Page 229 - Annual Report 2020

P. 229

Other items

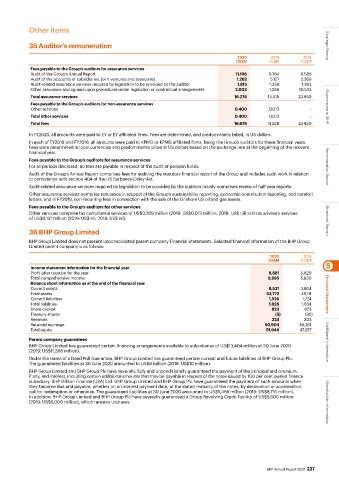

35 Auditor’s remuneration Strategic Report

2020 2019 2018

US$M US$M US$M

Fees payable to the Group’s auditors for assurance services

Audit of the Group’s Annual Report 11.196 6.764 6.585

Audit of the accounts of subsidiaries, joint ventures and associates 1.262 5.127 5.369

Audit-related assurance services required by legislation to be provided by the auditor 1.815 1.358 1.363

Other assurance and agreed-upon procedures under legislation or contractual arrangements 2.003 1.266 10.533

Total assurance services 16.276 14.515 23.850

Fees payable to the Group’s auditors for non-assurance services

Other services 0.400 0.013 − Governance at BHP

Total other services 0.400 0.013 −

Total fees 16.676 14.528 23.850

In FY2020, all amounts were paid to EY or EY affiliated firms. Fees are determined, and predominantly billed, in US dollars.

In each of FY2019 and FY2018, all amounts were paid to KPMG or KPMG affiliated firms, being the Group’s auditors for these financial years.

Fees were determined in local currencies and predominantly billed in US dollars based on the exchange rate at the beginning of the relevant

financial year.

Fees payable to the Group’s auditors for assurance services

For all periods disclosed, no fees are payable in respect of the audit of pension funds. Remuneration Report

Audit of the Group’s Annual Report comprises fees for auditing the statutory financial report of the Group and includes audit work in relation

to compliance with section 404 of the US Sarbanes-Oxley Act.

Audit-related assurance services required by legislation to be provided by the auditors mainly comprises review of half-year reports.

Other assurance services comprise assurance in respect of the Group’s sustainability reporting, economic contribution reporting, and comfort

letters, and in FY2018, non-recurring fees in connection with the sale of the Onshore US oil and gas assets.

Fees payable to the Group’s auditors for other services

Other services comprise tax compliance services of US$0.269 million (2019: US$0.013 million; 2018: US$ nil) and tax advisory services

of US$0.131 million (2019: US$ nil; 2018: US$ nil). Directors’ Report

36 BHP Group Limited

BHP Group Limited does not present unconsolidated parent company Financial Statements. Selected financial information of the BHP Group

Limited parent company is as follows:

2020 2019

US$M US$M

Income statement information for the financial year 5

Profit after taxation for the year 8,881 5,820

Total comprehensive income 8,895 5,830

Balance sheet information as at the end of the financial year

Current assets 8,531 3,804

Total assets 53,772 49,111 Financial Statements

Current liabilities 1,526 1,724

Total liabilities 1,826 1,854

Share capital 823 823

Treasury shares (5) (30)

Reserves 224 203

Retained earnings 50,904 46,261

Total equity 51,946 47,257

Parent company guarantees

BHP Group Limited has guaranteed certain financing arrangements available to subsidiaries of US$13,404 million at 30 June 2020 Additional information

(2019: US$11,368 million).

Under the terms of a Deed Poll Guarantee, BHP Group Limited has guaranteed certain current and future liabilities of BHP Group Plc.

The guaranteed liabilities at 30 June 2020 amounted to US$8 million (2019: US$10 million).

BHP Group Limited and BHP Group Plc have severally, fully and unconditionally guaranteed the payment of the principal and premium,

if any, and interest, including certain additional amounts that may be payable in respect of the notes issued by 100 per cent owned finance

subsidiary, BHP Billiton Finance (USA) Ltd. BHP Group Limited and BHP Group Plc have guaranteed the payment of such amounts when

they become due and payable, whether on an interest payment date, at the stated maturity of the notes, by declaration or acceleration,

call for redemption or otherwise. The guaranteed liabilities at 30 June 2020 amounted to US$5,466 million (2019: US$8,716 million).

In addition, BHP Group Limited and BHP Group Plc have severally guaranteed a Group Revolving Credit Facility of US$5,500 million

(2019: US$6,000 million), which remains undrawn. Shareholder information

BHP Annual Report 2020 227