Page 220 - Annual Report 2020

P. 220

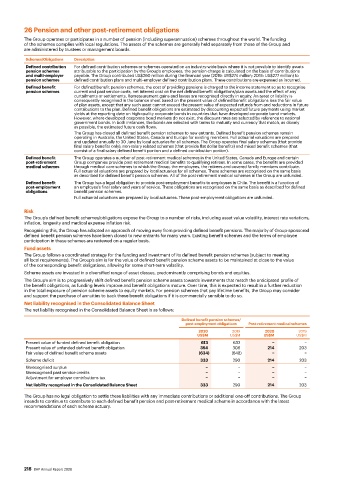

26 Pension and other post-retirement obligations

The Group operates or participates in a number of pension (including superannuation) schemes throughout the world. The funding

of the schemes complies with local regulations. The assets of the schemes are generally held separately from those of the Group and

are administered by trustees or management boards.

Schemes/Obligations Description

Defined contribution For defined contribution schemes or schemes operated on an industry-wide basis where it is not possible to identify assets

pension schemes attributable to the participation by the Group’s employees, the pension charge is calculated on the basis of contributions

and multi-employer payable. The Group contributed US$260 million during the financial year (2019: US$274 million; 2018: US$277 million) to

pension schemes defined contribution plans and multi-employer defined contribution plans. These contributions are expensed as incurred.

Defined benefit For defined benefit pension schemes, the cost of providing pensions is charged to the income statement so as to recognise

pension schemes current and past service costs, net interest cost on the net defined benefit obligations/plan assets and the effect of any

curtailments or settlements. Remeasurement gains and losses are recognised directly in equity. An asset or liability is

consequently recognised in the balance sheet based on the present value of defined benefit obligations less the fair value

of plan assets, except that any such asset cannot exceed the present value of expected refunds from and reductions in future

contributions to the plan. Defined benefit obligations are estimated by discounting expected future payments using market

yields at the reporting date on high-quality corporate bonds in countries that have developed corporate bond markets.

However, where developed corporate bond markets do not exist, the discount rates are selected by reference to national

government bonds. In both instances, the bonds are selected with terms to maturity and currency that match, as closely

as possible, the estimated future cash flows.

The Group has closed all defined benefit pension schemes to new entrants. Defined benefit pension schemes remain

operating in Australia, the United States, Canada and Europe for existing members. Full actuarial valuations are prepared

and updated annually to 30 June by local actuaries for all schemes. The Group operates final salary schemes (that provide

final salary benefits only), non-salary related schemes (that provide flat dollar benefits) and mixed benefit schemes (that

consist of a final salary defined benefit portion and a defined contribution portion).

Defined benefit The Group operates a number of post-retirement medical schemes in the United States, Canada and Europe and certain

post-retirement Group companies provide post-retirement medical benefits to qualifying retirees. In some cases, the benefits are provided

medical schemes through medical care schemes to which the Group, the employees, the retirees and covered family members contribute.

Full actuarial valuations are prepared by local actuaries for all schemes. These schemes are recognised on the same basis

as described for defined benefit pension schemes. All of the post-retirement medical schemes in the Group are unfunded.

Defined benefit The Group has a legal obligation to provide post-employment benefits to employees in Chile. The benefit is a function of

post-employment an employee’s final salary and years of service. These obligations are recognised on the same basis as described for defined

obligations benefit pension schemes.

Full actuarial valuations are prepared by local actuaries. These post-employment obligations are unfunded.

Risk

The Group’s defined benefit schemes/obligations expose the Group to a number of risks, including asset value volatility, interest rate variations,

inflation, longevity and medical expense inflation risk.

Recognising this, the Group has adopted an approach of moving away from providing defined benefit pensions. The majority of Group-sponsored

defined benefit pension schemes have been closed to new entrants for many years. Existing benefit schemes and the terms of employee

participation in these schemes are reviewed on a regular basis.

Fund assets

The Group follows a coordinated strategy for the funding and investment of its defined benefit pension schemes (subject to meeting

all local requirements). The Group’s aim is for the value of defined benefit pension scheme assets to be maintained at close to the value

of the corresponding benefit obligations, allowing for some short-term volatility.

Scheme assets are invested in a diversified range of asset classes, predominantly comprising bonds and equities.

The Group’s aim is to progressively shift defined benefit pension scheme assets towards investments that match the anticipated profile of

the benefit obligations, as funding levels improve and benefit obligations mature. Over time, this is expected to result in a further reduction

in the total exposure of pension scheme assets to equity markets. For pension schemes that pay lifetime benefits, the Group may consider

and support the purchase of annuities to back these benefit obligations if it is commercially sensible to do so.

Net liability recognised in the Consolidated Balance Sheet

The net liability recognised in the Consolidated Balance Sheet is as follows:

Defined benefit pension schemes/

post-employment obligations Post-retirement medical schemes

2020 2019 2020 2019

US$M US$M US$M US$M

Present value of funded defined benefit obligation 613 632 − −

Present value of unfunded defined benefit obligation 354 306 214 203

Fair value of defined benefit scheme assets (634) (648) − −

Scheme deficit 333 290 214 203

Unrecognised surplus − − − −

Unrecognised past service credits − − − −

Adjustment for employer contributions tax − − − −

Net liability recognised in the Consolidated Balance Sheet 333 290 214 203

The Group has no legal obligation to settle these liabilities with any immediate contributions or additional one-off contributions. The Group

intends to continue to contribute to each defined benefit pension and post-retirement medical scheme in accordance with the latest

recommendations of each scheme actuary.

218 BHP Annual Report 2020