Page 259 - Annual Report 2020

P. 259

5.7 Supplementary oil and gas information – unaudited continued

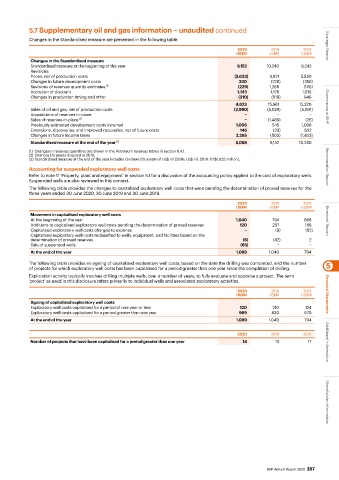

Changes in the Standardised measure are presented in the following table.

2020 2019 2018 Strategic Report

US$M US$M US$M

Changes in the Standardised measure

Standardised measure at the beginning of the year 9,152 10,240 8,242

Revisions:

Prices, net of production costs (5,633) 3,821 5,540

Changes in future development costs 330 (228) (358)

Revisions of reserves quantity estimates (1) (229) 1,268 (166)

Accretion of discount 1,313 1,178 1,016

Changes in production timing and other (310) (618) 946

4,623 15,661 15,220

Sales of oil and gas, net of production costs (2,980) (5,029) (5,091) Governance at BHP

Acquisitions of reserves-in-place − − −

Sales of reserves-in-place (2) − (1,489) (26)

Previously estimated development costs incurred 1,005 545 1,068

Extensions, discoveries, and improved recoveries, net of future costs 145 (33) 502

Changes in future income taxes 2,265 (503) (1,433)

Standardised measure at the end of the year (3) 5,058 9,152 10,240

(1) Changes in reserves quantities are shown in the Petroleum reserves tables in section 6.4.1.

(2) Onshore US assets disposal in 2019.

(3) Standardised measure at the end of the year includes Onshore US assets of US$ nil (2019: US$ nil; 2018: US$1,932 million).

Accounting for suspended exploratory well costs Remuneration Report

Refer to note 11 ‘Property, plant and equipment’ in section 5.1 for a discussion of the accounting policy applied to the cost of exploratory wells.

Suspended wells are also reviewed in this context.

The following table provides the changes to capitalised exploratory well costs that were pending the determination of proved reserves for the

three years ended 30 June 2020, 30 June 2019 and 30 June 2018.

2020 2019 2018

US$M US$M US$M

Movement in capitalised exploratory well costs

At the beginning of the year 1,040 794 668 Directors’ Report

Additions to capitalised exploratory well costs pending the determination of proved reserves 120 297 186

Capitalised exploratory well costs charged to expense − (9) (62)

Capitalised exploratory well costs reclassified to wells, equipment, and facilities based on the

determination of proved reserves (6) (42) 2

Sale of suspended wells (65) − −

At the end of the year 1,089 1,040 794

The following table provides an ageing of capitalised exploratory well costs, based on the date the drilling was completed, and the number 5

of projects for which exploratory well costs has been capitalised for a period greater than one year since the completion of drilling.

Exploration activity typically involves drilling multiple wells, over a number of years, to fully evaluate and appraise a project. The term

‘project’ as used in this disclosure refers primarily to individual wells and associated exploratory activities.

2020 2019 2018

US$M US$M US$M Financial Statements

Ageing of capitalised exploratory well costs

Exploratory well costs capitalised for a period of one year or less 120 210 124

Exploratory well costs capitalised for a period greater than one year 969 830 670

At the end of the year 1,089 1,040 794

2020 2019 2018

Number of projects that have been capitalised for a period greater than one year 14 13 17 Additional information

Shareholder information

BHP Annual Report 2020 257