Page 201 - Annual Report 2020

P. 201

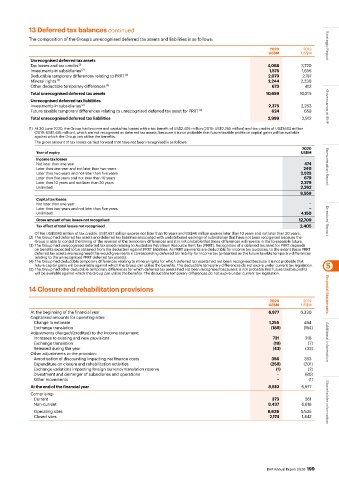

13 Deferred tax balances continued

The composition of the Group’s unrecognised deferred tax assets and liabilities is as follows:

2020 2019 Strategic Report

US$M US$M

Unrecognised deferred tax assets

Tax losses and tax credits (1) 4,088 3,720

Investments in subsidiaries (2) 1,575 1,656

Deductible temporary differences relating to PRRT (3) 2,079 2,197

Mineral rights (4) 2,244 2,230

Other deductible temporary differences (5) 673 412

Total unrecognised deferred tax assets 10,659 10,215

Unrecognised deferred tax liabilities

Investments in subsidiaries (2) 2,375 2,253 Governance at BHP

Future taxable temporary differences relating to unrecognised deferred tax asset for PRRT (3) 624 659

Total unrecognised deferred tax liabilities 2,999 2,912

(1) At 30 June 2020, the Group had income and capital tax losses with a tax benefit of US$2,405 million (2019: US$2,265 million) and tax credits of US$1,683 million

(2019: US$1,455 million), which are not recognised as deferred tax assets, because it is not probable that future taxable profits or capital gains will be available

against which the Group can utilise the benefits.

The gross amount of tax losses carried forward that have not been recognised is as follows:

2020

Year of expiry US$M

Income tax losses

Not later than one year 474

Later than one year and not later than two years 240 Remuneration Report

Later than two years and not later than five years 2,525

Later than five years and not later than 10 years 679

Later than 10 years and not later than 20 years 2,379

Unlimited 2,262

8,559

Capital tax losses

Not later than one year −

Later than two years and not later than five years −

Unlimited 4,150

Gross amount of tax losses not recognised 12,709 Directors’ Report

Tax effect of total losses not recognised 2,405

Of the US$1,683 million of tax credits, US$1,637 million expires not later than 10 years and US$46 million expires later than 10 years and not later than 20 years.

(2) The Group had deferred tax assets and deferred tax liabilities associated with undistributed earnings of subsidiaries that have not been recognised because the

Group is able to control the timing of the reversal of the temporary differences and it is not probable that these differences will reverse in the foreseeable future.

(3) The Group had unrecognised deferred tax assets relating to Australian Petroleum Resource Rent Tax (PRRT). Recognition of a deferred tax asset for PRRT depends

on benefits expected to be obtained from the deduction against PRRT liabilities. As PRRT payments are deductible for income tax purposes, to the extent these PRRT

deferred tax assets are recognised this would give rise to a corresponding deferred tax liability for income tax (presented as the future taxable temporary differences

relating to the unrecognised PRRT deferred tax assets).

(4) The Group had deductible temporary differences relating to mineral rights for which deferred tax assets had not been recognised because it is not probable that

future capital gains will be available against which the Group can utilise the benefits. The deductible temporary differences do not expire under current tax legislation. 5

(5) The Group had other deductible temporary differences for which deferred tax assets had not been recognised because it is not probable that future taxable profits

will be available against which the Group can utilise the benefits. The deductible temporary differences do not expire under current tax legislation.

14 Closure and rehabilitation provisions

2020 2019 Financial Statements

US$M US$M

At the beginning of the financial year 6,977 6,330

Capitalised amounts for operating sites:

Change in estimate 1,255 494

Exchange translation (188) (194)

Adjustments charged/(credited) to the income statement:

Increases to existing and new provisions 731 318

Exchange translation (19) (7) Additional information

Released during the year (43) (33)

Other adjustments to the provision:

Amortisation of discounting impacting net finance costs 356 353

Expenditure on closure and rehabilitation activities (258) (201)

Exchange variations impacting foreign currency translation reserve (1) (2)

Divestment and demerger of subsidiaries and operations − (80)

Other movements − (1)

At the end of the financial year 8,810 6,977

Comprising:

Current 373 361

Non-current 8,437 6,616 Shareholder information

Operating sites 6,636 5,535

Closed sites 2,174 1,442

BHP Annual Report 2020 199