Page 190 - Annual Report 2020

P. 190

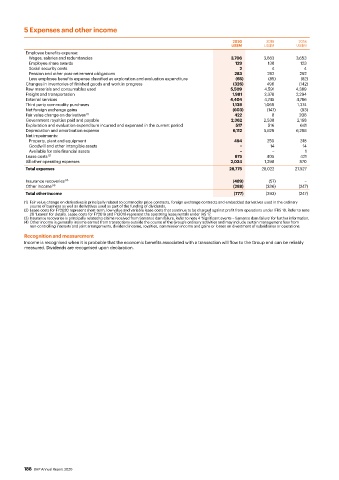

5 Expenses and other income

2020 2019 2018

US$M US$M US$M

Employee benefits expense:

Wages, salaries and redundancies 3,706 3,683 3,653

Employee share awards 129 138 123

Social security costs 2 4 4

Pension and other post-retirement obligations 283 292 292

Less employee benefits expense classified as exploration and evaluation expenditure (65) (85) (82)

Changes in inventories of finished goods and work in progress (326) 496 (142)

Raw materials and consumables used 5,509 4,591 4,389

Freight and transportation 1,981 2,378 2,294

External services 4,404 4,745 4,786

Third party commodity purchases 1,139 1,069 1,374

Net foreign exchange gains (603) (147) (93)

Fair value change on derivatives (1) 422 8 208

Government royalties paid and payable 2,362 2,538 2,168

Exploration and evaluation expenditure incurred and expensed in the current period 517 516 641

Depreciation and amortisation expense 6,112 5,829 6,288

Net impairments:

Property, plant and equipment 494 250 318

Goodwill and other intangible assets − 14 14

Available for sale financial assets − − 1

Lease costs (2) 675 405 421

All other operating expenses 2,034 1,298 870

Total expenses 28,775 28,022 27,527

Insurance recoveries (3) (489) (57) −

Other income (4) (288) (336) (247)

Total other income (777) (393) (247)

(1) Fair value change on derivatives is principally related to commodity price contracts, foreign exchange contracts and embedded derivatives used in the ordinary

course of business as well as derivatives used as part of the funding of dividends.

(2) Lease costs for FY2020 represent short-term, low-value and variable lease costs that continue to be charged against profit from operations under IFRS 16. Refer to note

20 ‘Leases’ for details. Lease costs for FY2019 and FY2018 represent the operating lease rentals under IAS 17.

(3) Insurance recoveries is principally related to claims received from Samarco dam failure. Refer to note 4 ‘Significant events – Samarco dam failure’ for further information.

(4) Other income is generally income earned from transactions outside the course of the Group’s ordinary activities and may include certain management fees from

non-controlling interests and joint arrangements, dividend income, royalties, commission income and gains or losses on divestment of subsidiaries or operations.

Recognition and measurement

Income is recognised when it is probable that the economic benefits associated with a transaction will flow to the Group and can be reliably

measured. Dividends are recognised upon declaration.

188 BHP Annual Report 2020