Page 199 - Annual Report 2020

P. 199

11 Property, plant and equipment continued

Key judgements and estimates Strategic Report

Judgements: Assessment of indicators of impairment or COVID-19

impairment reversal and the determination of CGUs for The macro economic disruptions relating to COVID-19 and

impairment purposes require significant management judgement. mitigating actions enforced by health authorities create

Indicators of impairment may include changes in the Group’s uncertainty in the Group’s operating and economic assumptions,

operating and economic assumptions, including those arising including commodity prices, demand and supply volumes,

from changes in reserves or mine planning, updates to the operating costs, and discount rates.

Group’s commodity supply, demand and price forecasts, or the However, given the long-lived nature of the majority of the

possible additional impacts from emerging risks such as those Group’s assets, COVID-19 did not, in isolation, result in the

related to climate change and the transition to a lower carbon identification of indicators of impairment for the Group’s

economy and pandemics similar to COVID-19. asset values at 30 June 2020.

Climate change Due to ongoing uncertainty as to the extent and duration Governance at BHP

of COVID-19 restrictions and the overall impact on economic

Impacts related to climate change and the transition to a lower activity, actual experience may materially differ from internal

carbon economy may include: forecasts and may result in the reassessment of indicators of

• demand for the Group’s commodities decreasing, due to impairment for the Group’s assets in future reporting periods.

policy, regulatory (including carbon pricing mechanisms),

legal, technological, market or societal responses to climate Petroleum

change, resulting in a proportion of a CGU’s reserves becoming Given the significant petroleum price volatility in CY2020 and the

incapable of extraction in an economically viable fashion; potential impact of climate change on long term petroleum prices,

• physical impacts related to acute risks resulting from increased the Group considered a range of long term price assumptions,

severity of extreme weather events, and those related to chronic including oil prices at US$55 a barrel (Brent), when determining

risks resulting from longer-term changes in climate patterns. that no indicators of impairment existed at 30 June 2020.

The Group continues to develop its assessment of the potential Estimates: In determining the recoverable amount of assets, Remuneration Report

impacts of climate change and the transition to a lower carbon in the absence of quoted market prices, estimates are made

economy. Where sufficiently developed, the potential financial regarding the present value of future post-tax cash flows. These

impacts on the Group of climate change and the transition to a estimates are made from the perspective of a market participant

lower carbon economy have been considered in the assessment and include prices, future production volumes, operating costs,

of indicators of impairment, including: tax attributes and discount rates. All estimates require significant

• the Group’s current assumptions relating to demand for management judgements and assumptions and are subject

to risk and uncertainty that may be beyond the control of the

commodities and carbon pricing and their impact on the Group; hence, there is a possibility that changes in circumstances

Group’s long term price forecasts; will materially alter projections, which may impact the

• the Group’s operational emissions reduction strategy. For recoverable amount of assets at each reporting date.

example, transitioning to renewable power supply contracts Directors’ Report

at the Group’s Escondida and Spence operations.

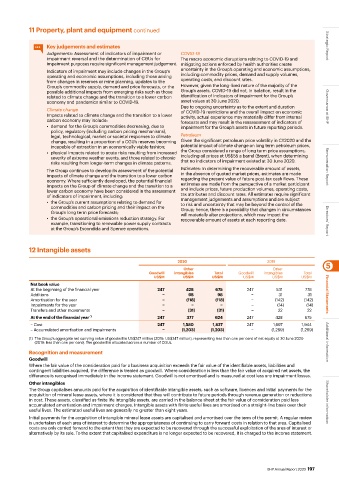

12 Intangible assets

2020 2019 5

Other Other

Goodwill intangibles Total Goodwill intangibles Total

US$M US$M US$M US$M US$M US$M

Net book value

At the beginning of the financial year 247 428 675 247 531 778

Additions − 98 98 − 31 31 Financial Statements

Amortisation for the year − (118) (118) − (142) (142)

Impairments for the year − − − − (14) (14)

Transfers and other movements − (31) (31) − 22 22

At the end of the financial year (1) 247 377 624 247 428 675

– Cost 247 1,580 1,827 247 1,697 1,944

– Accumulated amortisation and impairments − (1,203) (1,203) − (1,269) (1,269)

(1) The Group’s aggregate net carrying value of goodwill is US$247 million (2019: US$247 million), representing less than one per cent of net equity at 30 June 2020

(2019: less than one per cent). The goodwill is allocated across a number of CGUs. Additional information

Recognition and measurement

Goodwill

Where the fair value of the consideration paid for a business acquisition exceeds the fair value of the identifiable assets, liabilities and

contingent liabilities acquired, the difference is treated as goodwill. Where consideration is less than the fair value of acquired net assets, the

difference is recognised immediately in the income statement. Goodwill is not amortised and is measured at cost less any impairment losses.

Other intangibles

The Group capitalises amounts paid for the acquisition of identifiable intangible assets, such as software, licences and initial payments for the

acquisition of mineral lease assets, where it is considered that they will contribute to future periods through revenue generation or reductions

in cost. These assets, classified as finite life intangible assets, are carried in the balance sheet at the fair value of consideration paid less

accumulated amortisation and impairment charges. Intangible assets with finite useful lives are amortised on a straight-line basis over their Shareholder information

useful lives. The estimated useful lives are generally no greater than eight years.

Initial payments for the acquisition of intangible mineral lease assets are capitalised and amortised over the term of the permit. A regular review

is undertaken of each area of interest to determine the appropriateness of continuing to carry forward costs in relation to that area. Capitalised

costs are only carried forward to the extent that they are expected to be recovered through the successful exploitation of the area of interest or

alternatively by its sale. To the extent that capitalised expenditure is no longer expected to be recovered, it is charged to the income statement.

BHP Annual Report 2020 197