Page 186 - Annual Report 2020

P. 186

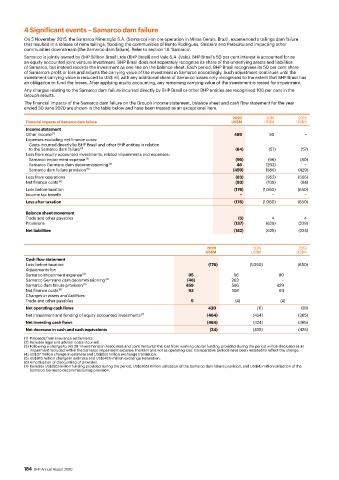

4 Significant events – Samarco dam failure

On 5 November 2015, the Samarco Mineração S.A. (Samarco) iron ore operation in Minas Gerais, Brazil, experienced a tailings dam failure

that resulted in a release of mine tailings, flooding the communities of Bento Rodrigues, Gesteira and Paracatu and impacting other

communities downstream (the Samarco dam failure). Refer to section 1.8 ‘Samarco’.

Samarco is jointly owned by BHP Billiton Brasil Ltda (BHP Brasil) and Vale S.A. (Vale). BHP Brasil’s 50 per cent interest is accounted for as

an equity accounted joint venture investment. BHP Brasil does not separately recognise its share of the underlying assets and liabilities

of Samarco, but instead records the investment as one line on the balance sheet. Each period, BHP Brasil recognises its 50 per cent share

of Samarco’s profit or loss and adjusts the carrying value of the investment in Samarco accordingly. Such adjustment continues until the

investment carrying value is reduced to US$ nil, with any additional share of Samarco losses only recognised to the extent that BHP Brasil has

an obligation to fund the losses. After applying equity accounting, any remaining carrying value of the investment is tested for impairment.

Any charges relating to the Samarco dam failure incurred directly by BHP Brasil or other BHP entities are recognised 100 per cent in the

Group’s results.

The financial impacts of the Samarco dam failure on the Group’s income statement, balance sheet and cash flow statement for the year

ended 30 June 2020 are shown in the table below and have been treated as an exceptional item.

2020 2019 2018

Financial impacts of Samarco dam failure US$M US$M US$M

Income statement

Other income (1) 489 50 −

Expenses excluding net finance costs:

Costs incurred directly by BHP Brasil and other BHP entities in relation

to the Samarco dam failure (2) (64) (57) (57)

Loss from equity accounted investments, related impairments and expenses:

Samarco impairment expense (3) (95) (96) (80)

Samarco Germano dam decommissioning (4) 46 (263) −

Samarco dam failure provision (5) (459) (586) (429)

Loss from operations (83) (952) (566)

Net finance costs (6) (93) (108) (84)

Loss before taxation (176) (1,060) (650)

Income tax benefit − − −

Loss after taxation (176) (1,060) (650)

Balance sheet movement

Trade and other payables (5) 4 4

Provisions (137) (629) (228)

Net liabilities (142) (625) (224)

2020 2019 2018

US$M US$M US$M

Cash flow statement

Loss before taxation (176) (1,060) (650)

Adjustments for:

Samarco impairment expense (3) 95 96 80

Samarco Germano dam decommissioning (4) (46) 263 −

Samarco dam failure provision (5) 459 586 429

Net finance costs (6) 93 108 84

Changes in assets and liabilities:

Trade and other payables 5 (4) (4)

Net operating cash flows 430 (11) (61)

Net investment and funding of equity accounted investments (7) (464) (424) (365)

Net investing cash flows (464) (424) (365)

Net decrease in cash and cash equivalents (34) (435) (426)

(1) Proceeds from insurance settlements.

(2) Includes legal and advisor costs incurred.

(3) Following a change to IAS 28 ‘Investments in Associates and Joint Ventures’ the loss from working capital funding provided during the period will be disclosed as an

impairment included within the Samarco impairment expense line item and not as operating loss. Comparative periods have been restated to reflect the change.

(4) US$37 million change in estimate and US$(83) million exchange translation.

(5) US$916 million change in estimate and US$(457) million exchange translation.

(6) Amortisation of discounting of provision.

(7) Includes US$(95) million funding provided during the period, US$(365) million utilisation of the Samarco dam failure provision, and US$(4) million utilisation of the

Samarco Germano decommissioning provision.

184 BHP Annual Report 2020