Page 225 - Annual Report 2020

P. 225

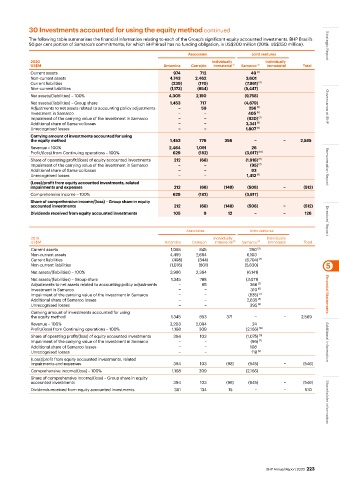

30 Investments accounted for using the equity method continued

The following table summarises the financial information relating to each of the Group’s significant equity accounted investments. BHP Brasil’s

50 per cent portion of Samarco’s commitments, for which BHP Brasil has no funding obligation, is US$200 million (2019: US$250 million). Strategic Report

Associates Joint ventures

2020 Individually Individually

US$M Antamina Cerrejón immaterial (1) Samarco (2) immaterial Total

Current assets 974 712 49 (3)

Non-current assets 4,743 2,462 3,601

Current liabilities (239) (170) (7,961) (4)

Non-current liabilities (1,173) (854) (5,447)

Net assets/(liabilities) – 100% 4,305 2,150 (9,758)

Net assets/(liabilities) – Group share 1,453 717 (4,879)

Adjustments to net assets related to accounting policy adjustments − 59 256 (5) Governance at BHP

Investment in Samarco – – 405 (6)

Impairment of the carrying value of the investment in Samarco − − (930) (7)

Additional share of Samarco losses − − 3,341 (8)

Unrecognised losses − − 1,807 (9)

Carrying amount of investments accounted for using

the equity method 1,453 776 356 − − 2,585

Revenue – 100% 2,464 1,091 26

Profit/(loss) from Continuing operations – 100% 629 (182) (3,617) (10)

Share of operating profit/(loss) of equity accounted investments 212 (68) (1,918) (11)

Impairment of the carrying value of the investment in Samarco – – (95) (7) Remuneration Report

Additional share of Samarco losses − − 93

Unrecognised losses − − 1,412 (9)

(Loss)/profit from equity accounted investments, related

impairments and expenses 212 (68) (148) (508) − (512)

Comprehensive income – 100% 629 (182) (3,617)

Share of comprehensive income/(loss) – Group share in equity

accounted investments 212 (68) (148) (508) − (512)

Dividends received from equity accounted investments 105 9 12 − − 126 Directors’ Report

Associates Joint ventures

2019 Individually Individually

US$M Antamina Cerrejón immaterial (1) Samarco (2) immaterial Total

Current assets 1,065 845 290 (3)

Non-current assets 4,495 2,664 6,103

Current liabilities (498) (344) (6,704) (4)

Non-current liabilities (1,076) (801) (5,830) 5

Net assets/(liabilities) – 100% 3,986 2,364 (6,141)

Net assets/(liabilities) – Group share 1,345 788 (3,071)

Adjustments to net assets related to accounting policy adjustments − 65 366 (5)

Investment in Samarco − − 310 (6)

Impairment of the carrying value of the investment in Samarco − − (835) (7) Financial Statements

Additional share of Samarco losses − − 2,835 (8)

Unrecognised losses − − 395 (9)

Carrying amount of investments accounted for using

the equity method 1,345 853 371 − − 2,569

Revenue – 100% 3,203 2,094 24

Profit/(loss) from Continuing operations – 100% 1,168 309 (2,166) (10)

Share of operating profit/(loss) of equity accounted investments 394 103 (1,075) (11)

Impairment of the carrying value of the investment in Samarco − − (96) (7) Additional information

Additional share of Samarco losses − − 108

Unrecognised losses − − 118 (9)

(Loss)/profit from equity accounted investments, related

impairments and expenses 394 103 (98) (945) − (546)

Comprehensive income/(loss) – 100% 1,168 309 (2,166)

Share of comprehensive income/(loss) – Group share in equity

accounted investments 394 103 (98) (945) − (546)

Dividends received from equity accounted investments 361 134 15 − − 510 Shareholder information

BHP Annual Report 2020 223