Page 207 - Annual Report 2020

P. 207

19 Net debt continued

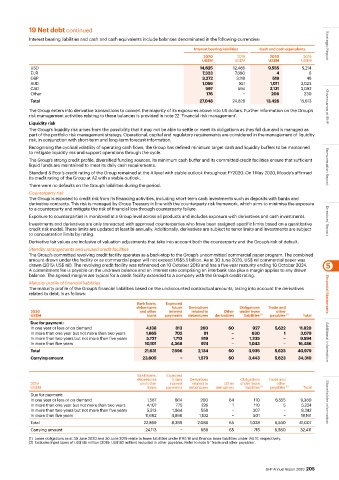

Interest bearing liabilities and cash and cash equivalents include balances denominated in the following currencies:

Interest bearing liabilities Cash and cash equivalents Strategic Report

2020 2019 2020 2019

US$M US$M US$M US$M

USD 14,625 12,485 9,555 9,214

EUR 7,323 7,680 4 6

GBP 3,272 3,118 519 48

AUD 1,055 951 1,011 3,023

CAD 597 594 2,131 3,092

Other 176 − 206 230

Total 27,048 24,828 13,426 15,613

The Group enters into derivative transactions to convert the majority of its exposures above into US dollars. Further information on the Group’s Governance at BHP

risk management activities relating to these balances is provided in note 22 ‘Financial risk management’.

Liquidity risk

The Group’s liquidity risk arises from the possibility that it may not be able to settle or meet its obligations as they fall due and is managed as

part of the portfolio risk management strategy. Operational, capital and regulatory requirements are considered in the management of liquidity

risk, in conjunction with short-term and long-term forecast information.

Recognising the cyclical volatility of operating cash flows, the Group has defined minimum target cash and liquidity buffers to be maintained

to mitigate liquidity risk and support operations through the cycle.

The Group’s strong credit profile, diversified funding sources, its minimum cash buffer and its committed credit facilities ensure that sufficient

liquid funds are maintained to meet its daily cash requirements. Remuneration Report

Standard & Poor’s credit rating of the Group remained at the A level with stable outlook throughout FY2020. On 1 May 2020, Moody’s affirmed

its credit rating of the Group at A2 with a stable outlook.

There were no defaults on the Group’s liabilities during the period.

Counterparty risk

The Group is exposed to credit risk from its financing activities, including short-term cash investments such as deposits with banks and

derivative contracts. This risk is managed by Group Treasury in line with the counterparty risk framework, which aims to minimise the exposure

to a counterparty and mitigate the risk of financial loss through counterparty failure.

Exposure to counterparties is monitored at a Group level across all products and includes exposure with derivatives and cash investments.

Investments and derivatives are only transacted with approved counterparties who have been assigned specific limits based on a quantitative Directors’ Report

credit risk model. These limits are updated at least bi-annually. Additionally, derivatives are subject to tenor limits and investments are subject

to concentration limits by rating.

Derivative fair values are inclusive of valuation adjustments that take into account both the counterparty and the Group’s risk of default.

Standby arrangements and unused credit facilities

The Group’s committed revolving credit facility operates as a back-stop to the Group’s uncommitted commercial paper program. The combined

amount drawn under the facility or as commercial paper will not exceed US$5.5 billion. As at 30 June 2020, US$ nil commercial paper was

drawn (2019: US$ nil). The revolving credit facility was refinanced on 10 October 2019 and has a five-year maturity ending 10 October 2024. 5

A commitment fee is payable on the undrawn balance and an interest rate comprising an interbank rate plus a margin applies to any drawn

balance. The agreed margins are typical for a credit facility extended to a company with the Group’s credit rating.

Maturity profile of financial liabilities

The maturity profile of the Group’s financial liabilities based on the undiscounted contractual amounts, taking into account the derivatives

related to debt, is as follows: Financial Statements

Bank loans, Expected

debentures future Derivatives Obligations Trade and

2020 and other interest related to Other under lease other

US$M loans payments debentures derivatives liabilities (1) payables Total

(2)

Due for payment:

In one year or less or on demand 4,138 813 260 60 927 5,622 11,820

In more than one year but not more than two years 1,665 702 81 − 630 1 3,079

In more than two years but not more than five years 5,727 1,713 819 − 1,335 − 9,594

In more than five years 10,101 4,368 974 − 1,043 − 16,486 Additional information

Total 21,631 7,596 2,134 60 3,935 5,623 40,979

Carrying amount 23,605 − 1,579 60 3,443 5,623 34,310

Bank loans, Expected

debentures future Derivatives Obligations Trade and

2019 and other interest related to Other under lease other

US$M loans payments debentures derivatives liabilities (1) payables Total

(2)

Due for payment:

In one year or less or on demand 1,587 864 200 64 110 6,555 9,380

In more than one year but not more than two years 4,107 775 226 1 110 5 5,224 Shareholder information

In more than two years but not more than five years 5,513 1,864 558 − 307 − 8,242

In more than five years 11,662 4,896 1,102 − 501 − 18,161

Total 22,869 8,399 2,086 65 1,028 6,560 41,007

Carrying amount 24,113 − 958 65 715 6,560 32,411

(1) Lease obligations as at 30 June 2020 and 30 June 2019 relate to lease liabilities under IFRS 16 and finance lease liabilities under IAS 17, respectively.

(2) Excludes input taxes of US$145 million (2019: US$162 million) included in other payables. Refer to note 9 ‘Trade and other payables’.

BHP Annual Report 2020 205