Page 183 - Annual Report 2020

P. 183

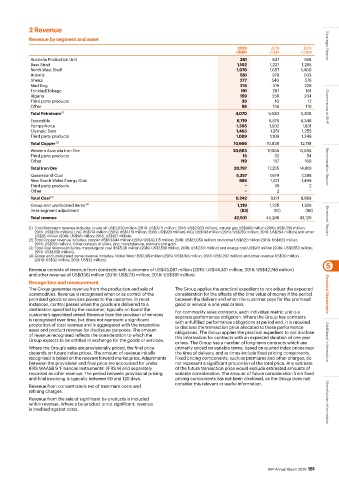

2 Revenue

Revenue by segment and asset

2020 2019 2018 Strategic Report

US$M US$M US$M

Australia Production Unit 361 507 568

Bass Strait 1,102 1,237 1,285

North West Shelf 1,076 1,657 1,400

Atlantis 561 979 833

Shenzi 277 540 576

Mad Dog 216 319 229

Trinidad/Tobago 191 287 161

Algeria 159 258 234

Third party products 39 10 12

Other 88 136 110 Governance at BHP

Total Petroleum (1) 4,070 5,930 5,408

Escondida 6,719 6,876 8,346

Pampa Norte 1,395 1,502 1,831

Olympic Dam 1,463 1,351 1,255

Third party products 1,089 1,109 1,349

Total Copper (2) 10,666 10,838 12,781

Western Australia Iron Ore 20,663 17,066 14,596

Third party products 15 32 54

Other 119 157 160

Total Iron Ore 20,797 17,255 14,810 Remuneration Report

Queensland Coal 5,357 7,679 7,388

New South Wales Energy Coal 885 1,421 1,499

Third party products − 19 2

Other − 2 −

Total Coal (3) 6,242 9,121 8,889

Group and unallocated items (4) 1,219 1,225 1,329

Inter-segment adjustment (63) (81) (88)

Total revenue 42,931 44,288 43,129 Directors’ Report

(1) Total Petroleum revenue includes: crude oil US$2,033 million (2019: US$3,171 million; 2018: US$2,933 million), natural gas US$980 million (2019: US$1,259 million;

2018: US$1,124 million), LNG US$774 million (2019: US$1,179 million; 2018: US$920 million), NGL US$198 million (2019: US$263 million; 2018: US$294 million) and other

US$85 million (2019: US$58 million; 2018: US$137 million).

(2) Total Copper revenue includes: copper US$10,044 million (2019: US$10,215 million; 2018: US$12,059 million) and other US$622 million (2019: US$623 million;

2018: US$722 million). Other consists of silver, zinc, molybdenum, uranium and gold.

(3) Total Coal revenue includes: metallurgical coal US$5,311 million (2019: US$7,568 million; 2018: US$7,331 million) and energy coal US$931 million (2019: US$1,553 million;

2018: US$1,558 million).

(4) Group and unallocated items revenue includes: Nickel West US$1,189 million (2019: US$1,193 million; 2018: US$1,297 million) and other revenue US$30 million

(2019: US$32 million; 2018: US$32 million).

5

Revenue consists of revenue from contracts with customers of US$43,087 million (2019: US$44,361 million; 2018: US$42,748 million)

and other revenue of US$(156) million (2019: US$(73) million; 2018: US$381 million).

Recognition and measurement

The Group generates revenue from the production and sale of The Group applies the practical expedient to not adjust the expected

commodities. Revenue is recognised when or as control of the consideration for the effects of the time value of money if the period Financial Statements

promised goods or services passes to the customer. In most between the delivery and when the customer pays for the promised

instances, control passes when the goods are delivered to a good or service is one year or less.

destination specified by the customer, typically on board the For commodity sales contracts, each individual metric unit is a

customer’s appointed vessel. Revenue from the provision of services separate performance obligation. Where the Group has contracts

is recognised over time, but does not represent a significant with unfulfilled performance obligations at period end, it is required

proportion of total revenue and is aggregated with the respective to disclose the transaction price allocated to these performance

asset and product revenue for disclosure purposes. The amount obligations. The Group applies the practical expedient to not disclose

of revenue recognised reflects the consideration to which the this information for contracts with an expected duration of one year

Group expects to be entitled in exchange for the goods or services. or less. The Group has a number of long-term contracts which are Additional information

Where the Group’s sales are provisionally priced, the final price primarily priced on variable terms, based on quoted index prices near

depends on future index prices. The amount of revenue initially the time of delivery, and at times include fixed pricing components.

recognised is based on the relevant forward market price. Adjustments Fixed pricing components, such as premiums and other charges, do

between the provisional and final price are accounted for under not represent a significant proportion of the total price. Any estimate

IFRS 9/AASB 9 ‘Financial Instruments’ (IFRS 9) and separately of the future transaction price would exclude estimated amounts of

recorded as other revenue. The period between provisional pricing variable consideration. The amount of future consideration from fixed

and final invoicing is typically between 60 and 120 days. pricing components has not been disclosed, as the Group does not

Revenue from concentrate is net of treatment costs and consider this relevant or useful information.

refining charges.

Revenue from the sale of significant by-products is included

within revenue. Where a by-product is not significant, revenue Shareholder information

is credited against costs.

BHP Annual Report 2020 181