Page 158 - Annual Report 2020

P. 158

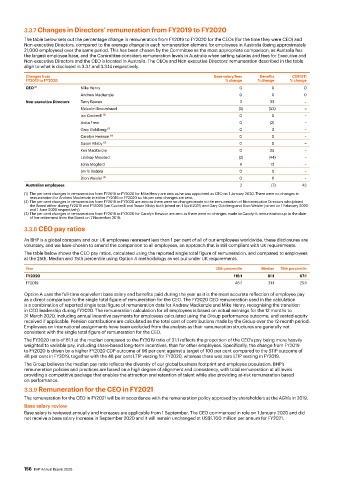

3.3.7 Changes in Directors’ remuneration from FY2019 to FY2020

The table below sets out the percentage change in remuneration from FY2019 to FY2020 for the CEOs (for the time they were CEO) and

Non-executive Directors, compared to the average change in each remuneration element for employees in Australia (being approximately

21,000 employees) over the same period. This has been chosen by the Committee as the most appropriate comparison, as Australia has

the largest employee base, and the Committee considers remuneration levels in Australia when setting salaries and fees for Executive and

Non-executive Directors and the CEO is located in Australia. The CEOs and Non-executive Directors’ remuneration described in the table

align to what is disclosed in 3.3.1 and 3.3.14 respectively.

Changes from Base salary/fees Benefits CDP/STI

FY2019 to FY2020 % change % change % change

CEO (1) Mike Henry 0 0 0

Andrew Mackenzie 0 0 0

Non-executive Directors Terry Bowen 2 33 –

Malcolm Broomhead (5) (53) –

Ian Cockerill (2) 0 0 –

Anita Frew 0 (2) –

Gary Goldberg (2) 0 0 –

Carolyn Hewson (3) 0 0 –

Susan Kilsby (2) 0 0 –

Ken MacKenzie 0 25 –

Lindsay Maxsted (2) (44) –

John Mogford 6 13 –

Shriti Vadera 0 0 –

Dion Weisler (2) 0 0 –

Australian employees 2 (7) 43

(1) The per cent changes in remuneration from FY2019 to FY2020 for Mike Henry are zero as he was appointed as CEO on 1 January 2020. There were no changes in

remuneration for Andrew Mackenzie in either FY2019 or FY2020 so his per cent changes are zero.

(2) The per cent changes in remuneration from FY2019 to FY2020 are zero as there were no changes made to the remuneration of Non-executive Directors who joined

the Board either during FY2019 and FY2020 (Ian Cockerill and Susan Kilsby both joined on 1 April 2019, and Gary Goldberg and Dion Weisler joined on 1 February 2020

and 1 June 2020 respectively).

(3) The per cent changes in remuneration from FY2019 to FY2020 for Carolyn Hewson are zero as there were no changes made to Carolyn’s remuneration up to the date

of her retirement from the Board on 7 November 2019.

3.3.8 CEO pay ratios

As BHP is a global company and our UK employees represent less than 1 per cent of all of our employees worldwide, these disclosures are

voluntary, and we have chosen to amend the comparison to all employees, an approach that is still compliant with UK requirements.

The table below shows the CEO pay ratios, calculated using the reported single total figure of remuneration, and compared to employees

at the 25th, Median and 75th percentile using Option A methodology as set out under UK requirements.

Year 25th percentile Median 75th percentile

FY2020 116:1 81:1 67:1

FY2019 46:1 31:1 25:1

Option A uses the full-time equivalent base salary and benefits paid during the year as it is the most accurate reflection of employee pay

as a direct comparison to the single total figure of remuneration for the CEO. The FY2020 CEO remuneration used in the calculation

is a combination of reported single total figure of remuneration data for Andrew Mackenzie and Mike Henry, recognising the transition

in CEO leadership during FY2020. The remuneration calculation for all employees is based on actual earnings for the 12 months to

31 March 2020, including annual incentive payments for employees calculated using the Group performance outcome, and vested equity

received if applicable. Pension contributions are calculated as the total cost of contributions made by the Group over the 12-month period.

Employees on international assignments have been excluded from the analysis as their remuneration structures are generally not

consistent with the single total figure of remuneration for the CEO.

The FY2020 ratio of 81:1 at the median compared to the FY2019 ratio of 31:1 reflects the proportion of the CEO’s pay being more heavily

weighted to variable pay, including share-based long-term incentives, than for other employees. Specifically, the change from FY2019

to FY2020 is driven by a higher FY2020 CDP outcome of 96 per cent against a target of 100 per cent compared to the STIP outcome of

48 per cent in FY2019, together with the 48 per cent LTIP vesting for FY2020, whereas there was zero LTIP vesting in FY2019.

The Group believes the median pay ratio reflects the diversity of our global business footprint and employee population. BHP’s

remuneration policies and practices are based on a high degree of alignment and consistency, with total remuneration at all levels

providing a competitive package that enables the attraction and retention of talent while also providing at-risk remuneration based

on performance.

3.3.9 Remuneration for the CEO in FY2021

The remuneration for the CEO in FY2021 will be in accordance with the remuneration policy approved by shareholders at the AGMs in 2019.

Base salary review

Base salary is reviewed annually and increases are applicable from 1 September. The CEO commenced in role on 1 January 2020 and did

not receive a base salary increase in September 2020 and it will remain unchanged at US$1.700 million per annum for FY2021.

156 BHP Annual Report 2020