Page 266 - Annual Report 2020

P. 266

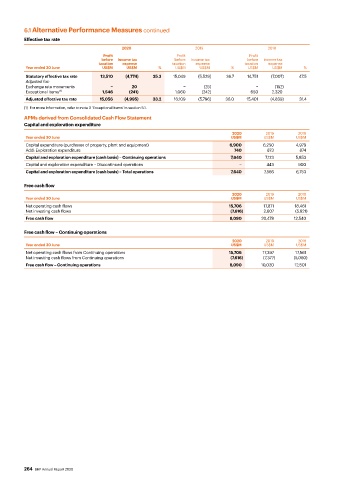

6.1 Alternative Performance Measures continued

Effective tax rate

2020 2019 2018

Profit Profit Profit

before Income tax before Income tax before Income tax

taxation expense taxation expense taxation expense

Year ended 30 June US$M US$M % US$M US$M % US$M US$M %

Statutory effective tax rate 13,510 (4,774) 35.3 15,049 (5,529) 36.7 14,751 (7,007) 47.5

Adjusted for:

Exchange rate movements − 20 − (25) − (152)

Exceptional items (1) 1,546 (241) 1,060 (242) 650 2,320

Adjusted effective tax rate 15,056 (4,995) 33.2 16,109 (5,796) 36.0 15,401 (4,839) 31.4

(1) For more information, refer to note 3 ‘Exceptional items’ in section 5.1.

APMs derived from Consolidated Cash Flow Statement

Capital and exploration expenditure

2020 2019 2018

Year ended 30 June US$M US$M US$M

Capital expenditure (purchases of property, plant and equipment) 6,900 6,250 4,979

Add: Exploration expenditure 740 873 874

Capital and exploration expenditure (cash basis) – Continuing operations 7,640 7,123 5,853

Capital and exploration expenditure – Discontinued operations − 443 900

Capital and exploration expenditure (cash basis) – Total operations 7,640 7,566 6,753

Free cash flow

2020 2019 2018

Year ended 30 June US$M US$M US$M

Net operating cash flows 15,706 17,871 18,461

Net investing cash flows (7,616) 2,607 (5,921)

Free cash flow 8,090 20,478 12,540

Free cash flow – Continuing operations

2020 2019 2018

Year ended 30 June US$M US$M US$M

Net operating cash flows from Continuing operations 15,706 17,397 17,561

Net investing cash flows from Continuing operations (7,616) (7,377) (5,060)

Free cash flow – Continuing operations 8,090 10,020 12,501

264 BHP Annual Report 2020