Page 98 - Annual Report 2020

P. 98

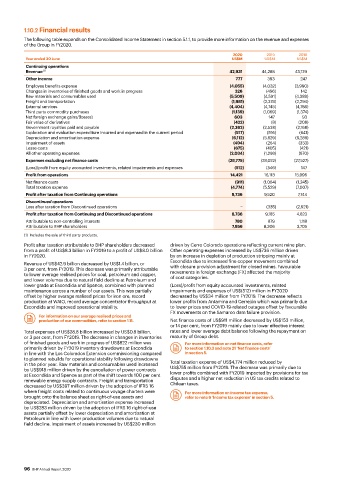

1.10.2 Financial results

The following table expands on the Consolidated Income Statement in section 5.1.1, to provide more information on the revenue and expenses

of the Group in FY2020.

2020 2019 2018

Year ended 30 June US$M US$M US$M

Continuing operations

Revenue (1) 42,931 44,288 43,129

Other income 777 393 247

Employee benefits expense (4,055) (4,032) (3,990)

Changes in inventories of finished goods and work in progress 326 (496) 142

Raw materials and consumables used (5,509) (4,591) (4,389)

Freight and transportation (1,981) (2,378) (2,294)

External services (4,404) (4,745) (4,786)

Third party commodity purchases (1,139) (1,069) (1,374)

Net foreign exchange gains/(losses) 603 147 93

Fair value of derivatives (422) (8) (208)

Government royalties paid and payable (2,362) (2,538) (2,168)

Exploration and evaluation expenditure incurred and expensed in the current period (517) (516) (641)

Depreciation and amortisation expense (6,112) (5,829) (6,288)

Impairment of assets (494) (264) (333)

Lease costs (675) (405) (421)

All other operating expenses (2,034) (1,298) (870)

Expenses excluding net finance costs (28,775) (28,022) (27,527)

(Loss)/profit from equity accounted investments, related impairments and expenses (512) (546) 147

Profit from operations 14,421 16,113 15,996

Net finance costs (911) (1,064) (1,245)

Total taxation expense (4,774) (5,529) (7,007)

Profit after taxation from Continuing operations 8,736 9,520 7,744

Discontinued operations

Loss after taxation from Discontinued operations − (335) (2,921)

Profit after taxation from Continuing and Discontinued operations 8,736 9,185 4,823

Attributable to non-controlling interests 780 879 1,118

Attributable to BHP shareholders 7,956 8,306 3,705

(1) Includes the sale of third party products.

Profit after taxation attributable to BHP shareholders decreased driven by Cerro Colorado operations reflecting current mine plan.

from a profit of US$8.3 billion in FY2019 to a profit of US$8.0 billion Other operating expenses increased by US$736 million driven

in FY2020. by an increase in depletion of production stripping mainly at

Revenue of US$42.9 billion decreased by US$1.4 billion, or Escondida due to increased fine copper movement combined

with closure provision adjustment for closed mines. Favourable

3 per cent, from FY2019. This decrease was primarily attributable

to lower average realised prices for coal, petroleum and copper, movements in foreign exchange (FX) affected the majority

of cost categories.

and lower volumes due to natural field decline at Petroleum and

lower grade at Escondida and Spence, combined with planned (Loss)/profit from equity accounted investments, related

maintenance across a number of our assets. This was partially impairments and expenses of US$(512) million in FY2020

offset by higher average realised prices for iron ore, record decreased by US$34 million from FY2019. The decrease reflects

production at WAIO, record average concentrator throughput at lower profits from Antamina and Cerrejón which was primarily due

Escondida and improved operational stability. to lower prices and COVID-19-related outages offset by favourable

FX movements on the Samarco dam failure provision.

For information on our average realised prices and

production of our commodities, refer to section 1.11. Net finance costs of US$911 million decreased by US$153 million,

or 14 per cent, from FY2019 mainly due to lower effective interest

Total expenses of US$28.8 billion increased by US$0.8 billion, rates and lower average debt balance following the repayment on

or 3 per cent, from FY2019. The decrease in changes in inventories maturity of Group debt.

of finished goods and work in progress of US$822 million was For more information on net finance costs, refer

primarily driven by FY2019 inventory drawdowns at Escondida to section 1.10.3 and note 21 ‘Net finance costs’

in line with the Los Colorados Extension commissioning compared in section 5.

to planned rebuilds for operational stability following drawdowns

in the prior year. Raw materials and consumables used increased Total taxation expense of US$4,774 million reduced by

by US$918 million driven by the cancellation of power contracts US$755 million from FY2019. The decrease was primarily due to

at Escondida and Spence as part of the shift towards 100 per cent lower profits combined with FY2019 impacted by provisions for tax

renewable energy supply contracts. Freight and transportation disputes and a higher net reduction in US tax credits related to

decreased by US$397 million driven by the adoption of IFRS 16 Chilean taxes.

where freight costs related to continuous voyage charters were For more information on income tax expense,

brought onto the balance sheet as right-of-use assets and refer to note 6 ‘Income tax expense’ in section 5.

depreciated. Depreciation and amortisation expense increased

by US$283 million driven by the adoption of IFRS 16 right-of-use

assets partially offset by lower depreciation and amortisation at

Petroleum in line with lower production volumes due to natural

field decline. Impairment of assets increased by US$230 million

96 BHP Annual Report 2020