Page 268 - Annual Report 2020

P. 268

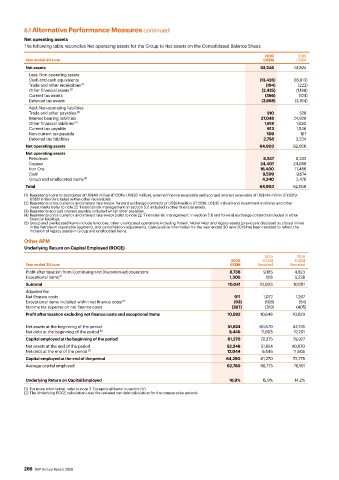

6.1 Alternative Performance Measures continued

Net operating assets

The following table reconciles Net operating assets for the Group to Net assets on the Consolidated Balance Sheet:

2020 2019

Year ended 30 June US$M US$M

Net assets 52,246 51,824

Less: Non-operating assets

Cash and cash equivalents (13,426) (15,613)

Trade and other receivables (1) (194) (222)

Other financial assets (2) (2,425) (1,188)

Current tax assets (366) (124)

Deferred tax assets (3,688) (3,764)

Add: Non-operating liabilities

Trade and other payables (3) 310 328

Interest bearing liabilities 27,048 24,828

Other financial liabilities (4) 1,618 1,020

Current tax payable 913 1,546

Non-current tax payable 109 187

Deferred tax liabilities 2,758 3,234

Net operating assets 64,903 62,056

Net operating assets

Petroleum 8,247 8,332

Copper 24,407 24,088

Iron Ore 18,400 17,486

Coal 9,509 9,674

Group and unallocated items (5) 4,340 2,476

Total 64,903 62,056

(1) Represents loans to associates of US$40 million (FY2019: US$33 million), external finance receivable and accrued interest receivable of US$144 million (FY2019:

US$51 million) included within other receivables.

(2) Represents cross currency and interest rate swaps, forward exchange contracts of US$24 million (FY2019: US$35 million) and investment in shares and other

investments (refer to note 22 ‘Financial risk management’ in section 5.1) included in other financial assets.

(3) Represents accrued interest payable included within other payables.

(4) Represents cross currency and interest rate swaps (refer to note 22 ‘Financial risk management’ in section 5.1) and forward exchange contracts included in other

financial liabilities.

(5) Group and unallocated items include functions, other unallocated operations including Potash, Nickel West and legacy assets (previously disclosed as closed mines

in the Petroleum reportable segment), and consolidation adjustments. Comparative information for the year ended 30 June 2019 has been restated to reflect the

inclusion of legacy assets in Group and unallocated items.

Other APM

Underlying Return on Capital Employed (ROCE)

2019 2018

2020 US$M US$M

Year ended 30 June US$M Restated Restated

Profit after taxation from Continuing and Discontinued operations 8,736 9,185 4,823

Exceptional items (1) 1,305 818 5,228

Subtotal 10,041 10,003 10,051

Adjusted for:

Net finance costs 911 1,072 1,267

Exceptional items included within net finance costs (1) (93) (108) (84)

Income tax expense on net finance costs (267) (319) (405)

Profit after taxation excluding net finance costs and exceptional items 10,592 10,648 10,829

Net assets at the beginning of the period 51,824 60,670 62,726

Net debt at the beginning of the period (2) 9,446 11,605 17,201

Capital employed at the beginning of the period 61,270 72,275 79,927

Net assets at the end of the period 52,246 51,824 60,670

Net debt at the end of the period (2) 12,044 9,446 11,605

Capital employed at the end of the period 64,290 61,270 72,275

Average capital employed 62,780 66,773 76,101

Underlying Return on Capital Employed 16.9% 15.9% 14.2%

(1) For more information, refer to note 3 ‘Exceptional items’ in section 5.1.

(2) The Underlying ROCE calculation uses the restated net debt calculation for the comparative periods.

266 BHP Annual Report 2020