018 to completion date to the buyers. Therefore, the pre-tax Directors’ Report

profit from operating the assets is largely offset by a pre-tax loss on disposal. Accordingly, the net loss from Discontinued operations

predominantly relates to incremental costs arising as a consequence of the divestment, including restructuring costs and provisions

for surplus office accommodation, and tax expenses largely triggered by the completion of the transactions.

There was no contribution of Discontinued operations for the year ended 30 June 2020. The contribution of Discontinued operations included

within the Group’s profit and cash flows for the year ended 30 June 2019 and the year ended 30 June 2018 are detailed below:

Income statement – Discontinued operations

2019 2018 5

US$M US$M

Profit/(loss) after taxation from operating activities 175 (2,921)

Net loss on disposal (510) −

Loss after taxation (335) (2,921)

Attributable to non-controlling interests 7 26 Financial Statements

Attributable to BHP shareholders (342) (2,947)

Basic loss per ordinary share (cents) (6.6) (55.4)

Diluted loss per ordinary share (cents) (6.6) (55.4)

The total comprehensive income attributable to BHP shareholders from Discontinued operations was a loss of US$342 million in FY2019

and a loss of US$2,943 million in FY2018. Additional information

The conversion of options and share rights would decrease the loss per share for the years ended 30 June 2019 and 2018 and therefore

its impact has been excluded from the diluted earnings per share calculation. Shareholder information

BHP Annual Report 2020 219