Page 214 - Annual Report 2020

P. 214

22 Financial risk management continued

22.4 Derivatives and hedge accounting • Cash flow hedges – changes in the fair value of cross currency

The Group uses derivatives to hedge its exposure to certain market interest rate swaps which hedge foreign currency cash flows on the

risks and may elect to apply hedge accounting. notes and debentures are recognised directly in other comprehensive

income and accumulated in the cash flow hedging reserve. To the

Hedge accounting extent a hedge is ineffective, changes in fair value are recognised

The Group has early adopted amendments to IFRS 9 ‘Financial immediately in the income statement.

Instruments’ and IFRS 7 ‘Financial Instruments: Disclosures’ in relation When a hedging instrument expires, or is sold, terminated or

to Interest Rate Benchmark Reform. There is no impact on the Group’s exercised, or when a hedge no longer meets the criteria for hedge

hedge accounting as a result of adopting the amendments. Refer to accounting, any cumulative gain or loss existing in equity at that

note 38 ‘New and amended accounting standards and interpretations’ time remains in equity and is amortised to the income statement

for further information. over the period to the hedged item’s maturity.

Derivatives are included within financial assets or liabilities at fair When hedged, the Group hedges the full notional value of notes

value through profit or loss unless they are designated as effective or debentures. However, certain components of the fair value of

hedging instruments. Financial instruments in this category are derivatives are not permitted under IFRS 9 to be included in the

classified as current if they are expected to be settled within hedge accounting above. Certain costs of hedging are permitted

12 months otherwise they are classified as non-current. to be recognised in other comprehensive income. Any change in the

Where hedge accounting is applied, at the start of the transaction, fair value of a derivative that does not qualify for hedge accounting,

or is ineffective in hedging the designated risk due to contractual

the Group documents the type of hedge, the relationship between differences between the hedged item and hedging instrument,

the hedging instrument and hedged items and its risk management is recognised immediately in the income statement.

objective and strategy for undertaking various hedge transactions.

The documentation also demonstrates that the hedge is expected The table below shows the carrying amounts of the Group’s notes

to be effective. and debentures by currency and the derivatives which hedge them:

The Group applies the following types of hedge accounting to its • The carrying amount of the notes and debentures includes foreign

exchange remeasurement to period end rates and fair value

derivatives hedging the interest rate and currency risks in its notes adjustments when included in a fair value hedge.

and debentures:

• Fair value hedges – the fair value gain or loss on interest rate and • The breakdown of the hedging derivatives includes remeasurement

cross currency swaps relating to interest rate risk, together with of foreign currency notional values at period end rates, fair value

the change in the fair value of the hedged fixed rate borrowings movements due to interest rate risk, foreign currency cash flows

attributable to interest rate risk are recognised immediately in the designated into cash flow hedges, costs of hedging recognised in

income statement. other comprehensive income, ineffectiveness recognised in the

income statement and accruals or prepayments.

If the hedge no longer meets the criteria for hedge accounting, the • The hedged value of notes and debentures includes their carrying

fair value adjustment on the note or debenture is amortised to the amounts adjusted for the offsetting derivative fair value movements

income statement over the period to maturity using a recalculated due to foreign currency and interest rate risk remeasurement.

effective interest rate.

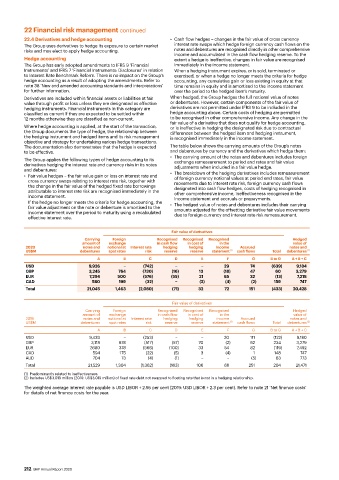

Fair value of derivatives

Carrying Foreign Recognised Recognised Recognised Hedged

amount of exchange in cash flow in cost of in the value of

2020 notes and notional at Interest rate hedging hedging income Accrued notes and

US$M debentures spot rates risk reserve reserve statement (1) cash flows Total debentures (2)

A B C D E F G B to G A + B + C

USD 9,926 − (742) − − 29 74 (639) 9,184

GBP 3,245 764 (730) (16) 13 (18) 47 60 3,279

EUR 7,294 500 (576) (55) 21 65 32 (13) 7,218

CAD 580 199 (32) − (2) (4) (2) 159 747

Total 21,045 1,463 (2,080) (71) 32 72 151 (433) 20,428

Fair value of derivatives

Carrying Foreign Recognised Recognised Recognised Hedged

amount of exchange in cash flow in cost of in the value of

2019 notes and notional at Interest rate hedging hedging income Accrued notes and

US$M debentures spot rates risk reserve reserve statement (1) cash flows Total debentures (2)

A B C D E F G B to G A + B + C

USD 9,433 − (253) − − 20 111 (122) 9,180

GBP 3,118 678 (517) (57) 70 (2) 62 234 3,279

EUR 7,680 378 (566) (100) 33 54 82 (119) 7,492

CAD 594 175 (22) (5) 3 (4) 1 148 747

AUD 704 73 (4) (1) − − (5) 63 773

Total 21,529 1,304 (1,362) (163) 106 68 251 204 21,471

(1) Predominantly related to ineffectiveness.

(2) Includes US$3,019 million (2019: US$3,019 million) of fixed rate debt not swapped to floating rate that is not in a hedging relationship.

The weighted average interest rate payable is USD LIBOR + 2.95 per cent (2019: USD LIBOR + 2.3 per cent). Refer to note 21 ‘Net finance costs’

for details of net finance costs for the year.

212 BHP Annual Report 2020