Page 101 - Annual Report 2020

P. 101

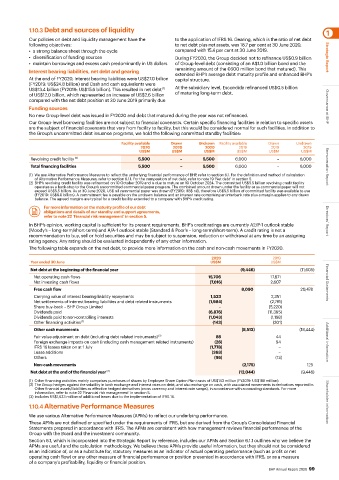

1.10.3 Debt and sources of liquidity 1

Our policies on debt and liquidity management have the to the application of IFRS 16. Gearing, which is the ratio of net debt

following objectives: to net debt plus net assets, was 18.7 per cent at 30 June 2020,

• a strong balance sheet through the cycle compared with 15.4 per cent at 30 June 2019.

• diversification of funding sources During FY2020, the Group decided not to refinance US$0.9 billion Strategic Report

• maintain borrowings and excess cash predominantly in US dollars of Group-level debt (consisting of an A$1.0 billion bond and the

Interest bearing liabilities, net debt and gearing remaining amount of the €600 million bond that matured). This

extended BHP’s average debt maturity profile and enhanced BHP’s

At the end of FY2020, Interest bearing liabilities were US$27.0 billion capital structure.

(FY2019: US$24.8 billion) and Cash and cash equivalents were

(1)

US$13.4 billion (FY2019: US$15.6 billion). This resulted in net debt At the subsidiary level, Escondida refinanced US$0.5 billion

of US$12.0 billion, which represented an increase of US$2.6 billion of maturing long-term debt.

compared with the net debt position at 30 June 2019 primarily due

Funding sources Governance at BHP

No new Group-level debt was issued in FY2020 and debt that matured during the year was not refinanced.

Our Group-level borrowing facilities are not subject to financial covenants. Certain specific financing facilities in relation to specific assets

are the subject of financial covenants that vary from facility to facility, but this would be considered normal for such facilities. In addition to

the Group’s uncommitted debt issuance programs, we hold the following committed standby facilities:

Facility available Drawn Undrawn Facility available Drawn Undrawn

2020 2020 2020 2019 2019 2019

US$M US$M US$M US$M US$M US$M

Revolving credit facility (2) 5,500 – 5,500 6,000 – 6,000

Total financing facilities 5,500 – 5,500 6,000 – 6,000 Remuneration Report

(1) We use Alternative Performance Measures to reflect the underlying financial performance of BHP, refer to section 6.1. For the definition and method of calculation

of Alternative Performance Measures, refer to section 6.1.1. For the composition of net debt, refer to note 19 ‘Net debt’ in section 5.

(2) BHP’s revolving credit facility was refinanced on 10 October 2019 and is due to mature on 10 October 2024. The committed US$5.5 billion revolving credit facility

operates as a back-stop to the Group’s uncommitted commercial paper program. The combined amount drawn under the facility or as commercial paper will not

exceed US$5.5 billion. As at 30 June 2020, US$ nil commercial paper was drawn (FY2019: US$ nil), therefore US$5.5 billion of committed facility was available to use

(FY2019: US$6.0 billion). A commitment fee is payable on the undrawn balance and an interest rate comprising an interbank rate plus a margin applies to any drawn

balance. The agreed margins are typical for a credit facility extended to a company with BHP’s credit rating.

For more information on the maturity profile of our debt

obligations and details of our standby and support agreements,

refer to note 22 ‘Financial risk management’ in section 5.

In BHP’s opinion, working capital is sufficient for its present requirements. BHP’s credit ratings are currently A2/P-1 outlook stable Directors’ Report

(Moody’s – long-term/short-term) and A/A-1 outlook stable (Standard & Poor’s – long-term/short-term). A credit rating is not a

recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by an assigning

rating agency. Any rating should be evaluated independently of any other information.

The following table expands on the net debt, to provide more information on the cash and non-cash movements in FY2020.

2020 2019

Year ended 30 June US$M US$M

Net debt at the beginning of the financial year (9,446) (11,605)

Net operating cash flows 15,706 17,871

Net investing cash flows (7,616) 2,607 Financial Statements

Free cash flow 8,090 20,478

Carrying value of interest bearing liability repayments 1,533 2,351

Net settlements of interest bearing liabilities and debt related instruments (1,984) (2,781)

Share buy-back – BHP Group Limited – (5,220)

Dividends paid (6,876) (11,395)

Dividends paid to non-controlling interests (1,043) (1,198)

Other financing activities (1) (143) (201)

Other cash movements (8,513) (18,444)

Fair value adjustment on debt (including debt related instruments) (2) 88 44

Foreign exchange impacts on cash (including cash management related instruments) (26) 94 Additional information

IFRS 16 leases taken on at 1 July (1,778) −

Lease additions (363) –

Others (96) (13)

Non-cash movements (2,175) 125

Net debt at the end of the financial year (3) (12,044) (9,446)

(1) Other financing activities mainly comprises purchases of shares by Employee Share Option Plan trusts of US$143 million (FY2019: US$188 million).

(2) The Group hedges against the volatility in both exchange and interest rates on debt, and also exchange on cash, with associated movements in derivatives reported in

Other financial assets/liabilities as effective hedged derivatives (cross currency and interest rate swaps), in accordance with accounting standards. For more

information, refer to note 22 ‘Financial risk management’ in section 5.

(3) Includes US$1,633 million of additional leases due to the implementation of IFRS 16.

1.10.4 Alternative Performance Measures Shareholder information

We use various Alternative Performance Measures (APMs) to reflect our underlying performance.

These APMs are not defined or specified under the requirements of IFRS, but are derived from the Group’s Consolidated Financial

Statements prepared in accordance with IFRS. The APMs are consistent with how management reviews financial performance of the

Group with the Board and the investment community.

Section 6.1, which is incorporated into the Strategic Report by reference, includes our APMs and Section 6.1.1 outlines why we believe the

APMs are useful and the calculation methodology. We believe these APMs provide useful information, but they should not be considered

as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as profit or net

operating cash flow) or any other measure of financial performance or position presented in accordance with IFRS, or as a measure

of a company’s profitability, liquidity or financial position.

BHP Annual Report 2020 99