Page 195 - Annual Report 2020

P. 195

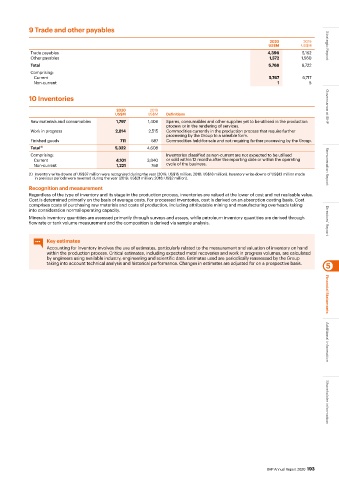

9 Trade and other payables

2020 2019

US$M US$M Strategic Report

Trade payables 4,396 5,162

Other payables 1,372 1,560

Total 5,768 6,722

Comprising:

Current 5,767 6,717

Non-current 1 5

10 Inventories

2020 2019 Governance at BHP

US$M US$M Definitions

Raw materials and consumables 1,797 1,406 Spares, consumables and other supplies yet to be utilised in the production

process or in the rendering of services.

Work in progress 2,814 2,515 Commodities currently in the production process that require further

processing by the Group to a saleable form.

Finished goods 711 687 Commodities held-for-sale and not requiring further processing by the Group.

Total (1) 5,322 4,608

Comprising: Inventories classified as non-current are not expected to be utilised

Current 4,101 3,840 or sold within 12 months after the reporting date or within the operating

Non-current 1,221 768 cycle of the business. Remuneration Report

(1) Inventory write-downs of US$37 million were recognised during the year (2019: US$16 million; 2018: US$18 million). Inventory write-downs of US$13 million made

in previous periods were reversed during the year (2019: US$21 million; 2018: US$2 million).

Recognition and measurement

Regardless of the type of inventory and its stage in the production process, inventories are valued at the lower of cost and net realisable value.

Cost is determined primarily on the basis of average costs. For processed inventories, cost is derived on an absorption costing basis. Cost

comprises costs of purchasing raw materials and costs of production, including attributable mining and manufacturing overheads taking

into consideration normal operating capacity.

Minerals inventory quantities are assessed primarily through surveys and assays, while petroleum inventory quantities are derived through

flow rate or tank volume measurement and the composition is derived via sample analysis. Directors’ Report

Key estimates

Accounting for inventory involves the use of estimates, particularly related to the measurement and valuation of inventory on hand

within the production process. Critical estimates, including expected metal recoveries and work in progress volumes, are calculated

by engineers using available industry, engineering and scientific data. Estimates used are periodically reassessed by the Group

taking into account technical analysis and historical performance. Changes in estimates are adjusted for on a prospective basis. 5

Financial Statements

Additional information

BHP Annual Report 2020 193 Shareholder information