Page 108 - Annual Report 2020

P. 108

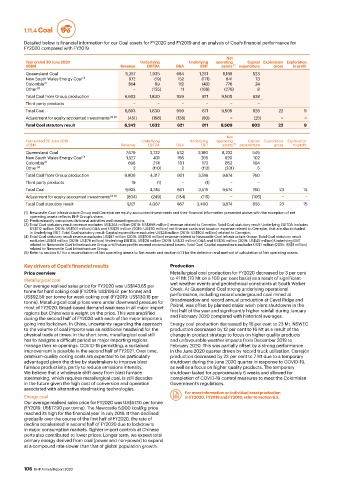

1.11.4 Coal

Detailed below is financial information for our Coal assets for FY2020 and FY2019 and an analysis of Coal’s financial performance for

FY2020 compared with FY2019.

Net

Year ended 30 June 2020 Underlying Underlying operating Capital Exploration Exploration

US$M Revenue EBITDA D&A EBIT assets (5) expenditure gross to profit

Queensland Coal 5,357 1,935 684 1,251 8,168 523

New South Wales Energy Coal (1) 972 (19) 152 (171) 841 73

Colombia (1) 364 69 112 (43) 776 24

Other (2) − (155) 11 (166) (276) 8

Total Coal from Group production 6,693 1,830 959 871 9,509 628

Third party products − − − − − −

Total Coal 6,693 1,830 959 871 9,509 628 22 9

Adjustment for equity accounted investments (3) (4) (451) (198) (138) (60) − (25) − −

Total Coal statutory result 6,242 1,632 821 811 9,509 603 22 9

Net

Year ended 30 June 2019 Underlying Underlying operating Capital Exploration Exploration

US$M Revenue EBITDA D&A EBIT assets (5) expenditure gross to profit

Queensland Coal 7,679 3,722 532 3,190 8,232 549

New South Wales Energy Coal (1) 1,527 431 166 265 920 102

Colombia (1) 698 274 101 173 853 104

Other (2) 2 (110) 2 (112) (331) 5

Total Coal from Group production 9,906 4,317 801 3,516 9,674 760

Third party products 19 (1) − (1) − −

Total Coal 9,925 4,316 801 3,515 9,674 760 23 15

Adjustment for equity accounted investments (3) (4) (804) (249) (134) (115) − (105) − −

Total Coal statutory result 9,121 4,067 667 3,400 9,674 655 23 15

(1) Newcastle Coal Infrastructure Group and Cerrejón are equity accounted investments and their financial information presented above with the exception of net

operating assets reflects BHP Group’s share.

(2) Predominantly comprises divisional activities and ceased operations.

(3) Total Coal statutory result revenue excludes US$364 million (2019: US$698 million) revenue related to Cerrejón. Total Coal statutory result Underlying EBITDA includes

US$112 million (2019: US$101 million) D&A and US$25 million (2019: US$70 million) net finance costs and taxation expense related to Cerrejón, that are also included

in Underlying EBIT. Total Coal statutory result Capital expenditure excludes US$24 million (2019: US$104 million) related to Cerrejón.

(4) Total Coal statutory result revenue excludes US$87 million (2019: US$106 million) revenue related to Newcastle Coal Infrastructure Group. Total Coal statutory result

excludes US$61 million (2019: US$78 million) Underlying EBITDA, US$26 million (2019: US$33 million) D&A and US$35 million (2019: US$45 million) Underlying EBIT

related to Newcastle Coal Infrastructure Group until future profits exceed accumulated losses. Total Coal Capital expenditure excludes US$1 million (2019: US$1 million)

related to Newcastle Coal Infrastructure Group.

(5) Refer to section 6.1 for a reconciliation of Net operating assets to Net assets and section 6.1.1 for the definition and method of calculation of Net operating assets.

Key drivers of Coal’s financial results Production

Price overview Metallurgical coal production for FY2020 decreased by 3 per cent

Metallurgical coal to 41 Mt (73 Mt on a 100 per cent basis) as a result of significant

Our average realised sales price for FY2020 was US$143.65 per wet weather events and geotechnical constraints at South Walker

tonne for hard coking coal (FY2019: US$199.61 per tonne) and Creek. At Queensland Coal strong underlying operational

US$92.59 per tonne for weak coking coal (FY2019: US$130.18 per performance, including record underground coal mined at

tonne). Metallurgical coal prices were under downward pressure for Broadmeadow and record annual production at Caval Ridge and

most of FY2020. Broad-based demand weakness in all major import Poitrel, was offset by planned major wash plant shutdowns in the

regions but China was a weight on the price. This was amplified first half of the year and significantly higher rainfall during January

during the second half of FY2020 with each of the major importers and February 2020 compared with historical averages.

going into lockdown. In China, uncertainty regarding the approach Energy coal production decreased by 16 per cent to 23 Mt. NSWEC

to the volume of coal imports was an additional headwind for the production decreased by 12 per cent to 16 Mt as a result of the

physical trade at times. In the short term, metallurgical coal still change in product strategy to focus on higher quality products

has to navigate a difficult period as major importing regions and unfavourable weather impacts from December 2019 to

manage their re-openings. COVID-19 permitting, a sustained February 2020. This was partially offset by a strong performance

improvement is possible in the second half of FY2021. Over time, in the June 2020 quarter driven by record truck utilisation. Cerrejón

premium-quality coking coals are expected to be particularly production decreased by 23 per cent to 7 Mt due to a temporary

advantaged given the drive by steelmakers to improve blast shutdown during the June 2020 quarter in response to COVID-19,

furnace productivity, partly to reduce emissions intensity. as well as a focus on higher quality products. The temporary

We believe that a wholesale shift away from blast furnace shutdown lasted for approximately 6 weeks and allowed for

steelmaking, which requires metallurgical coal, is still decades completion of COVID-19 control measures to meet the Colombian

in the future given the high cost of conversion and operation Government’s regulations.

associated with alternative steelmaking technologies. For more information on individual asset production

Energy coal in FY2020, FY2019 and FY2018, refer to section 6.3.

Our average realised sales price for FY2020 was US$57.10 per tonne

(FY2019: US$77.90 per tonne). The Newcastle 6,000 kcal/kg price

reached its high for the financial year in July 2019. It then declined

gradually over the course of the first half of FY2020, the rate of

decline accelerated in second half of FY2020 due to lockdowns

in major consumption markets. Tighter import controls at Chinese

ports also contributed to lower prices. Longer term, we expect total

primary energy derived from coal (power and non-power) to expand

at a compound rate slower than that of global population growth.

106 BHP Annual Report 2020