Page 97 - Annual Report 2020

P. 97

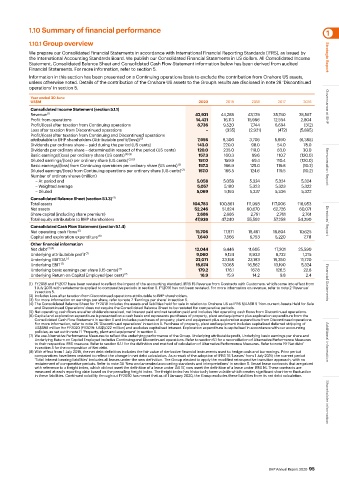

1.10 Summary of financial performance 1

1.10.1 Group overview

We prepare our Consolidated Financial Statements in accordance with International Financial Reporting Standards (IFRS), as issued by

the International Accounting Standards Board. We publish our Consolidated Financial Statements in US dollars. All Consolidated Income Strategic Report

Statement, Consolidated Balance Sheet and Consolidated Cash Flow Statement information below has been derived from audited

Financial Statements. For more information, refer to section 5.

Information in this section has been presented on a Continuing operations basis to exclude the contribution from Onshore US assets,

unless otherwise noted. Details of the contribution of the Onshore US assets to the Group’s results are disclosed in note 28 ‘Discontinued

operations’ in section 5.

Year ended 30 June

US$M 2020 2019 2018 2017 2016

Consolidated Income Statement (section 5.1.1) Governance at BHP

Revenue 42,931 44,288 43,129 35,740 28,567

(1)

Profit from operations 14,421 16,113 15,996 12,554 2,804

Profit/(loss) after taxation from Continuing operations 8,736 9,520 7,744 6,694 (312)

Loss after taxation from Discontinued operations − (335) (2,921) (472) (5,895)

Profit/(loss) after taxation from Continuing and Discontinued operations

attributable to BHP shareholders (Attributable profit/(loss)) (2) 7,956 8,306 3,705 5,890 (6,385)

Dividends per ordinary share – paid during the period (US cents) 143.0 220.0 98.0 54.0 78.0

Dividends per ordinary share – determined in respect of the period (US cents) 120.0 235.0 118.0 83.0 30.0

Basic earnings/(loss) per ordinary share (US cents) (2) (3) 157.3 160.3 69.6 110.7 (120.0)

Diluted earnings/(loss) per ordinary share (US cents) (2) (3) 157.0 159.9 69.4 110.4 (120.0)

Basic earnings/(loss) from Continuing operations per ordinary share (US cents) (3) 157.3 166.9 125.0 119.8 (10.2) Remuneration Report

Diluted earnings/(loss) from Continuing operations per ordinary share (US cents) (3) 157.0 166.5 124.6 119.5 (10.2)

Number of ordinary shares (million)

– At period end 5,058 5,058 5,324 5,324 5,324

– Weighted average 5,057 5,180 5,323 5,323 5,322

– Diluted 5,069 5,193 5,337 5,336 5,322

Consolidated Balance Sheet (section 5.1.3) (4)

Total assets 104,783 100,861 111,993 117,006 118,953

Net assets 52,246 51,824 60,670 62,726 60,071

Share capital (including share premium) 2,686 2,686 2,761 2,761 2,761

Total equity attributable to BHP shareholders 47,936 47,240 55,592 57,258 54,290 Directors’ Report

Consolidated Cash Flow Statement (section 5.1.4)

Net operating cash flows (5) 15,706 17,871 18,461 16,804 10,625

Capital and exploration expenditure (6) 7,640 7,566 6,753 5,220 7,711

Other financial information

Net debt (7) (8) 12,044 9,446 11,605 17,201 25,590

Underlying attributable profit (7) 9,060 9,124 8,933 6,732 1,215

Underlying EBITDA (7) 22,071 23,158 23,183 19,350 11,720

Underlying EBIT (7) 15,874 17,065 16,562 13,190 5,324

Underlying basic earnings per share (US cents) (7) 179.2 176.1 167.8 126.5 22.8

Underlying Return on Capital Employed (per cent) (7) 16.9 15.9 14.2 9.8 2.4

(1) FY2018 and FY2017 have been restated to reflect the impact of the accounting standard, IFRS 15 Revenue from Contracts with Customers, which came into effect from Financial Statements

1 July 2018 with restatements applied to comparative periods in section 5. FY2016 has not been restated. For more information on revenue, refer to note 2 ‘Revenue’

in section 5.

(2) Includes Loss after taxation from Discontinued operations attributable to BHP shareholders.

(3) For more information on earnings per share, refer to note 7 ‘Earnings per share’ in section 5.

(4) The Consolidated Balance Sheet for FY2018 includes the assets and liabilities held for sale in relation to Onshore US as IFRS 5/AASB 5 ‘Non-current Assets Held for Sale

and Discontinued Operations’ does not require the Consolidated Balance Sheet to be restated for comparative periods.

(5) Net operating cash flows are after dividends received, net interest paid and net taxation paid and includes Net operating cash flows from Discontinued operations.

(6) Capital and exploration expenditure is presented on a cash basis and represents purchases of property, plant and equipment plus exploration expenditure from the

Consolidated Cash Flow Statement in section 5 and includes purchases of property, plant and equipment plus exploration expenditure from Discontinued operations.

For more information, refer to note 28 ‘Discontinued operations’ in section 5. Purchase of property, plant and equipment includes capitalised deferred stripping of

US$698 million for FY2020 (FY2019: US$1,022 million) and excludes capitalised interest. Exploration expenditure is capitalised in accordance with our accounting

policies, as set out in note 11 ‘Property, plant and equipment’ in section 5.

(7) We use Alternative Performance Measures to reflect the underlying performance of the Group. Underlying attributable profit, Underlying basic earnings per share and

Underlying Return on Capital Employed includes Continuing and Discontinued operations. Refer to section 6.1 for a reconciliation of Alternative Performance Measures

to their respective IFRS measure. Refer to section 6.1.1 for the definition and method of calculation of Alternative Performance Measures. Refer to note 19 ‘Net debt’ Additional information

in section 5 for the composition of Net debt.

(8) With effect from 1 July 2019, the net debt definition includes the fair value of derivative financial instruments used to hedge cash and borrowings. Prior period

comparatives have been restated to reflect the change in net debt calculation. As a result of the adoption of IFRS 16 ‘Leases’ from 1 July 2019, the current period

‘Total Interest bearing liabilities’ includes all leases under the new definition. The Group elected to apply the modified retrospective transition approach, with no

restatement of comparative periods. Refer to note 38 ‘New and amended accounting standards and interpretations’ in section 5. Vessel lease contracts that are priced

with reference to a freight index, which did not meet the definition of a lease under IAS 17, now meet the definition of a lease under IFRS 16. These contracts are

measured at each reporting date based on the prevailing freight index. The freight index has historically been volatile which creates significant short-term fluctuation

in these liabilities. Continued volatility throughout FY2020 has meant that as of 1 January 2020, the Group excludes these liabilities from its net debt calculation. Shareholder information

BHP Annual Report 2020 95