Page 149 - Annual Report 2020

P. 149

3.2.3 Potential remuneration outcomes

The Remuneration Committee recognises that market forces necessarily influence remuneration practices and it strongly believes the

fundamental driver of remuneration outcomes should be business performance. It also believes that overall remuneration should be Strategic Report

fair to the individual, such that remuneration levels accurately reflect the CEO’s responsibilities and contributions, and align with the

expectations of our shareholders, while considering the positioning and relativities of pay and employment conditions across the wider

BHP workforce.

The amount of remuneration actually received each year depends on the achievement of superior business and individual performance

generating sustained shareholder value. Before deciding on the final incentive outcomes for the CEO, the Committee first considers the

achievement against the pre-determined performance conditions. The Committee then applies its overarching discretion on the basis

of what it considers to be a fair and commensurate remuneration level to decide if the outcome should be reduced. When the CEO was

appointed in January 2020 the Board advised him that the Committee would exercise its discretion on the basis of what it considered

to be a fair and commensurate remuneration level to decide if the outcome should be reduced.

In this way, the Committee believes it can set a remuneration level for the CEO that is sufficient to incentivise him and that is also fair

to him and commensurate with shareholder expectations and prevailing market conditions. Governance at BHP

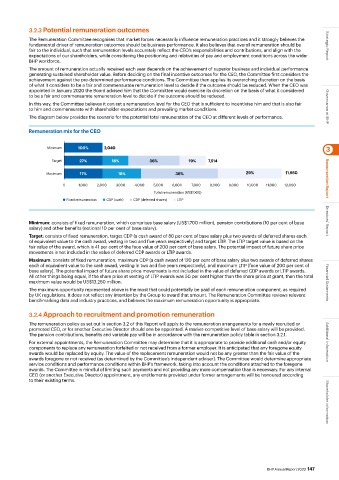

The diagram below provides the scenario for the potential total remuneration of the CEO at different levels of performance.

Remuneration mix for the CEO

Minimum 100% 2,040 3

Target 27% 18% 36% 19% 7,514

Maximum 17% 18% 36% 29% 11,560 Remuneration Report

0 1,000 2,000 3000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 12,000

Total remuneration (US$’000)

Fixed remuneration CDP (cash) CDP (deferred shares) LTIP

Minimum: consists of fixed remuneration, which comprises base salary (US$1.700 million), pension contributions (10 per cent of base Directors’ Report

salary) and other benefits (notional 10 per cent of base salary).

Target: consists of fixed remuneration, target CDP (a cash award of 80 per cent of base salary plus two awards of deferred shares each

of equivalent value to the cash award, vesting in two and five years respectively) and target LTIP. The LTIP target value is based on the

fair value of the award, which is 41 per cent of the face value of 200 per cent of base salary. The potential impact of future share price

movements is not included in the value of deferred CDP awards or LTIP awards.

Maximum: consists of fixed remuneration, maximum CDP (a cash award of 120 per cent of base salary plus two awards of deferred shares

each of equivalent value to the cash award, vesting in two and five years respectively), and maximum LTIP (face value of 200 per cent of

base salary). The potential impact of future share price movements is not included in the value of deferred CDP awards or LTIP awards.

All other things being equal, if the share price at vesting of LTIP awards was 50 per cent higher than the share price at grant, then the total

maximum value would be US$13.260 million. Financial Statements

The maximum opportunity represented above is the most that could potentially be paid of each remuneration component, as required

by UK regulations. It does not reflect any intention by the Group to award that amount. The Remuneration Committee reviews relevant

benchmarking data and industry practices, and believes the maximum remuneration opportunity is appropriate.

3.2.4 Approach to recruitment and promotion remuneration

The remuneration policy as set out in section 3.2 of this Report will apply to the remuneration arrangements for a newly recruited or

promoted CEO, or for another Executive Director should one be appointed. A market-competitive level of base salary will be provided.

The pension contributions, benefits and variable pay will be in accordance with the remuneration policy table in section 3.2.1.

For external appointments, the Remuneration Committee may determine that it is appropriate to provide additional cash and/or equity Additional information

components to replace any remuneration forfeited or not received from a former employer. It is anticipated that any foregone equity

awards would be replaced by equity. The value of the replacement remuneration would not be any greater than the fair value of the

awards foregone or not received (as determined by the Committee’s independent adviser). The Committee would determine appropriate

service conditions and performance conditions within BHP’s framework, taking into account the conditions attached to the foregone

awards. The Committee is mindful of limiting such payments and not providing any more compensation than is necessary. For any internal

CEO (or another Executive Director) appointment, any entitlements provided under former arrangements will be honoured according

to their existing terms. Shareholder information

BHP Annual Report 2020 147