Page 205 - Annual Report 2020

P. 205

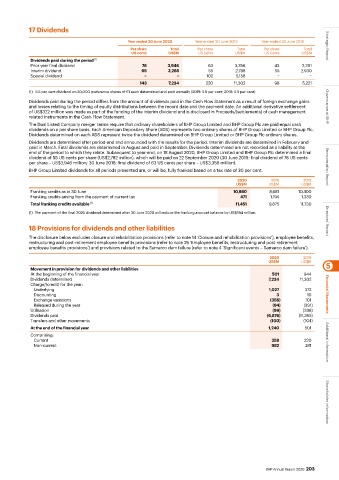

17 Dividends

Year ended 30 June 2020 Year ended 30 June 2019 Year ended 30 June 2018

Per share Total Per share Total Per share Total Strategic Report

US cents US$M US cents US$M US cents US$M

Dividends paid during the period (1)

Prior year final dividend 78 3,946 63 3,356 43 2,291

Interim dividend 65 3,288 55 2,788 55 2,930

Special dividend − − 102 5,158 − −

143 7,234 220 11,302 98 5,221

(1) 5.5 per cent dividend on 50,000 preference shares of £1 each determined and paid annually (2019: 5.5 per cent; 2018: 5.5 per cent).

Dividends paid during the period differs from the amount of dividends paid in the Cash Flow Statement as a result of foreign exchange gains

and losses relating to the timing of equity distributions between the record date and the payment date. An additional derivative settlement Governance at BHP

of US$322 million was made as part of the funding of the interim dividend and is disclosed in Proceeds/(settlements) of cash management

related instruments in the Cash Flow Statement.

The Dual Listed Company merger terms require that ordinary shareholders of BHP Group Limited and BHP Group Plc are paid equal cash

dividends on a per share basis. Each American Depositary Share (ADS) represents two ordinary shares of BHP Group Limited or BHP Group Plc.

Dividends determined on each ADS represent twice the dividend determined on BHP Group Limited or BHP Group Plc ordinary shares.

Dividends are determined after period-end and announced with the results for the period. Interim dividends are determined in February and

paid in March. Final dividends are determined in August and paid in September. Dividends determined are not recorded as a liability at the

end of the period to which they relate. Subsequent to year-end, on 18 August 2020, BHP Group Limited and BHP Group Plc determined a final

dividend of 55 US cents per share (US$2,782 million), which will be paid on 22 September 2020 (30 June 2019: final dividend of 78 US cents

per share – US$3,946 million; 30 June 2018: final dividend of 63 US cents per share – US$3,356 million).

BHP Group Limited dividends for all periods presented are, or will be, fully franked based on a tax rate of 30 per cent. Remuneration Report

2020 2019 2018

US$M US$M US$M

Franking credits as at 30 June 10,980 8,681 10,400

Franking credits arising from the payment of current tax 471 1,194 1,330

Total franking credits available (1) 11,451 9,875 11,730

(1) The payment of the final 2020 dividend determined after 30 June 2020 will reduce the franking account balance by US$694 million.

18 Provisions for dividends and other liabilities Directors’ Report

The disclosure below excludes closure and rehabilitation provisions (refer to note 14 ‘Closure and rehabilitation provisions’), employee benefits,

restructuring and post-retirement employee benefits provisions (refer to note 25 ‘Employee benefits, restructuring and post-retirement

employee benefits provisions’) and provisions related to the Samarco dam failure (refer to note 4 ‘Significant events – Samarco dam failure’).

2020 2019

US$M US$M

Movement in provision for dividends and other liabilities 5

At the beginning of the financial year 501 944

Dividends determined 7,234 11,302

Charge/(credit) for the year:

Underlying 1,027 372

Discounting 3 10 Financial Statements

Exchange variations (356) 101

Released during the year (94) (391)

Utilisation (99) (338)

Dividends paid (6,876) (11,395)

Transfers and other movements (100) (104)

At the end of the financial year 1,240 501

Comprising:

Current 258 220

Non-current 982 281 Additional information

Shareholder information

BHP Annual Report 2020 203