Page 153 - Annual Report 2020

P. 153

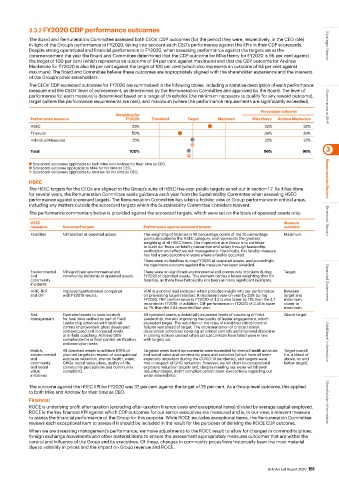

3.3.2 FY2020 CDP performance outcomes

The Board and Remuneration Committee assessed both CEOs’ CDP outcomes (for the period they were, respectively, in the CEO role)

in light of the Group’s performance in FY2020, taking into account each CEO’s performance against the KPIs in their CDP scorecards. Strategic Report

Despite strong operational and financial performance in FY2020, when assessing performance against the targets set at the

commencement the year the Board and Committee determined that the CDP outcome for Mike Henry for FY2020 is 96 per cent against

the target of 100 per cent (which represents an outcome of 64 per cent against maximum) and that the CDP outcome for Andrew

Mackenzie for FY2020 is also 96 per cent against the target of 100 per cent (which also represents an outcome of 64 per cent against

maximum). The Board and Committee believe these outcomes are appropriately aligned with the shareholder experience and the interests

of the Group’s other stakeholders.

The CEOs’ CDP scorecard outcomes for FY2020 are summarised in the following tables, including a narrative description of each performance

measure and the CEOs’ level of achievement, as determined by the Remuneration Committee and approved by the Board. The level of

performance for each measure is determined based on a range of thresholds (the minimum necessary to qualify for any reward outcome),

target (where the performance requirements are met), and maximum (where the performance requirements are significantly exceeded).

Percentage outcome Governance at BHP

Weighting for

Performance measure FY2020 Threshold Target Maximum Mike Henry Andrew Mackenzie

HSEC 25% 32% 32%

Financial 50% 39% 39%

Individual Measures 25% 25% 25%

3

Total 100% 96% 96%

Scorecard outcomes applicable to both Mike and Andrew for their time as CEO.

Scorecard outcome applicable to Mike for his time as CEO.

Scorecard outcomes applicable to Andrew for his time as CEO.

HSEC Remuneration Report

The HSEC targets for the CEOs are aligned to the Group’s suite of HSEC five-year public targets as set out in section 1.7. As it has done

for several years, the Remuneration Committee seeks guidance each year from the Sustainability Committee when assessing HSEC

performance against scorecard targets. The Remuneration Committee has taken a holistic view of Group performance in critical areas,

including any matters outside the scorecard targets which the Sustainability Committee considers relevant.

The performance commentary below is provided against the scorecard targets, which were set on the basis of operated assets only.

HSEC Measure Directors’ Report

measures Scorecard targets Performance against scorecard targets outcome

Fatalities Nil fatalities at operated assets. The weighting of fatalities is 10 percentage points of the 25 percentage Maximum.

points allocated to the HSEC category, and represents the greatest

weighting of all HSEC items. Our imperative as a Group is to continue

to build our focus on fatality prevention and safety through leadership,

verification and effective risk management. Historically, this fatality measure

has had a zero outcome in years where a fatality occurred.

There were no fatalities during FY2020 at operated assets, and accordingly

the maximum outcome against this measure has been awarded.

Environmental Nil significant environmental and There were no significant environmental and community incidents during Target.

and community incidents at operated assets. FY2020 at operated assets. This element carries a lesser weighting than for

community fatalities, as there have historically not been as many significant incidents.

incidents Financial Statements

HPIF, TRIF Improved performance compared HPIF is a critical lead indicator which provides insight into our performance Between

and OIF with FY2019 results. on preventing future fatalities. It decreased year-on-year by 23% during target and

FY2020. TRIF performance in FY2020 of 4.2 is also lower by 11% than the 4.7 maximum,

recorded in FY2019. In addition, OIF performance in FY2020 of 2.46 is lower closer to

by 7% than the 2.64 recorded last year. maximum.

Risk Operated assets to have controls All operated assets substantially increased levels of coaching of Field Above target.

management for fatal risks verified as part of Field Leadership, thereby improving the quality of leader engagement, which

Leadership activities with fatal risk exceeded target. The reduction in the rates of identified critical control

control improvement plans developed failures was ahead of target. The implementation of critical control

and executed and increased levels observation schedules covering all critical controls and improved discipline

of in-field coaching. Achieve 90% in closing actions created when critical controls have failed were in line

compliance for critical control verification with targets set.

and execution tasks. Additional information

Health, All operated assets to achieve 100% of Targeted asset level improvements were exceeded for mental health activities Target overall

environmental planned targets in respect of occupational and social value and community plans and activities (which have all been (i.e. a blend of

and exposure reduction, mental health, water, especially important during the COVID-19 pandemic), and targets were above, on and

community GHGs, social value plans, quality of life, met in respect of GHG reduction. However, we fell short on occupational below target).

and social community perceptions and community exposure reduction targets and, despite meeting our water withdrawal

value complaints. reduction target, didn’t complete certain asset level actions regarding our

initiatives water stewardship.

The outcome against the HSEC KPI for FY2020 was 32 per cent against the target of 25 per cent. As a Group-level outcome, this applied

to both Mike and Andrew for their time as CEO.

Financial Shareholder information

ROCE is underlying profit after taxation (excluding after-taxation finance costs and exceptional items) divided by average capital employed.

ROCE is the key financial KPI against which CDP outcomes for our senior executives are measured and is, in our view, a relevant measure

to assess the financial performance of the Group for this purpose. While ROCE excludes exceptional items, the Remuneration Committee

reviews each exceptional item to assess if it should be included in the result for the purposes of deriving the ROCE CDP outcome.

When we are assessing management’s performance, we make adjustments to the ROCE result to allow for changes in commodity prices,

foreign exchange movements and other material items to ensure the assessment appropriately measures outcomes that are within the

control and influence of the Group and its executives. Of these, changes in commodity prices have historically been the most material

due to volatility in prices and the impact on Group revenue and ROCE.

BHP Annual Report 2020 151