Page 204 - Annual Report 2020

P. 204

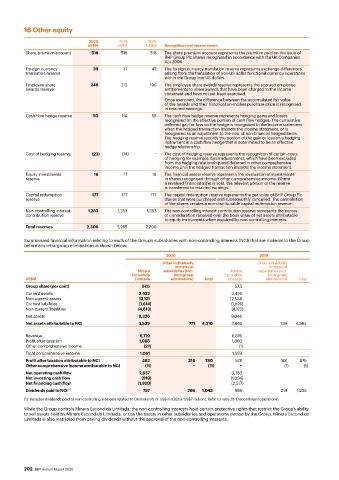

16 Other equity

2020 2019 2018

US$M US$M US$M Recognition and measurement

Share premium account 518 518 518 The share premium account represents the premium paid on the issue of

BHP Group Plc shares recognised in accordance with the UK Companies

Act 2006.

Foreign currency 39 37 42 The foreign currency translation reserve represents exchange differences

translation reserve arising from the translation of non-US dollar functional currency operations

within the Group into US dollars.

Employee share 246 213 196 The employee share awards reserve represents the accrued employee

awards reserve entitlements to share awards that have been charged to the income

statement and have not yet been exercised.

Once exercised, the difference between the accumulated fair value

of the awards and their historical on-market purchase price is recognised

in retained earnings.

Cash flow hedge reserve 50 114 58 The cash flow hedge reserve represents hedging gains and losses

recognised on the effective portion of cash flow hedges. The cumulative

deferred gain or loss on the hedge is recognised in the income statement

when the hedged transaction impacts the income statement, or is

recognised as an adjustment to the cost of non-financial hedged items.

The hedging reserve records the portion of the gain or loss on a hedging

instrument in a cash flow hedge that is determined to be an effective

hedge relationship.

Cost of hedging reserve (23) (74) − The cost of hedging reserve represents the recognition of certain costs

of hedging for example, basis adjustments, which have been excluded

from the hedging relationship and deferred in other comprehensive

income until the hedged transaction impacts the income statement.

Equity investments 16 17 16 The financial assets reserve represents the revaluation of investments

reserve in shares recognised through other comprehensive income. Where

a revalued financial asset is sold, the relevant portion of the reserve

is transferred to retained earnings.

Capital redemption 177 177 177 The capital redemption reserve represents the par value of BHP Group Plc

reserve shares that were purchased and subsequently cancelled. The cancellation

of the shares creates a non-distributable capital redemption reserve.

Non-controlling interest 1,283 1,283 1,283 The non-controlling interest contribution reserve represents the excess

contribution reserve of consideration received over the book value of net assets attributable

to equity instruments when acquired by non-controlling interests.

Total reserves 2,306 2,285 2,290

Summarised financial information relating to each of the Group’s subsidiaries with non-controlling interests (NCI) that are material to the Group

before any intra-group eliminations is shown below:

2020 2019

Other individually Other individually

immaterial immaterial

Minera subsidiaries (incl. Minera subsidiaries (incl.

Escondida intra-group Escondida intra-group

US$M Limitada eliminations) Total Limitada eliminations) Total

Group share (per cent) 57.5 57.5

Current assets 2,432 2,456

Non-current assets 12,121 12,538

Current liabilities (1,614) (1,826)

Non-current liabilities (4,613) (4,122)

Net assets 8,326 9,046

Net assets attributable to NCI 3,539 771 4,310 3,845 739 4,584

Revenue 6,719 6,876

Profit after taxation 1,088 1,360

Other comprehensive income (27) (1)

Total comprehensive income 1,061 1,359

Profit after taxation attributable to NCI 462 318 780 578 301 879

Other comprehensive income attributable to NCI (11) − (11) − (1) (1)

Net operating cash flow 2,637 3,283

Net investing cash flow (919) (1,034)

Net financing cash flow (1,920) (2,517)

Dividends paid to NCI (1) 757 286 1,043 986 219 1,205

(1) Includes dividends paid to non-controlling interests related to Onshore US of US$ nil (2019: US$7 million). Refer to note 28 ‘Discontinued operations’.

While the Group controls Minera Escondida Limitada, the non-controlling interests hold certain protective rights that restrict the Group’s ability

to sell assets held by Minera Escondida Limitada, or use the assets in other subsidiaries and operations owned by the Group. Minera Escondida

Limitada is also restricted from paying dividends without the approval of the non-controlling interests.

202 BHP Annual Report 2020