Page 182 - Annual Report 2020

P. 182

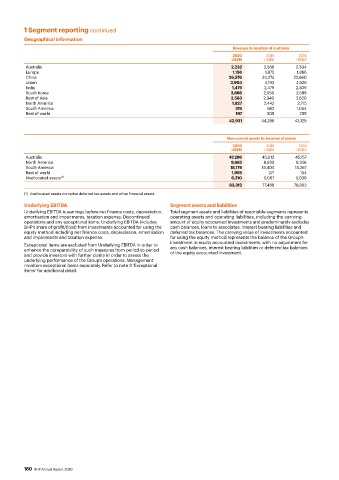

1 Segment reporting continued

Geographical information

Revenue by location of customer

2020 2019 2018

US$M US$M US$M

Australia 2,232 2,568 2,304

Europe 1,156 1,875 1,886

China 26,576 24,274 22,660

Japan 3,904 4,193 4,628

India 1,475 2,479 2,439

South Korea 2,666 2,550 2,588

Rest of Asia 2,583 2,940 2,620

North America 1,827 2,442 2,715

South America 315 662 1,054

Rest of world 197 305 235

42,931 44,288 43,129

Non-current assets by location of assets

2020 2019 2018

US$M US$M US$M

Australia 47,286 45,013 45,157

North America 9,682 8,633 8,246

South America 18,179 18,404 18,267

Rest of world 1,955 371 154

Unallocated assets (1) 6,210 5,067 5,039

83,312 77,488 76,863

(1) Unallocated assets comprise deferred tax assets and other financial assets.

Underlying EBITDA Segment assets and liabilities

Underlying EBITDA is earnings before net finance costs, depreciation, Total segment assets and liabilities of reportable segments represents

amortisation and impairments, taxation expense, Discontinued operating assets and operating liabilities, including the carrying

operations and any exceptional items. Underlying EBITDA includes amount of equity accounted investments and predominantly excludes

BHP’s share of profit/(loss) from investments accounted for using the cash balances, loans to associates, interest bearing liabilities and

equity method including net finance costs, depreciation, amortisation deferred tax balances. The carrying value of investments accounted

and impairments and taxation expense. for using the equity method represents the balance of the Group’s

Exceptional items are excluded from Underlying EBITDA in order to investment in equity accounted investments, with no adjustment for

any cash balances, interest bearing liabilities or deferred tax balances

enhance the comparability of such measures from period-to-period of the equity accounted investment.

and provide investors with further clarity in order to assess the

underlying performance of the Group’s operations. Management

monitors exceptional items separately. Refer to note 3 ‘Exceptional

items’ for additional detail.

180 BHP Annual Report 2020