Page 210 - Annual Report 2020

P. 210

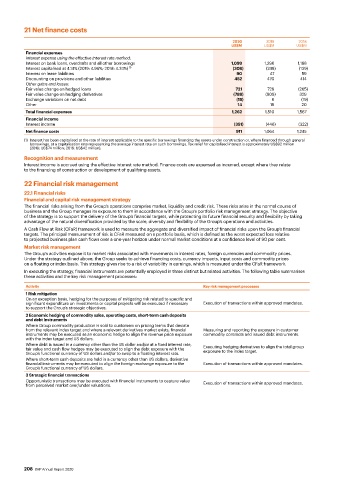

21 Net finance costs

2020 2019 2018

US$M US$M US$M

Financial expenses

Interest expense using the effective interest rate method:

Interest on bank loans, overdrafts and all other borrowings 1,099 1,296 1,168

Interest capitalised at 4.14% (2019: 4.96%; 2018: 4.24%) (1) (308) (248) (139)

Interest on lease liabilities 90 47 59

Discounting on provisions and other liabilities 452 470 414

Other gains and losses:

Fair value change on hedged loans 721 729 (265)

Fair value change on hedging derivatives (788) (809) 329

Exchange variations on net debt (18) 6 (19)

Other 14 19 20

Total financial expenses 1,262 1,510 1,567

Financial income

Interest income (351) (446) (322)

Net finance costs 911 1,064 1,245

(1) Interest has been capitalised at the rate of interest applicable to the specific borrowings financing the assets under construction or, where financed through general

borrowings, at a capitalisation rate representing the average interest rate on such borrowings. Tax relief for capitalised interest is approximately US$92 million

(2019: US$74 million; 2018: US$42 million).

Recognition and measurement

Interest income is accrued using the effective interest rate method. Finance costs are expensed as incurred, except where they relate

to the financing of construction or development of qualifying assets.

22 Financial risk management

22.1 Financial risks

Financial and capital risk management strategy

The financial risks arising from the Group’s operations comprise market, liquidity and credit risk. These risks arise in the normal course of

business and the Group manages its exposure to them in accordance with the Group’s portfolio risk management strategy. The objective

of the strategy is to support the delivery of the Group’s financial targets, while protecting its future financial security and flexibility by taking

advantage of the natural diversification provided by the scale, diversity and flexibility of the Group’s operations and activities.

A Cash Flow at Risk (CFaR) framework is used to measure the aggregate and diversified impact of financial risks upon the Group’s financial

targets. The principal measurement of risk is CFaR measured on a portfolio basis, which is defined as the worst expected loss relative

to projected business plan cash flows over a one-year horizon under normal market conditions at a confidence level of 90 per cent.

Market risk management

The Group’s activities expose it to market risks associated with movements in interest rates, foreign currencies and commodity prices.

Under the strategy outlined above, the Group seeks to achieve financing costs, currency impacts, input costs and commodity prices

on a floating or index basis. This strategy gives rise to a risk of variability in earnings, which is measured under the CFaR framework.

In executing the strategy, financial instruments are potentially employed in three distinct but related activities. The following table summarises

these activities and the key risk management processes:

Activity Key risk management processes

1 Risk mitigation

On an exception basis, hedging for the purposes of mitigating risk related to specific and

significant expenditure on investments or capital projects will be executed if necessary Execution of transactions within approved mandates.

to support the Group’s strategic objectives.

2 Economic hedging of commodity sales, operating costs, short-term cash deposits

and debt instruments

Where Group commodity production is sold to customers on pricing terms that deviate

from the relevant index target and where a relevant derivatives market exists, financial Measuring and reporting the exposure in customer

instruments may be executed as an economic hedge to align the revenue price exposure commodity contracts and issued debt instruments.

with the index target and US dollars.

Where debt is issued in a currency other than the US dollar and/or at a fixed interest rate,

fair value and cash flow hedges may be executed to align the debt exposure with the Executing hedging derivatives to align the total group

exposure to the index target.

Group’s functional currency of US dollars and/or to swap to a floating interest rate.

Where short-term cash deposits are held in a currency other than US dollars, derivative

financial instruments may be executed to align the foreign exchange exposure to the Execution of transactions within approved mandates.

Group’s functional currency of US dollars.

3 Strategic financial transactions

Opportunistic transactions may be executed with financial instruments to capture value Execution of transactions within approved mandates.

from perceived market over/under valuations.

208 BHP Annual Report 2020