Page 157 - Annual Report 2020

P. 157

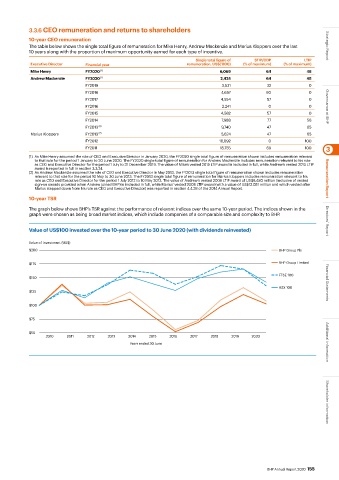

3.3.6 CEO remuneration and returns to shareholders

10-year CEO remuneration

The table below shows the single total figure of remuneration for Mike Henry, Andrew Mackenzie and Marius Kloppers over the last Strategic Report

10 years along with the proportion of maximum opportunity earned for each type of incentive.

Single total figure of STIP/CDP LTIP

Executive Director Financial year remuneration, US$(‘000) (% of maximum) (% of maximum)

Mike Henry FY2020 (1) 6,069 64 48

Andrew Mackenzie FY2020 (1) 2,424 64 48

FY2019 3,531 32 0

FY2018 4,657 60 0

FY2017 4,554 57 0

FY2016 2,241 0 0 Governance at BHP

FY2015 4,582 57 0

FY2014 7,988 77 58

FY2013 (2) 9,740 47 65

Marius Kloppers FY2013 (2) 5,624 47 65

FY2012 16,092 0 100

FY2011 15,755 69 100 3

(1) As Mike Henry assumed the role of CEO and Executive Director in January 2020, the FY2020 single total figure of remuneration shown includes remuneration relevant

to that role for the period 1 January to 30 June 2020. The FY2020 single total figure of remuneration for Andrew Mackenzie includes remuneration relevant to his role

as CEO and Executive Director for the period 1 July to 31 December 2019. The value of Mike’s vested 2015 LTIP award is included in full, while Andrew’s vested 2015 LTIP

award is reported in full in section 3.3.24.

(2) As Andrew Mackenzie assumed the role of CEO and Executive Director in May 2013, the FY2013 single total figure of remuneration shown includes remuneration

relevant to that role for the period 10 May to 30 June 2013. The FY2013 single total figure of remuneration for Marius Kloppers includes remuneration relevant to his

role as CEO and Executive Director for the period 1 July 2012 to 10 May 2013. The value of Andrew’s vested 2008 LTIP award of US$8.480 million (inclusive of vested Remuneration Report

sign-on awards provided when Andrew joined BHP) is included in full, while Marius’ vested 2008 LTIP award (with a value of US$12.051 million and which vested after

Marius stepped down from his role as CEO and Executive Director) was reported in section 4.4.28 of the 2014 Annual Report.

10-year TSR

The graph below shows BHP’s TSR against the performance of relevant indices over the same 10-year period. The indices shown in the

graph were chosen as being broad market indices, which include companies of a comparable size and complexity to BHP. Directors’ Report

Value of US$100 invested over the 10-year period to 30 June 2020 (with dividends reinvested)

Value of investment (US$)

$200 BHP Group Plc

$175 BHP Group Limited

FTSE 100

$150

ASX 100 Financial Statements

$125

$100

$75

$50

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Years ended 30 June Additional information

Shareholder information

BHP Annual Report 2020 155