Page 215 - Annual Report 2020

P. 215

22 Financial risk management continued

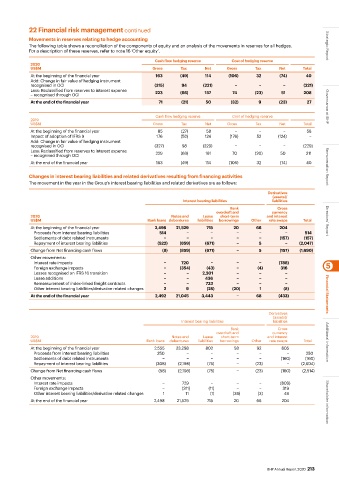

Movements in reserves relating to hedge accounting

The following table shows a reconciliation of the components of equity and an analysis of the movements in reserves for all hedges. Strategic Report

For a description of these reserves, refer to note 16 ‘Other equity’.

Cash flow hedging reserve Cost of hedging reserve

2020

US$M Gross Tax Net Gross Tax Net Total

At the beginning of the financial year 163 (49) 114 (106) 32 (74) 40

Add: Change in fair value of hedging instrument

recognised in OCI (315) 94 (221) − − − (221)

Less: Reclassified from reserves to interest expense 223 (66) 157 74 (23) 51 208

– recognised through OCI

At the end of the financial year 71 (21) 50 (32) 9 (23) 27 Governance at BHP

Cash flow hedging reserve Cost of hedging reserve

2019

US$M Gross Tax Net Gross Tax Net Total

At the beginning of the financial year 85 (27) 58 − − − 58

Impact of adoption of IFRS 9 176 (52) 124 (176) 52 (124) −

Add: Change in fair value of hedging instrument

recognised in OCI (327) 98 (229) − − − (229)

Less: Reclassified from reserves to interest expense 229 (68) 161 70 (20) 50 211

– recognised through OCI

At the end of the financial year 163 (49) 114 (106) 32 (74) 40 Remuneration Report

Changes in interest bearing liabilities and related derivatives resulting from financing activities

The movement in the year in the Group’s interest bearing liabilities and related derivatives are as follows:

Derivatives

(assets)/

Interest bearing liabilities liabilities

Bank Cross

overdraft and currency

2020 Notes and Lease short-term and interest

US$M Bank loans debentures liabilities borrowings Other rate swaps Total Directors’ Report

At the beginning of the financial year 2,498 21,529 715 20 66 204

Proceeds from interest bearing liabilities 514 − − − − − 514

Settlements of debt related instruments − − − − − (157) (157)

Repayment of interest bearing liabilities (522) (859) (671) − 5 − (2,047)

Change from Net financing cash flows (8) (859) (671) − 5 (157) (1,690)

Other movements:

Interest rate impacts − 720 − − − (788)

Foreign exchange impacts − (354) (43) − (4) 316 5

Leases recognised on IFRS 16 transition − − 2,301 − − −

Lease additions − − 436 − − −

Remeasurement of index-linked freight contracts − − 733 − − −

Other interest bearing liabilities/derivative related changes 2 9 (28) (20) 1 (8)

At the end of the financial year 2,492 21,045 3,443 − 68 (433) Financial Statements

Derivatives

(assets)/

Interest bearing liabilities liabilities

Bank Cross

overdraft and currency

2019 Notes and Lease short-term and interest

US$M Bank loans debentures liabilities borrowings Other rate swaps Total Additional information

At the beginning of the financial year 2,555 23,298 802 58 92 805

Proceeds from interest bearing liabilities 250 − − − − − 250

Settlements of debt related instruments − − − − − (160) (160)

Repayment of interest bearing liabilities (308) (2,198) (75) − (23) − (2,604)

Change from Net financing cash flows (58) (2,198) (75) − (23) (160) (2,514)

Other movements:

Interest rate impacts − 729 − − − (809)

Foreign exchange impacts − (311) (11) − − 319

Other interest bearing liabilities/derivative related changes 1 11 (1) (38) (3) 49

At the end of the financial year 2,498 21,529 715 20 66 204 Shareholder information

BHP Annual Report 2020 213