Page 184 - Annual Report 2020

P. 184

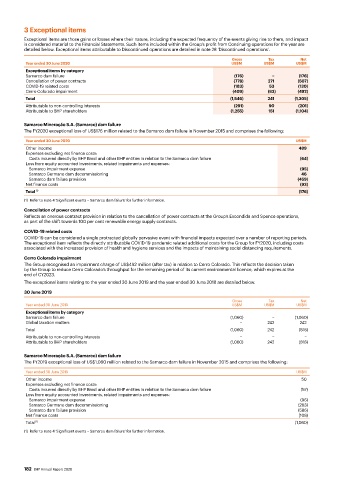

3 Exceptional items

Exceptional items are those gains or losses where their nature, including the expected frequency of the events giving rise to them, and impact

is considered material to the Financial Statements. Such items included within the Group’s profit from Continuing operations for the year are

detailed below. Exceptional items attributable to Discontinued operations are detailed in note 28 ‘Discontinued operations’.

Gross Tax Net

Year ended 30 June 2020 US$M US$M US$M

Exceptional items by category

Samarco dam failure (176) − (176)

Cancellation of power contracts (778) 271 (507)

COVID-19 related costs (183) 53 (130)

Cerro Colorado impairment (409) (83) (492)

Total (1,546) 241 (1,305)

Attributable to non-controlling interests (291) 90 (201)

Attributable to BHP shareholders (1,255) 151 (1,104)

Samarco Mineração S.A. (Samarco) dam failure

The FY2020 exceptional loss of US$176 million related to the Samarco dam failure in November 2015 and comprises the following:

Year ended 30 June 2020 US$M

Other income 489

Expenses excluding net finance costs:

Costs incurred directly by BHP Brasil and other BHP entities in relation to the Samarco dam failure (64)

Loss from equity accounted investments, related impairments and expenses:

Samarco impairment expense (95)

Samarco Germano dam decommissioning 46

Samarco dam failure provision (459)

Net finance costs (93)

Total (1) (176)

(1) Refer to note 4 ‘Significant events – Samarco dam failure’ for further information.

Cancellation of power contracts

Reflects an onerous contract provision in relation to the cancellation of power contracts at the Group’s Escondida and Spence operations,

as part of the shift towards 100 per cent renewable energy supply contracts.

COVID-19 related costs

COVID-19 can be considered a single protracted globally pervasive event with financial impacts expected over a number of reporting periods.

The exceptional item reflects the directly attributable COVID-19 pandemic related additional costs for the Group for FY2020, including costs

associated with the increased provision of health and hygiene services and the impacts of maintaining social distancing requirements.

Cerro Colorado impairment

The Group recognised an impairment charge of US$492 million (after tax) in relation to Cerro Colorado. This reflects the decision taken

by the Group to reduce Cerro Colorado’s throughput for the remaining period of its current environmental licence, which expires at the

end of CY2023.

The exceptional items relating to the year ended 30 June 2019 and the year ended 30 June 2018 are detailed below.

30 June 2019

Gross Tax Net

Year ended 30 June 2019 US$M US$M US$M

Exceptional items by category

Samarco dam failure (1,060) − (1,060)

Global taxation matters − 242 242

Total (1,060) 242 (818)

Attributable to non-controlling interests − − −

Attributable to BHP shareholders (1,060) 242 (818)

Samarco Mineração S.A. (Samarco) dam failure

The FY2019 exceptional loss of US$1,060 million related to the Samarco dam failure in November 2015 and comprises the following:

Year ended 30 June 2019 US$M

Other income 50

Expenses excluding net finance costs:

Costs incurred directly by BHP Brasil and other BHP entities in relation to the Samarco dam failure (57)

Loss from equity accounted investments, related impairments and expenses:

Samarco impairment expense (96)

Samarco Germano dam decommissioning (263)

Samarco dam failure provision (586)

Net finance costs (108)

Total (1) (1,060)

(1) Refer to note 4 ‘Significant events – Samarco dam failure’ for further information.

182 BHP Annual Report 2020