Page 226 - Annual Report 2020

P. 226

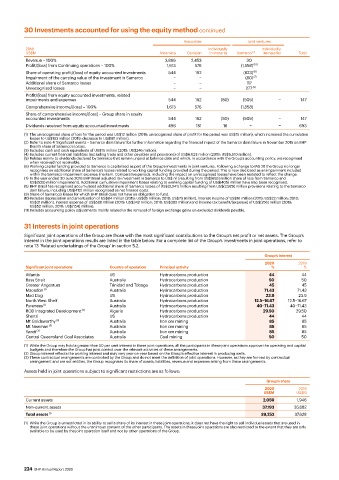

30 Investments accounted for using the equity method continued

Associates Joint ventures

2018 Individually Individually

US$M Antamina Cerrejón immaterial Samarco (2) immaterial Total

Revenue – 100% 3,866 2,453 30

Profit/(loss) from Continuing operations – 100% 1,613 576 (1,558) (10)

Share of operating profit/(loss) of equity accounted investments 544 192 (823) (11)

Impairment of the carrying value of the investment in Samarco − − (80) (7)

Additional share of Samarco losses − − 117

Unrecognised losses − − 277 (9)

Profit/(loss) from equity accounted investments, related

impairments and expenses 544 192 (80) (509) − 147

Comprehensive income/(loss) – 100% 1,613 576 (1,558)

Share of comprehensive income/(loss) – Group share in equity

accounted investments 544 192 (80) (509) − 147

Dividends received from equity accounted investments 496 181 16 − − 693

(1) The unrecognised share of loss for the period was US$12 million (2019: unrecognised share of profit for the period was US$15 million), which increased the cumulative

losses to US$193 million (2019: decrease to US$181 million).

(2) Refer to note 4 ‘Significant events – Samarco dam failure’ for further information regarding the financial impact of the Samarco dam failure in November 2015 on BHP

Brasil’s share of Samarco’s losses.

(3) Includes cash and cash equivalents of US$15 million (2019: US$246 million).

(4) Includes current financial liabilities (excluding trade and other payables and provisions) of US$6,023 million (2019: US$5,510 million).

(5) Relates mainly to dividends declared by Samarco that remain unpaid at balance date and which, in accordance with the Group’s accounting policy, are recognised

when received not receivable.

(6) Working capital funding provided to Samarco is capitalised as part of the Group’s investments in joint ventures. Following a change to IAS 28 the Group no longer

recognises an additional share of Samarco’s losses related to working capital funding provided during the period. This is now disclosed as an impairment included

within the Samarco impairment expense line item. Comparative periods, including the impact on unrecognised losses have been restated to reflect the change.

(7) In the year ended 30 June 2016 BHP Brasil adjusted its investment in Samarco to US$ nil (resulting from US$(655) million share of loss from Samarco and

US$(525) million impairment). Additional cumulative impairment losses relating to working capital funding of US$(405) million have also been recognised.

(8) BHP Brasil has recognised accumulated additional share of Samarco losses of US$(3,341) million resulting from US$(2,929) million provisions relating to the Samarco

dam failure, including US$(412) million recognised as net finance costs.

(9) Share of Samarco’s losses for which BHP Brasil does not have an obligation to fund.

(10) Includes depreciation and amortisation of US$84 million (2019: US$85 million; 2018: US$73 million), interest income of US$16 million (2019: US$22 million; 2018:

US$31 million), interest expense of US$588 million (2019: US$342 million; 2018: US$385 million) and income tax benefit/(expense) of US$(256) million (2019:

US$52 million; 2018: US$(154) million).

(11) Includes accounting policy adjustments mainly related to the removal of foreign exchange gains on excluded dividends payable.

31 Interests in joint operations

Significant joint operations of the Group are those with the most significant contributions to the Group’s net profit or net assets. The Group’s

interest in the joint operations results are listed in the table below. For a complete list of the Group’s investments in joint operations, refer to

note 13 ‘Related undertakings of the Group’ in section 5.2.

Group’s interest

2020 2019

Significant joint operations Country of operation Principal activity % %

Atlantis US Hydrocarbons production 44 44

Bass Strait Australia Hydrocarbons production 50 50

Greater Angostura Trinidad and Tobago Hydrocarbons production 45 45

Macedon (1) Australia Hydrocarbons production 71.43 71.43

Mad Dog US Hydrocarbons production 23.9 23.9

North West Shelf Australia Hydrocarbons production 12.5–16.67 12.5–16.67

Pyrenees (1) Australia Hydrocarbons production 40–71.43 40–71.43

ROD Integrated Development (2) Algeria Hydrocarbons production 29.50 29.50

Shenzi US Hydrocarbons production 44 44

Mt Goldsworthy (3) Australia Iron ore mining 85 85

Mt Newman (3) Australia Iron ore mining 85 85

Yandi (3) Australia Iron ore mining 85 85

Central Queensland Coal Associates Australia Coal mining 50 50

(1) While the Group may hold a greater than 50 per cent interest in these joint operations, all the participants in these joint operations approve the operating and capital

budgets and therefore the Group has joint control over the relevant activities of these arrangements.

(2) Group interest reflects the working interest and may vary year-on-year based on the Group’s effective interest in producing wells.

(3) These contractual arrangements are controlled by the Group and do not meet the definition of joint operations. However, as they are formed by contractual

arrangement and are not entities, the Group recognises its share of assets, liabilities, revenue and expenses arising from these arrangements.

Assets held in joint operations subject to significant restrictions are as follows:

Group’s share

2020 2019

US$M US$M

Current assets 2,059 1,946

Non-current assets 37,193 35,682

Total assets (1) 39,252 37,628

(1) While the Group is unrestricted in its ability to sell a share of its interest in these joint operations, it does not have the right to sell individual assets that are used in

these joint operations without the unanimous consent of the other participants. The assets in these joint operations are also restricted to the extent that they are only

available to be used by the joint operation itself and not by other operations of the Group.

224 BHP Annual Report 2020