Page 228 - Annual Report 2020

P. 228

Unrecognised items and uncertain events

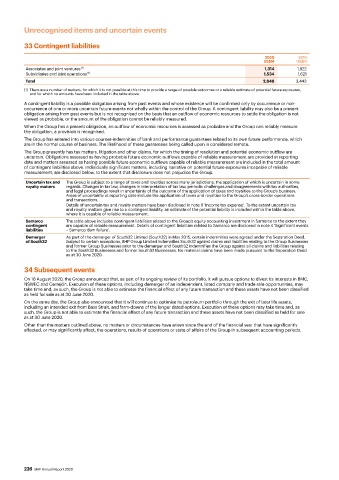

33 Contingent liabilities

2020 2019

US$M US$M

Associates and joint ventures (1) 1,314 1,822

Subsidiaries and joint operations (1) 1,534 1,621

Total 2,848 3,443

(1) There are a number of matters, for which it is not possible at this time to provide a range of possible outcomes or a reliable estimate of potential future exposures,

and for which no amounts have been included in the table above.

A contingent liability is a possible obligation arising from past events and whose existence will be confirmed only by occurrence or non-

occurrence of one or more uncertain future events not wholly within the control of the Group. A contingent liability may also be a present

obligation arising from past events but is not recognised on the basis that an outflow of economic resources to settle the obligation is not

viewed as probable, or the amount of the obligation cannot be reliably measured.

When the Group has a present obligation, an outflow of economic resources is assessed as probable and the Group can reliably measure

the obligation, a provision is recognised.

The Group has entered into various counter-indemnities of bank and performance guarantees related to its own future performance, which

are in the normal course of business. The likelihood of these guarantees being called upon is considered remote.

The Group presently has tax matters, litigation and other claims, for which the timing of resolution and potential economic outflow are

uncertain. Obligations assessed as having probable future economic outflows capable of reliable measurement are provided at reporting

date and matters assessed as having possible future economic outflows capable of reliable measurement are included in the total amount

of contingent liabilities above. Individually significant matters, including narrative on potential future exposures incapable of reliable

measurement, are disclosed below, to the extent that disclosure does not prejudice the Group.

Uncertain tax and The Group is subject to a range of taxes and royalties across many jurisdictions, the application of which is uncertain in some

royalty matters regards. Changes in tax law, changes in interpretation of tax law, periodic challenges and disagreements with tax authorities,

and legal proceedings result in uncertainty of the outcome of the application of taxes and royalties to the Group’s business.

Areas of uncertainty at reporting date include the application of taxes and royalties to the Group’s cross-border operations

and transactions.

Details of uncertain tax and royalty matters have been disclosed in note 6 ‘Income tax expense’. To the extent uncertain tax

and royalty matters give rise to a contingent liability, an estimate of the potential liability is included within the table above,

where it is capable of reliable measurement.

Samarco The table above includes contingent liabilities related to the Group’s equity accounting investment in Samarco to the extent they

contingent are capable of reliable measurement. Details of contingent liabilities related to Samarco are disclosed in note 4 ‘Significant events

liabilities – Samarco dam failure’.

Demerger As part of the demerger of South32 Limited (South32) in May 2015, certain indemnities were agreed under the Separation Deed.

of South32 Subject to certain exceptions, BHP Group Limited indemnifies South32 against claims and liabilities relating to the Group Businesses

and former Group Businesses prior to the demerger and South32 indemnifies the Group against all claims and liabilities relating

to the South32 Businesses and former South32 Businesses. No material claims have been made pursuant to the Separation Deed

as at 30 June 2020.

34 Subsequent events

On 18 August 2020, the Group announced that, as part of its ongoing review of its portfolio, it will pursue options to divest its interests in BMC,

NSWEC and Cerrejón. Execution of these options, including demerger of an independent, listed company and trade sale opportunities, may

take time and, as such, the Group is not able to estimate the financial effect of any future transaction and these assets have not been classified

as held for sale as at 30 June 2020.

On the same day, the Group also announced that it will continue to optimise its petroleum portfolio through the exit of later life assets,

including an intended exit from Bass Strait, and farm-downs of the longer dated options. Execution of these options may take time and, as

such, the Group is not able to estimate the financial effect of any future transaction and these assets have not been classified as held for sale

as at 30 June 2020.

Other than the matters outlined above, no matters or circumstances have arisen since the end of the financial year that have significantly

affected, or may significantly affect, the operations, results of operations or state of affairs of the Group in subsequent accounting periods.

226 BHP Annual Report 2020