Page 262 - Annual Report 2020

P. 262

6.1 Alternative Performance Measures

We use various Alternative Performance Measures (APMs) to reflect The measures and below reconciliations included in this section

our underlying financial performance. for the year ended 30 June 2020 and comparative periods are

These APMs are not defined or specified under the requirements unaudited and have been derived from the Group’s Consolidated

of IFRS, but are derived from the Group’s Consolidated Financial Financial Statements.

Statements prepared in accordance with IFRS. The APMs are Exceptional items

consistent with how management review the financial performance To improve the comparability of underlying financial performance

of the Group with the Board and the investment community. between reporting periods, some of our APMs adjust the relevant

Sections 6.1.1 and 6.1.2 outlines why we believe the APMs are useful IFRS measures for exceptional items. For more information on

and the calculation methodology. We believe these APMs provide exceptional items, refer to note 3 ‘Exceptional items’ in section 5.1.

useful information, but they should not be considered as an Exceptional items are those gains or losses where their nature,

indication of or as a substitute for statutory measures as an including the expected frequency of the events giving rise to them,

indicator of actual operating performance (such as profit or net and impact is considered material to the Group’s Consolidated

operating cash flow) or any other measure of financial performance Financial Statements. The exceptional items included within the

or position presented in accordance with IFRS, or as a measure Group’s profit from Continuing and Discontinued operations for

of a company’s profitability, liquidity or financial position. the financial years are detailed below.

The following tables provide reconciliations between the APMs

and their nearest respective IFRS measure.

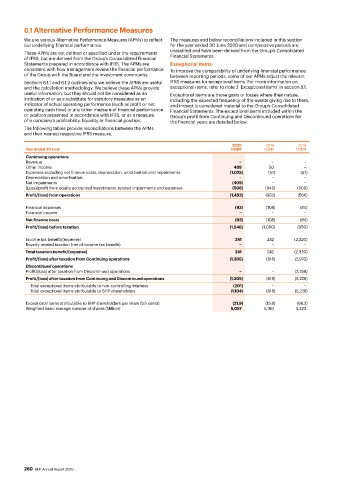

2020 2019 2018

Year ended 30 June US$M US$M US$M

Continuing operations

Revenue − − −

Other income 489 50 −

Expenses excluding net finance costs, depreciation, amortisation and impairments (1,025) (57) (57)

Depreciation and amortisation − − −

Net impairments (409) − −

(Loss)/profit from equity accounted investments, related impairments and expenses (508) (945) (509)

Profit/(loss) from operations (1,453) (952) (566)

Financial expenses (93) (108) (84)

Financial income − − −

Net finance costs (93) (108) (84)

Profit/(loss) before taxation (1,546) (1,060) (650)

Income tax benefit/(expense) 241 242 (2,320)

Royalty-related taxation (net of income tax benefit) − − −

Total taxation benefit/(expense) 241 242 (2,320)

Profit/(loss) after taxation from Continuing operations (1,305) (818) (2,970)

Discontinued operations

Profit/(loss) after taxation from Discontinued operations − − (2,258)

Profit/(loss) after taxation from Continuing and Discontinued operations (1,305) (818) (5,228)

Total exceptional items attributable to non-controlling interests (201) − −

Total exceptional items attributable to BHP shareholders (1,104) (818) (5,228)

Exceptional items attributable to BHP shareholders per share (US cents) (21.9) (15.8) (98.2)

Weighted basic average number of shares (Million) 5,057 5,180 5,323

260 BHP Annual Report 2020