Page 200 - Annual Report 2020

P. 200

12 Intangible assets continued

Key judgements and estimates

Judgements: Assessment of impairment indicators requires management judgement. If a judgement is made that recovery of

previously capitalised intangible mineral lease assets is unlikely, the relevant amount will be charged to the income statement.

Estimates: Determining the recoverable amount requires management to make certain estimates and assumptions as to future

events and circumstances, in particular whether an economically viable extraction operation can be established.

Where indicators of impairment exist for intangible assets, in the absence of quoted market prices, estimates are made regarding the

present value of future post-tax cash flows. These estimates require management judgement and assumptions and are subject to risk

and uncertainty that may be beyond the control of the Group; hence, there is a possibility that changes in circumstances will materially

alter projections, which may impact the recoverable amount of assets at each reporting date. The estimates are made from the

perspective of a market participant and include prices, future production volumes, operating costs, tax attributes and discount rates.

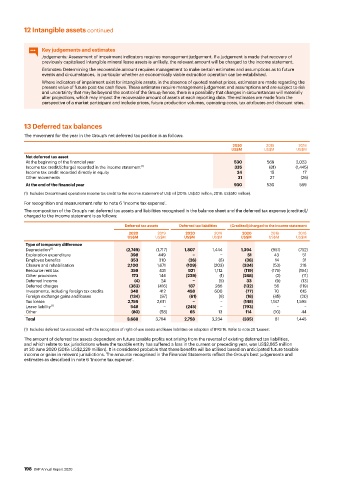

13 Deferred tax balances

The movement for the year in the Group’s net deferred tax position is as follows:

2020 2019 2018

US$M US$M US$M

Net deferred tax asset

At the beginning of the financial year 530 569 2,023

Income tax credit/(charge) recorded in the income statement (1) 335 (81) (1,445)

Income tax credit recorded directly in equity 34 15 17

Other movements 31 27 (26)

At the end of the financial year 930 530 569

(1) Includes Discontinued operations income tax credit to the income statement of US$ nil (2019: US$40 million; 2018: US$510 million).

For recognition and measurement refer to note 6 ‘Income tax expense’.

The composition of the Group’s net deferred tax assets and liabilities recognised in the balance sheet and the deferred tax expense (credited)/

charged to the income statement is as follows:

Deferred tax assets Deferred tax liabilities (Credited)/charged to the income statement

2020 2019 2020 2019 2020 2019 2018

US$M US$M US$M US$M US$M US$M US$M

Type of temporary difference

Depreciation (1) (2,749) (1,717) 1,807 1,444 1,394 (951) (752)

Exploration expenditure 398 449 − − 51 43 51

Employee benefits 353 310 (26) (6) (38) 14 31

Closure and rehabilitation 2,100 1,671 (109) (203) (334) (53) 218

Resource rent tax 359 431 921 1,112 (119) (179) (194)

Other provisions 173 144 (239) (1) (268) (2) (11)

Deferred income (4) 24 − (5) 33 (9) (13)

Deferred charges (383) (416) 187 286 (132) 56 (119)

Investments, including foreign tax credits 348 412 458 600 (77) 70 615

Foreign exchange gains and losses (134) (97) (61) (6) (18) (45) (20)

Tax losses 2,759 2,611 − − (148) 1,147 1,595

Lease liability (1) 548 − (245) − (793) − −

Other (80) (58) 65 13 114 (10) 44

Total 3,688 3,764 2,758 3,234 (335) 81 1,445

(1) Includes deferred tax associated with the recognition of right-of-use assets and lease liabilities on adoption of IFRS 16. Refer to note 20 ‘Leases’.

The amount of deferred tax assets dependent on future taxable profits not arising from the reversal of existing deferred tax liabilities,

and which relate to tax jurisdictions where the taxable entity has suffered a loss in the current or preceding year, was US$2,865 million

at 30 June 2020 (2019: US$2,229 million). It is considered probable that these benefits will be utilised based on anticipated future taxable

income or gains in relevant jurisdictions. The amounts recognised in the Financial Statements reflect the Group’s best judgements and

estimates as described in note 6 ‘Income tax expense’.

198 BHP Annual Report 2020