Page 222 - Annual Report 2020

P. 222

28 Discontinued operations continued

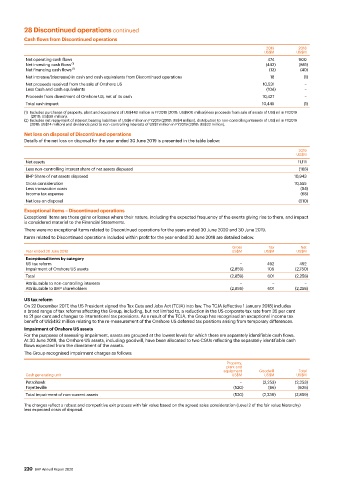

Cash flows from Discontinued operations

2019 2018

US$M US$M

Net operating cash flows 474 900

Net investing cash flows (1) (443) (861)

Net financing cash flows (2) (13) (40)

Net increase/(decrease) in cash and cash equivalents from Discontinued operations 18 (1)

Net proceeds received from the sale of Onshore US 10,531 −

Less Cash and cash equivalents (104) −

Proceeds from divestment of Onshore US, net of its cash 10,427 −

Total cash impact 10,445 (1)

(1) Includes purchases of property, plant and equipment of US$443 million in FY2019 (2018: US$900 million) less proceeds from sale of assets of US$ nil in FY2019

(2018: US$39 million).

(2) Includes net repayment of interest bearing liabilities of US$6 million in FY2019 (2018: US$4 million), distribution to non-controlling interests of US$ nil in FY2019

(2018: US$14 million) and dividends paid to non-controlling interests of US$7 million in FY2019 (2018: US$22 million).

Net loss on disposal of Discontinued operations

Details of the net loss on disposal for the year ended 30 June 2019 is presented in the table below:

2019

US$M

Net assets 11,111

Less non-controlling interest share of net assets disposed (168)

BHP Share of net assets disposed 10,943

Gross consideration 10,555

Less transaction costs (54)

Income tax expense (68)

Net loss on disposal (510)

Exceptional items – Discontinued operations

Exceptional items are those gains or losses where their nature, including the expected frequency of the events giving rise to them, and impact

is considered material to the Financial Statements.

There were no exceptional items related to Discontinued operations for the years ended 30 June 2020 and 30 June 2019.

Items related to Discontinued operations included within profit for the year ended 30 June 2018 are detailed below.

Gross Tax Net

Year ended 30 June 2018 US$M US$M US$M

Exceptional items by category

US tax reform − 492 492

Impairment of Onshore US assets (2,859) 109 (2,750)

Total (2,859) 601 (2,258)

Attributable to non-controlling interests − − −

Attributable to BHP shareholders (2,859) 601 (2,258)

US tax reform

On 22 December 2017, the US President signed the Tax Cuts and Jobs Act (TCJA) into law. The TCJA (effective 1 January 2018) includes

a broad range of tax reforms affecting the Group, including, but not limited to, a reduction in the US corporate tax rate from 35 per cent

to 21 per cent and changes to international tax provisions. As a result of the TCJA, the Group has recognised an exceptional income tax

benefit of US$492 million relating to the re-measurement of the Onshore US deferred tax positions arising from temporary differences.

Impairment of Onshore US assets

For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows.

At 30 June 2018, the Onshore US assets, including goodwill, have been allocated to two CGUs reflecting the separately identifiable cash

flows expected from the divestment of the assets.

The Group recognised impairment charges as follows:

Property,

plant and

equipment Goodwill Total

Cash generating unit US$M US$M US$M

Petrohawk – (2,253) (2,253)

Fayetteville (520) (86) (606)

Total impairment of non-current assets (520) (2,339) (2,859)

The charges reflect a robust and competitive exit process with fair value based on the agreed sales consideration (Level 2 of the fair value hierarchy)

less expected costs of disposal.

220 BHP Annual Report 2020