Page 155 - Annual Report 2020

P. 155

Andrew Mackenzie

Individual Measure

measures Individual scorecard targets Performance against scorecard targets outcome

Performance • Deliver value through Transformation. • BHP Operating System implementation, value chain automation and Target. Strategic Report

• Risk management embedded. World Class Functions activities on-track.

• Material risks being recorded appropriately, and agreed risk appetites

being embedded in the business.

Tailings dams • Tailings Dam Taskforce work. • Progressed the work of the Tailings Dam Taskforce in accordance with Target.

• Long-term strategy development. agreed plans, schedules and targets.

• Progressed a long-term tailings management strategy to deliver step

change risk reduction within 10 years.

Portfolio • Maximise the value of the current • Identified projects and options in Petroleum, Escondida, Western Australia Target.

portfolio. Iron Ore, Queensland Coal and Olympic Dam progressed according

• Progress delivery of value and returns to plans.

from future options. • Future option projects continue to progress well, including identified

• Exploration success. options in Petroleum, Copper and Potash. Governance at BHP

• Achieved positive exploration outcomes, with extensions to the lives

and reserves of conventional oil and gas fields.

Culture and • Gender representation advanced. • Notwithstanding positive improvements in gender representation Target overall

capability • Maintain a robust succession slate. in the second half, there was a slow start to FY2020 in the first half. (i.e. a blend

By 31 December 2019 gender diversity had increased to 24.8%, of above and

up from 24.5% at 30 June 2019. below target).

• A robust slate of potential successors to the CEO role and other ELT roles

has been achieved through a deliberate focus on a strong long-term talent

pool of candidates, evidenced by internal appointments to several key 3

roles during the year.

Social value • Manage risks to protect operating licence. • Continued to manage risks by meeting commitments to our workforce, Target overall

• Samarco strategy implemented. partners, communities and governments through health and safety, the (i.e. a blend of

• Create opportunities to enhance public commitment to and implementation of the climate change strategy above, on and

social value. including an action plan around our public commitments, and managing below target).

water permits, Native Title agreements and social investments.

• Progress made in implementing the agreed Samarco strategy, however Remuneration Report

there were some delays and further work and focus required.

• Continued to work closely with our communities and collaborate with

various local, regional and global stakeholders, new employment models

are building better outcomes for employees, and have a leading position

on social value through placing a high value on the long-term needs of

society and the environment.

Overall, it was considered that the performance of both Mike and Andrew against their individual measures KPI was as expected for their

respective periods as CEO. Accordingly, they were each awarded an outcome of 25 per cent, which is equal to target. Directors’ Report

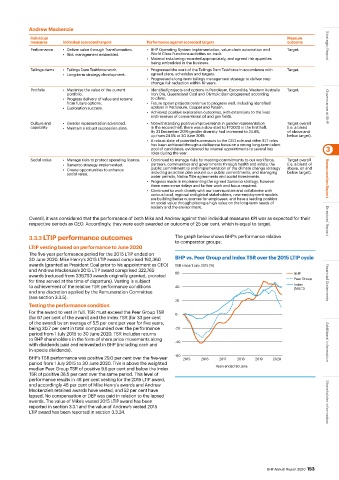

3.3.3 LTIP performance outcomes The graph below shows BHP’s performance relative

to comparator groups.

LTIP vesting based on performance to June 2020

The five-year performance period for the 2015 LTIP ended on

30 June 2020. Mike Henry’s 2015 LTIP award comprised 192,360 BHP vs. Peer Group and Index TSR over the 2015 LTIP cycle

awards (granted as President Coal prior to his appointment as CEO) TSR since 1 July 2015 (%)

and Andrew Mackenzie’s 2015 LTIP award comprised 322,765

awards (reduced from 339,753 awards originally granted, prorated 60 BHP

for time served at the time of departure). Vesting is subject Peer Group

to achievement of the relative TSR performance conditions 40 Index Financial Statements

(MSCI)

and any discretion applied by the Remuneration Committee

(see section 3.3.5).

20

Testing the performance condition

For the award to vest in full, TSR must exceed the Peer Group TSR 0

(for 67 per cent of the award) and the Index TSR (for 33 per cent

of the award) by an average of 5.5 per cent per year for five years,

being 30.7 per cent in total compounded over the performance -20

period from 1 July 2015 to 30 June 2020. TSR includes returns

to BHP shareholders in the form of share price movements along

with dividends paid and reinvested in BHP (including cash and -40 Additional information

in-specie dividends).

BHP’s TSR performance was positive 29.0 per cent over the five-year -60 2015 2016 2017 2018 2019 2020

period from 1 July 2015 to 30 June 2020. This is above the weighted

median Peer Group TSR of positive 9.6 per cent and below the Index Years ended 30 June

TSR of positive 38.5 per cent over the same period. This level of

performance results in 48 per cent vesting for the 2015 LTIP award,

and accordingly 48 per cent of Mike Henry’s awards and Andrew

Mackenzie’s retained awards have vested, and 52 per cent have

lapsed. No compensation or DEP was paid in relation to the lapsed

awards. The value of Mike’s vested 2015 LTIP award has been Shareholder information

reported in section 3.3.1 and the value of Andrew’s vested 2015

LTIP award has been reported in section 3.3.24.

BHP Annual Report 2020 153