Page 208 - Annual Report 2020

P. 208

20 Leases

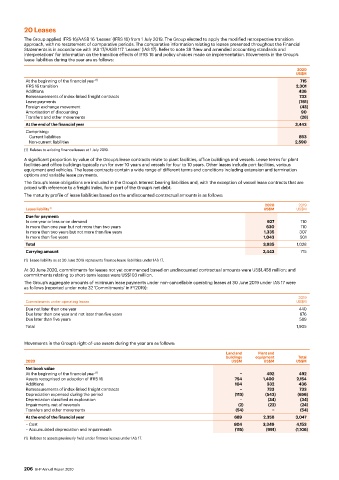

The Group applied IFRS 16/AASB 16 ‘Leases’ (IFRS 16) from 1 July 2019. The Group elected to apply the modified retrospective transition

approach, with no restatement of comparative periods. The comparative information relating to leases presented throughout the Financial

Statements is in accordance with IAS 17/AASB 117 ‘Leases’ (IAS 17). Refer to note 38 ‘New and amended accounting standards and

interpretations’ for information on the transition effects of IFRS 16 and policy choices made on implementation. Movements in the Group’s

lease liabilities during the year are as follows:

2020

US$M

At the beginning of the financial year (1) 715

IFRS 16 transition 2,301

Additions 436

Remeasurements of index-linked freight contracts 733

Lease payments (761)

Foreign exchange movement (43)

Amortisation of discounting 90

Transfers and other movements (28)

At the end of the financial year 3,443

Comprising:

Current liabilities 853

Non-current liabilities 2,590

(1) Relates to existing finance leases at 1 July 2019.

A significant proportion by value of the Group’s lease contracts relate to plant facilities, office buildings and vessels. Lease terms for plant

facilities and office buildings typically run for over 10 years and vessels for four to 10 years. Other leases include port facilities, various

equipment and vehicles. The lease contracts contain a wide range of different terms and conditions including extension and termination

options and variable lease payments.

The Group’s lease obligations are included in the Group’s Interest bearing liabilities and, with the exception of vessel lease contracts that are

priced with reference to a freight index, form part of the Group’s net debt.

The maturity profile of lease liabilities based on the undiscounted contractual amounts is as follows:

2020 2019

Lease liability (1) US$M US$M

Due for payment:

In one year or less or on demand 927 110

In more than one year but not more than two years 630 110

In more than two years but not more than five years 1,335 307

In more than five years 1,043 501

Total 3,935 1,028

Carrying amount 3,443 715

(1) Lease liability as at 30 June 2019 represents finance lease liabilities under IAS 17.

At 30 June 2020, commitments for leases not yet commenced based on undiscounted contractual amounts were US$1,458 million; and

commitments relating to short-term leases were US$103 million.

The Group’s aggregate amounts of minimum lease payments under non-cancellable operating leases at 30 June 2019 under IAS 17 were

as follows (reported under note 32 ‘Commitments’ in FY2019):

2019

Commitments under operating leases US$M

Due not later than one year 440

Due later than one year and not later than five years 876

Due later than five years 589

Total 1,905

Movements in the Group’s right-of-use assets during the year are as follows:

Land and Plant and

buildings equipment Total

2020 US$M US$M US$M

Net book value

At the beginning of the financial year (1) − 492 492

Assets recognised on adoption of IFRS 16 754 1,400 2,154

Additions 104 332 436

Remeasurements of index-linked freight contracts − 733 733

Depreciation expensed during the period (113) (543) (656)

Depreciation classified as exploration − (34) (34)

Impairments, net of reversals (2) (22) (24)

Transfers and other movements (54) − (54)

At the end of the financial year 689 2,358 3,047

– Cost 804 3,349 4,153

– Accumulated depreciation and impairments (115) (991) (1,106)

(1) Relates to assets previously held under finance leases under IAS 17.

206 BHP Annual Report 2020