Page 203 - Annual Report 2020

P. 203

Capital structure

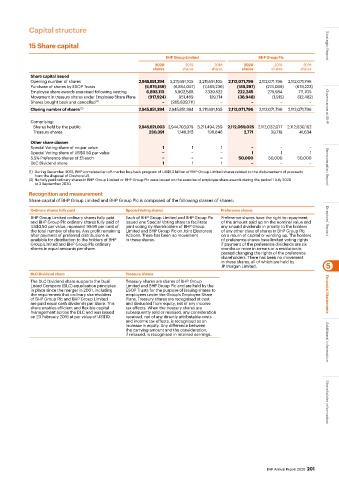

15 Share capital Strategic Report

BHP Group Limited BHP Group Plc

2020 2019 2018 2020 2019 2018

shares shares shares shares shares shares

Share capital issued

Opening number of shares 2,945,851,394 3,211,691,105 3,211,691,105 2,112,071,796 2,112,071,796 2,112,071,796

Purchase of shares by ESOP Trusts (5,975,189) (6,854,057) (7,469,236) (185,297) (274,069) (679,223)

Employee share awards exercised following vesting 6,893,113 5,902,588 7,339,522 222,245 275,984 711,705

Movement in treasury shares under Employee Share Plans (917,924) 951,469 129,714 (36,948) (1,915) (32,482)

Shares bought back and cancelled (1) − (265,839,711) − − − −

Closing number of shares (2) 2,945,851,394 2,945,851,394 3,211,691,105 2,112,071,796 2,112,071,796 2,112,071,796 Governance at BHP

Comprising:

Shares held by the public 2,945,621,003 2,944,703,079 3,211,494,259 2,112,069,025 2,112,032,077 2,112,030,162

Treasury shares 230,391 1,148,315 196,846 2,771 39,719 41,634

Other share classes

Special Voting share of no par value 1 1 1 − − −

Special Voting share of US$0.50 par value − − − 1 1 1

5.5% Preference shares of £1 each − − − 50,000 50,000 50,000

DLC Dividend share 1 1 1 − − − Remuneration Report

(1) During December 2018, BHP completed an off-market buy-back program of US$5.2 billion of BHP Group Limited shares related to the disbursement of proceeds

from the disposal of Onshore US.

(2) No fully paid ordinary shares in BHP Group Limited or BHP Group Plc were issued on the exercise of employee share awards during the period 1 July 2020

to 3 September 2020.

Recognition and measurement

Share capital of BHP Group Limited and BHP Group Plc is composed of the following classes of shares:

Ordinary shares fully paid Special Voting shares Preference shares

BHP Group Limited ordinary shares fully paid Each of BHP Group Limited and BHP Group Plc Preference shares have the right to repayment

and BHP Group Plc ordinary shares fully paid of issued one Special Voting share to facilitate of the amount paid up on the nominal value and Directors’ Report

US$0.50 par value, represent 99.99 per cent of joint voting by shareholders of BHP Group any unpaid dividends in priority to the holders

the total number of shares. Any profit remaining Limited and BHP Group Plc on Joint Electorate of any other class of shares in BHP Group Plc

after payment of preferred distributions is Actions. There has been no movement on a return of capital or winding up. The holders

available for distribution to the holders of BHP in these shares. of preference shares have limited voting rights

Group Limited and BHP Group Plc ordinary if payment of the preference dividends are six

shares in equal amounts per share. months or more in arrears or a resolution is

passed changing the rights of the preference

shareholders. There has been no movement

in these shares, all of which are held by

JP Morgan Limited. 5

DLC Dividend share Treasury shares

The DLC Dividend share supports the Dual Treasury shares are shares of BHP Group

Listed Company (DLC) equalisation principles Limited and BHP Group Plc and are held by the

in place since the merger in 2001, including ESOP Trusts for the purpose of issuing shares to

the requirement that ordinary shareholders employees under the Group’s Employee Share Financial Statements

of BHP Group Plc and BHP Group Limited Plans. Treasury shares are recognised at cost

are paid equal cash dividends per share. This and deducted from equity, net of any income

share enables efficient and flexible capital tax effects. When the treasury shares are

management across the DLC and was issued subsequently sold or reissued, any consideration

on 23 February 2016 at par value of US$10. received, net of any directly attributable costs

and income tax effects, is recognised as an

increase in equity. Any difference between

the carrying amount and the consideration,

if reissued, is recognised in retained earnings. Additional information

BHP Annual Report 2020 201 Shareholder information