Page 105 - Annual Report 2020

P. 105

1.11.2 Copper 1

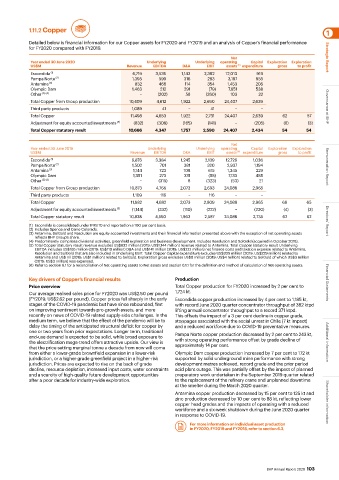

Detailed below is financial information for our Copper assets for FY2020 and FY2019 and an analysis of Copper’s financial performance

for FY2020 compared with FY2019.

Net Strategic Report

Year ended 30 June 2020 Underlying Underlying operating Capital Exploration Exploration

US$M Revenue EBITDA D&A EBIT assets expenditure gross to profit

(6)

Escondida (1) 6,719 3,535 1,143 2,392 12,013 919

Pampa Norte (2) 1,395 599 316 283 3,187 955

Antamina (3) 832 468 114 354 1,453 205

Olympic Dam 1,463 212 291 (79) 7,651 538

Other (3) (4) − (202) 58 (260) 103 22

Total Copper from Group production 10,409 4,612 1,922 2,690 24,407 2,639

Third party products 1,089 41 − 41 − − Governance at BHP

Total Copper 11,498 4,653 1,922 2,731 24,407 2,639 62 57

Adjustment for equity accounted investments (5) (832) (306) (165) (141) − (205) (8) (3)

Total Copper statutory result 10,666 4,347 1,757 2,590 24,407 2,434 54 54

Net

Year ended 30 June 2019 Underlying Underlying operating Capital Exploration Exploration

US$M Revenue EBITDA D&A EBIT assets (6) expenditure gross to profit

Escondida (1) 6,876 3,384 1,245 2,139 12,726 1,036

Pampa Norte (2) 1,502 701 381 320 2,937 1,194 Remuneration Report

Antamina (3) 1,144 723 108 615 1,345 229

Olympic Dam 1,351 273 331 (58) 7,133 485

Other (3) (4) − (315) 8 (323) (53) 21

Total Copper from Group production 10,873 4,766 2,073 2,693 24,088 2,965

Third party products 1,109 116 − 116 − −

Total Copper 11,982 4,882 2,073 2,809 24,088 2,965 66 65

Adjustment for equity accounted investments (5) (1,144) (332) (110) (222) − (230) (4) (3)

Total Copper statutory result 10,838 4,550 1,963 2,587 24,088 2,735 62 62

(1) Escondida is consolidated under IFRS 10 and reported on a 100 per cent basis. Directors’ Report

(2) Includes Spence and Cerro Colorado.

(3) Antamina, SolGold and Resolution are equity accounted investments and their financial information presented above with the exception of net operating assets

reflects BHP Group’s share.

(4) Predominantly comprises divisional activities, greenfield exploration and business development. Includes Resolution and SolGold (acquired in October 2018).

(5) Total Copper statutory result revenue excludes US$832 million (2019: US$1,144 million) revenue related to Antamina. Total Copper statutory result Underlying

EBITDA includes US$165 million (2019: US$110 million) D&A and US$141 million (2019: US$222 million) net finance costs and taxation expense related to Antamina,

Resolution and SolGold that are also included in Underlying EBIT. Total Copper Capital expenditure excludes US$205 million (2019: US$229 million) related to

Antamina and US$ nil (2019: US$1 million) related to SolGold. Exploration gross excludes US$8 million (2019: US$4 million) related to SolGold of which US$3 million

(2019: US$3 million) was expensed.

(6) Refer to section 6.1 for a reconciliation of Net operating assets to Net assets and section 6.1.1 for the definition and method of calculation of Net operating assets.

Key drivers of Copper’s financial results Production

Price overview Total Copper production for FY2020 increased by 2 per cent to Financial Statements

Our average realised sales price for FY2020 was US$2.50 per pound 1,724 kt.

(FY2019: US$2.62 per pound). Copper prices fell sharply in the early Escondida copper production increased by 4 per cent to 1,185 kt,

stages of the COVID-19 pandemic but have since rebounded, first with record June 2020 quarter concentrator throughput of 382 ktpd

on improving sentiment towards pro-growth assets, and more lifting annual concentrator throughput to a record 371 ktpd.

recently on news of COVID-19 related supply-side challenges. In the This offsets the impact of a 3 per cent decline in copper grade,

medium term, we believe that the effect of the pandemic will be to stoppages associated with the social unrest in Chile (7 kt impact)

delay the timing of the anticipated structural deficit for copper by and a reduced workforce due to COVID-19 preventative measures.

one or two years from prior expectations. Longer term, traditional Pampa Norte copper production decreased by 2 per cent to 243 kt,

end-use demand is expected to be solid, while broad exposure to

the electrification mega-trend offers attractive upside. Our view is with strong operating performance offset by grade decline of Additional information

approximately 14 per cent.

that the price setting marginal tonne a decade from now will come

from either a lower-grade brownfield expansion in a lower-risk Olympic Dam copper production increased by 7 per cent to 172 kt

jurisdiction, or a higher-grade greenfield project in a higher-risk supported by solid underground mine performance with strong

jurisdiction. Prices are expected to rise on the back of grade development metres achieved, record grade and the prior period

decline, resource depletion, increased input costs, water constraints acid plant outage. This was partially offset by the impact of planned

and a scarcity of high-quality future development opportunities preparatory work undertaken in the September 2019 quarter related

after a poor decade for industry-wide exploration. to the replacement of the refinery crane and unplanned downtime

at the smelter during the March 2020 quarter.

Antamina copper production decreased by 15 per cent to 125 kt and

zinc production decreased by 10 per cent to 88 kt, reflecting lower

copper head grades and the impacts of operating with a reduced Shareholder information

workforce and a six-week shutdown during the June 2020 quarter

in response to COVID-19.

For more information on individual asset production

in FY2020, FY2019 and FY2018, refer to section 6.3.

BHP Annual Report 2020 103