Page 159 - Annual Report 2020

P. 159

FY2021 CDP performance measures

For FY2021, the Remuneration Committee has set the following CDP scorecard performance measures:

Performance categories Weighting Target measures Strategic Report

HSEC 25% The following HSEC performance measures are designed to incentivise achievement of the Group’s public five-year

HSEC targets.

Significant events (10%): No significant (actual level 4) health, safety (including fatalities), environment or community

events during the year.

Climate change (10%): Steps in place to achieve reported GHG emissions in FY2022 at the FY2017 level.

Decarbonisation plans developed in line with pathways to net zero and incorporated into the capital allocation plan

process. Two partnerships formalised with strategic customers in the steel sector.

Management of priority tailings storage facilities (5%): All priority tailings storage facilities are assessed based on key risk

indicator data, and are either within appetite or continued operation outside appetite is approved with remediation

progressing to plan.

Financial 50% ROCE is underlying profit after taxation (excluding after-taxation finance costs and exceptional items) divided by

average capital employed. When we are assessing management’s performance, we make adjustments to the ROCE Governance at BHP

result to allow for changes in commodity prices, foreign exchange movements and other material items to ensure the

assessment appropriately measures outcomes that are within the control and influence of the Group and its executives.

For reasons of commercial sensitivity, the target for ROCE will not be disclosed in advance; however, we plan to disclose

targets and outcomes retrospectively in our next Remuneration Report, following the end of each performance year.

In the rare instances where this may not be prudent on grounds of commercial sensitivity, we will explain why and give

an indication of when they will be disclosed.

Individual 25% The CEO’s individual measures for FY2021 comprise contribution to BHP’s overall performance and the management

team and the delivery of projects and initiatives within the scope of the CEO role as set out by the Board. These include

projects and initiatives in respect of performance (material improvement in the system that supports exceptional 3

performance), social value (long-term growth in value and returns for all stakeholders), people (right people, right skills,

coming together in the right way to support exceptional performance) and portfolio (progress on our strategic

objectives to create a winning portfolio and set BHP up for the next 20 years).

These performance measures are aligned with medium and long-term strategy aspirations that are intended to drive

long-term value for shareholders and other stakeholders.

The strong link between BHP’s HSEC performance and executive remuneration (with HSEC performance representing 25 per cent of the Remuneration Report

total scorecard) is well regarded by shareholders. The Board and Committee recognise that climate change is a material governance and

strategic issue. Increasingly, shareholders expect action to address climate change to be linked to executive remuneration. We have been

setting operational GHG emissions targets and linking performance against them to executive remuneration through our HSEC scorecard

for many years.

However, recognising the increasing importance of this issue, we have clarified and strengthened this link for FY2021 by enhancing our

approach, including a weighting of 10 per cent of the 25 per cent HSEC weighting under the CDP, which compares to circa 4 per cent

allocated to climate change in the prior STIP, together with enhanced disclosure of our performance targets as set out above (against Directors’ Report

which we will report at the end of the year).

FY2021 LTIP award

The maximum face value of the CEO’s LTIP award under the remuneration policy approved by shareholders at the 2019 AGMs is

US$3.400 million, being 200 per cent of the CEO’s base salary. The number of LTIP awards in FY2021 has been determined using the

share price and US$/A$ exchange rate over the 12 months up to and including 30 June 2020. Based on this, a FY2021 grant of 140,239

LTIP awards is proposed and approval for this LTIP grant will be sought from shareholders at the 2020 AGMs. If approved, the award will

be granted following the AGMs (i.e. in or around October/November 2020 subject to securities dealing considerations). The FY2021 LTIP

award will use the same performance, service conditions and peer groups as the FY2020 LTIP award (with the exception of the sector

peer group where Anadarko Petroleum was acquired by Occidental Petroleum in August 2019).

Financial Statements

Remuneration for other Executive KMP (excluding the CEOs)

The information in this section contains details of the remuneration policy that guided the Remuneration Committee’s decisions and

resulted in the remuneration outcomes for other Executive KMP (excluding the CEOs).

The remuneration policy and structures for other Executive KMP are essentially the same as those already described for the CEO in

previous sections of the Remuneration Report, including the treatment of remuneration on loss of office as detailed in section 3.2.5.

3.3.10 Components of remuneration

The components of remuneration for other Executive KMP are the same as for the CEO, with any differences described below. Additional information

CDP

The CDP performance measures for other Executive KMP for FY2020 are similar to those of the CEO, which are outlined at section 3.3.2;

however, the weighting of each performance measure will vary to reflect the focus required from each Executive KMP role.

Individual performance measures are determined at the start of the financial year. These include the other Executive KMP’s contribution to the

delivery of projects and initiatives within the scope of their role and the overall performance of the Group. Individual performance of other

Executive KMP was reviewed against these measures by the Committee and, on average, was considered above target.

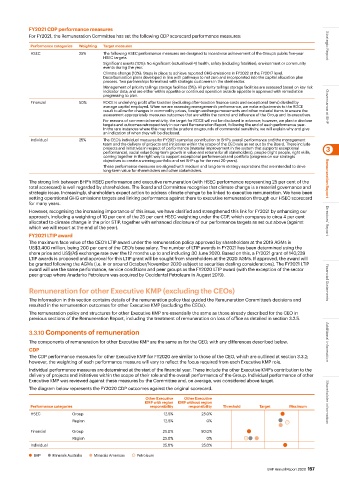

The diagram below represents the FY2020 CDP outcomes against the original scorecard.

Other Executive Other Executive

KMP with region KMP without region Shareholder information

Performance categories responsibility responsibility Threshold Target Maximum

HSEC Group 12.5% 25.0%

Region 12.5% 0%

Financial Group 25.0% 50.0%

Region 25.0% 0%

Individual 25.0% 25.0%

BHP Minerals Australia Minerals Americas Petroleum

BHP Annual Report 2020 157