Page 265 - Annual Report 2020

P. 265

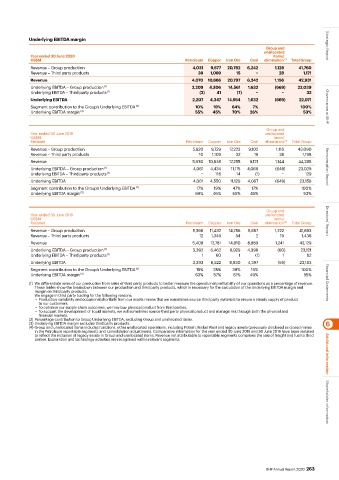

Underlying EBITDA margin

Group and Strategic Report

unallocated

Year ended 30 June 2020 items/

US$M Petroleum Copper Iron Ore Coal elimination (4) Total Group

Revenue – Group production 4,031 9,577 20,782 6,242 1,128 41,760

Revenue – Third party products 39 1,089 15 − 28 1,171

Revenue 4,070 10,666 20,797 6,242 1,156 42,931

Underlying EBITDA – Group production (1) 2,209 4,306 14,561 1,632 (669) 22,039

Underlying EBITDA – Third party products (1) (2) 41 (7) − − 32

Underlying EBITDA 2,207 4,347 14,554 1,632 (669) 22,071

Segment contribution to the Group’s Underlying EBITDA (2) 10% 19% 64% 7% 100% Governance at BHP

Underlying EBITDA margin (3) 55% 45% 70% 26% 53%

Group and

Year ended 30 June 2019 unallocated

US$M items/

Restated Petroleum Copper Iron Ore Coal elimination (4) Total Group

Revenue – Group production 5,920 9,729 17,223 9,102 1,116 43,090

Revenue – Third party products 10 1,109 32 19 28 1,198

Revenue 5,930 10,838 17,255 9,121 1,144 44,288

Underlying EBITDA – Group production 4,061 4,434 11,115 4,068 (649) 23,029 Remuneration Report

(1)

Underlying EBITDA – Third party products (1) − 116 14 (1) − 129

Underlying EBITDA 4,061 4,550 11,129 4,067 (649) 23,158

Segment contribution to the Group’s Underlying EBITDA (2) 17% 19% 47% 17% 100%

Underlying EBITDA margin (3) 69% 46% 65% 45% 53%

Group and

Year ended 30 June 2018 unallocated

US$M items/

Restated Petroleum Copper Iron Ore Coal elimination (4) Total Group Directors’ Report

Revenue – Group production 5,396 11,432 14,756 8,887 1,222 41,693

Revenue – Third party products 12 1,349 54 2 19 1,436

Revenue 5,408 12,781 14,810 8,889 1,241 43,129

Underlying EBITDA – Group production (1) 3,392 6,462 8,929 4,398 (60) 23,121

Underlying EBITDA – Third party products (1) 1 60 1 (1) 1 62

Underlying EBITDA 3,393 6,522 8,930 4,397 (59) 23,183

Segment contribution to the Group’s Underlying EBITDA (2) 15% 28% 38% 19% 100%

Underlying EBITDA margin (3) 63% 57% 61% 49% 55%

(1) We differentiate sales of our production from sales of third party products to better measure the operational profitability of our operations as a percentage of revenue. Financial Statements

These tables show the breakdown between our production and third party products, which is necessary for the calculation of the Underlying EBITDA margin and

margin on third party products.

We engage in third party trading for the following reasons:

• Production variability and occasional shortfalls from our assets means that we sometimes source third party materials to ensure a steady supply of product

to our customers.

• To optimise our supply chain outcomes, we may buy physical product from third parties.

• To support the development of liquid markets, we will sometimes source third party physical product and manage risk through both the physical and

financial markets.

(2) Percentage contribution to Group Underlying EBITDA, excluding Group and unallocated items.

(3) Underlying EBITDA margin excludes third party products. 6

(4) Group and unallocated items includes functions, other unallocated operations, including Potash, Nickel West and legacy assets (previously disclosed as closed mines

in the Petroleum reportable segment), and consolidation adjustments. Comparative information for the year ended 30 June 2019 and 30 June 2018 have been restated

to reflect the inclusion of legacy assets in Group and unallocated items. Revenue not attributable to reportable segments comprises the sale of freight and fuel to third

parties. Exploration and technology activities are recognised within relevant segments. Additional information

Shareholder information

BHP Annual Report 2020 263