Page 196 - Annual Report 2020

P. 196

Resource assets

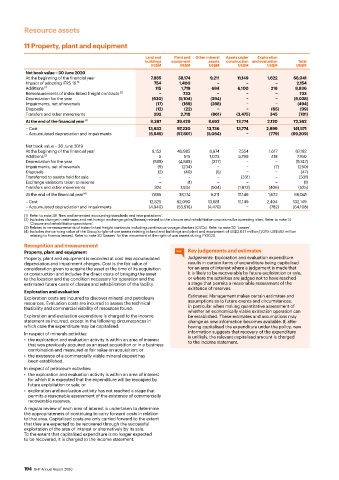

11 Property, plant and equipment

Land and Plant and Other mineral Assets under Exploration

buildings equipment assets construction and evaluation Total

US$M US$M US$M US$M US$M US$M

Net book value – 30 June 2020

At the beginning of the financial year 7,885 38,174 9,211 11,149 1,622 68,041

Impact of adopting IFRS 16 (1) 754 1,400 − − − 2,154

Additions (2) 115 1,719 684 6,100 218 8,836

Remeasurements of index-linked freight contracts (3) − 733 − − − 733

Depreciation for the year (630) (5,104) (294) − − (6,028)

Impairments, net of reversals (17) (189) (288) − − (494)

Disposals (12) (22) − − (65) (99)

Transfers and other movements 292 2,718 (661) (3,475) 345 (781)

At the end of the financial year (4) 8,387 39,429 8,652 13,774 2,120 72,362

– Cost 13,932 97,230 13,736 13,774 2,899 141,571

– Accumulated depreciation and impairments (5,545) (57,801) (5,084) − (779) (69,209)

Net book value – 30 June 2019

At the beginning of the financial year 8,152 40,885 8,974 7,554 1,617 67,182

Additions (2) 5 515 1,023 5,799 418 7,760

Depreciation for the year (585) (4,885) (277) − − (5,747)

Impairments, net of reversals (9) (234) − − (7) (250)

Disposals (2) (40) (5) − − (47)

Transferred to assets held for sale − − − (331) − (331)

Exchange variations taken to reserve − (1) − − − (1)

Transfers and other movements 324 1,934 (504) (1,873) (406) (525)

At the end of the financial year (4) 7,885 38,174 9,211 11,149 1,622 68,041

– Cost 12,825 92,090 13,681 11,149 2,404 132,149

– Accumulated depreciation and impairments (4,940) (53,916) (4,470) − (782) (64,108)

(1) Refer to note 38 ‘New and amended accounting standards and interpretations’.

(2) Includes change in estimates and net foreign exchange gains/(losses) related to the closure and rehabilitation provisions for operating sites. Refer to note 14

‘Closure and rehabilitation provisions’.

(3) Relates to remeasurements of index-linked freight contracts including continuous voyage charters (CVCs). Refer to note 20 ‘Leases’.

(4) Includes the carrying value of the Group’s right-of-use assets relating to land and buildings and plant and equipment of US$3,047 million (2019: US$492 million

relating to finance leases). Refer to note 20 ‘Leases’ for the movement of the right-of-use assets during FY2020.

Recognition and measurement

Property, plant and equipment Key judgements and estimates

Property, plant and equipment is recorded at cost less accumulated Judgements: Exploration and evaluation expenditure

depreciation and impairment charges. Cost is the fair value of results in certain items of expenditure being capitalised

consideration given to acquire the asset at the time of its acquisition for an area of interest where a judgement is made that

or construction and includes the direct costs of bringing the asset it is likely to be recoverable by future exploitation or sale,

to the location and the condition necessary for operation and the or where the activities are judged not to have reached

estimated future costs of closure and rehabilitation of the facility. a stage that permits a reasonable assessment of the

Exploration and evaluation existence of reserves.

Exploration costs are incurred to discover mineral and petroleum Estimates: Management makes certain estimates and

resources. Evaluation costs are incurred to assess the technical assumptions as to future events and circumstances,

feasibility and commercial viability of resources found. in particular when making quantitative assessment of

whether an economically viable extraction operation can

Exploration and evaluation expenditure is charged to the income be established. These estimates and assumptions may

statement as incurred, except in the following circumstances in change as new information becomes available. If, after

which case the expenditure may be capitalised: having capitalised the expenditure under the policy, new

In respect of minerals activities: information suggests that recovery of the expenditure

• the exploration and evaluation activity is within an area of interest is unlikely, the relevant capitalised amount is charged

to the income statement.

that was previously acquired as an asset acquisition or in a business

combination and measured at fair value on acquisition; or

• the existence of a commercially viable mineral deposit has

been established.

In respect of petroleum activities:

• the exploration and evaluation activity is within an area of interest

for which it is expected that the expenditure will be recouped by

future exploitation or sale; or

• exploration and evaluation activity has not reached a stage that

permits a reasonable assessment of the existence of commercially

recoverable reserves.

A regular review of each area of interest is undertaken to determine

the appropriateness of continuing to carry forward costs in relation

to that area. Capitalised costs are only carried forward to the extent

that they are expected to be recovered through the successful

exploitation of the area of interest or alternatively by its sale.

To the extent that capitalised expenditure is no longer expected

to be recovered, it is charged to the income statement.

194 BHP Annual Report 2020