Page 152 - Annual Report 2020

P. 152

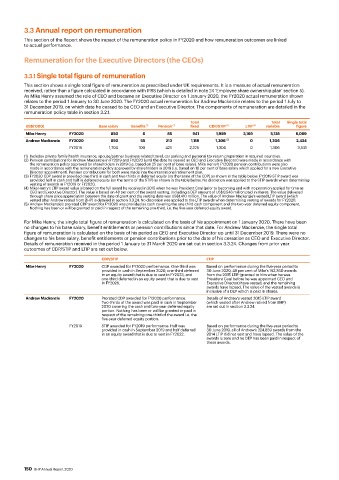

3.3 Annual report on remuneration

This section of the Report shows the impact of the remuneration policy in FY2020 and how remuneration outcomes are linked

to actual performance.

Remuneration for the Executive Directors (the CEOs)

3.3.1 Single total figure of remuneration

This section shows a single total figure of remuneration as prescribed under UK requirements. It is a measure of actual remuneration

received, rather than a figure calculated in accordance with IFRS (which is detailed in note 24 ‘Employee share ownership plan’ section 5).

As Mike Henry assumed the role of CEO and became an Executive Director on 1 January 2020, the FY2020 actual remuneration shown

relates to the period 1 January to 30 June 2020. The FY2020 actual remuneration for Andrew Mackenzie relates to the period 1 July to

31 December 2019, on which date he ceased to be CEO and an Executive Director. The components of remuneration are detailed in the

remuneration policy table in section 3.2.1.

Total Total Single total

US$(‘000) Base salary Benefits (1) Pension (2) fixed CDP/STIP (3) LTIP (4) variable figure

Mike Henry FY2020 850 6 85 941 1,959 3,169 5,128 6,069

Andrew Mackenzie FY2020 850 55 213 1,118 1,306 (5) 0 1,306 2,424

FY2019 1,700 100 425 2,225 1,306 0 1,306 3,531

(1) Includes private family health insurance, spouse/partner business-related travel, car parking and personal tax return preparation in required countries.

(2) Pension contributions for Andrew Mackenzie in FY2019 and FY2020 (until the date he ceased as CEO and Executive Director) were made in accordance with

the remuneration policy approved by shareholders in 2019 (i.e. based on 25 per cent of base salary). Mike Henry’s FY2020 pension contributions were also

made in accordance with the remuneration policy approved by shareholders in 2019 (i.e. based on 10 per cent of base salary which applied for a new Executive

Director appointment). Pension contributions for both were made into the international retirement plan.

(3) FY2020 CDP award is provided one-third in cash and two-thirds in deferred equity (on the terms of the CDP) as shown in the table below. FY2019 STIP award was

provided half in cash and half in deferred equity (on the terms of the STIP) as shown in the table below. No discretion was applied to the STIP awards when determining

vesting of awards in FY2019 or FY2020.

(4) Mike Henry’s LTIP award value is based on the full award he received in 2015 when he was President Coal (prior to becoming and with no proration applied for time as

CEO and Executive Director). The value is based on 48 per cent of the award vesting, including a DEP amount of US$0.548 million paid in shares. The value delivered

through share price appreciation between the date of grant and the vesting date was US$1.410 million. The value of Andrew Mackenzie’s vested LTIP award (which

vested after Andrew retired from BHP) is detailed in section 3.3.24. No discretion was applied to the LTIP awards when determining vesting of awards for FY2020.

(5) Andrew Mackenzie’s prorated CDP award for FY2020 was provided as cash covering the one-third cash component and the two-year deferred equity component.

Nothing has been or will be granted or paid in respect of the remaining one-third, i.e. the five-year deferred equity award.

For Mike Henry, the single total figure of remuneration is calculated on the basis of his appointment on 1 January 2020. There have been

no changes to his base salary, benefit entitlements or pension contributions since that date. For Andrew Mackenzie, the single total

figure of remuneration is calculated on the basis of his period as CEO and Executive Director up until 31 December 2019. There were no

changes to his base salary, benefit entitlements or pension contributions prior to the date of his cessation as CEO and Executive Director.

Details of remuneration received in the period 1 January to 31 March 2020 are set out in section 3.3.24. Changes from prior year

outcomes of CDP/STIP and LTIP are set out below.

CDP/STIP LTIP

Mike Henry FY2020 CDP awarded for FY2020 performance. One-third was Based on performance during the five-year period to

provided in cash in September 2020, one-third deferred 30 June 2020, 48 per cent of Mike’s 192,360 awards

in an equity award that is due to vest in FY2023, and from the 2015 LTIP (granted to him when he was

one-third deferred in an equity award that is due to vest President Coal before he was appointed CEO and

in FY2026. Executive Director) have vested, and the remaining

awards have lapsed. The value of the vested awards is

inclusive of a DEP which is paid in shares.

Andrew Mackenzie FY2020 Prorated CDP awarded for FY2020 performance. Details of Andrew’s vested 2015 LTIP award

Two-thirds of the award was paid in cash in September (which vested after Andrew retired from BHP)

2020 covering the cash and two-year deferred equity are set out in section 3.3.24.

portion. Nothing has been or will be granted or paid in

respect of the remaining one-third of the award i.e. the

five-year deferred equity portion.

FY2019 STIP awarded for FY2019 performance. Half was Based on performance during the five-year period to

provided in cash in September 2019 and half deferred 30 June 2019, all of Andrew’s 224,859 awards from the

in an equity award that is due to vest in FY2022. 2014 LTIP did not vest and have lapsed. The value of the

awards is zero and no DEP has been paid in respect of

these awards.

150 BHP Annual Report 2020