Page 219 - Annual Report 2020

P. 219

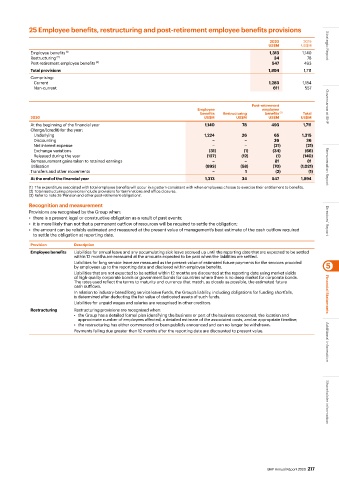

25 Employee benefits, restructuring and post-retirement employee benefits provisions

2020 2019

US$M US$M Strategic Report

Employee benefits (1) 1,313 1,140

Restructuring (2) 34 78

Post-retirement employee benefits (3) 547 493

Total provisions 1,894 1,711

Comprising:

Current 1,283 1,154

Non-current 611 557

Post-retirement Governance at BHP

Employee employee

benefits Restructuring benefits (3) Total

2020 US$M US$M US$M US$M

At the beginning of the financial year 1,140 78 493 1,711

Charge/(credit) for the year:

Underlying 1,224 26 65 1,315

Discounting − − 36 36

Net interest expense − − (21) (21)

Exchange variations (31) (1) (34) (66)

Released during the year (127) (12) (1) (140)

Remeasurement gains taken to retained earnings − − 81 81

Utilisation (893) (58) (70) (1,021) Remuneration Report

Transfers and other movements − 1 (2) (1)

At the end of the financial year 1,313 34 547 1,894

(1) The expenditure associated with total employee benefits will occur in a pattern consistent with when employees choose to exercise their entitlement to benefits.

(2) Total restructuring provisions include provisions for terminations and office closures.

(3) Refer to note 26 ‘Pension and other post-retirement obligations’.

Recognition and measurement

Provisions are recognised by the Group when:

• there is a present legal or constructive obligation as a result of past events;

• it is more likely than not that a permanent outflow of resources will be required to settle the obligation; Directors’ Report

• the amount can be reliably estimated and measured at the present value of management’s best estimate of the cash outflow required

to settle the obligation at reporting date.

Provision Description

Employee benefits Liabilities for annual leave and any accumulating sick leave accrued up until the reporting date that are expected to be settled

within 12 months are measured at the amounts expected to be paid when the liabilities are settled.

Liabilities for long service leave are measured as the present value of estimated future payments for the services provided

by employees up to the reporting date and disclosed within employee benefits. 5

Liabilities that are not expected to be settled within 12 months are discounted at the reporting date using market yields

of high-quality corporate bonds or government bonds for countries where there is no deep market for corporate bonds.

The rates used reflect the terms to maturity and currency that match, as closely as possible, the estimated future

cash outflows.

In relation to industry-based long service leave funds, the Group’s liability, including obligations for funding shortfalls,

is determined after deducting the fair value of dedicated assets of such funds. Financial Statements

Liabilities for unpaid wages and salaries are recognised in other creditors.

Restructuring Restructuring provisions are recognised when:

• the Group has a detailed formal plan identifying the business or part of the business concerned, the location and

approximate number of employees affected, a detailed estimate of the associated costs, and an appropriate timeline;

• the restructuring has either commenced or been publicly announced and can no longer be withdrawn.

Payments falling due greater than 12 months after the reporting date are discounted to present value. Additional information

BHP Annual Report 2020 217 Shareholder information