Page 256 - Annual Report 2020

P. 256

5.7 Supplementary oil and gas information – unaudited

In accordance with the requirements of the Financial Accounting Standards Board (FASB) Accounting Standard Codification ‘Extractive

Activities-Oil and Gas’ (Topic 932) and SEC requirements set out in Subpart 1200 of Regulation S-K, the Group is presenting certain disclosures

about its oil and gas activities. These disclosures are presented below as supplementary oil and gas information, in addition to information

disclosed in section 1.11.1 ‘Petroleum’ and section 6.4.1 ‘Petroleum reserves’.

The information set out in this section is referred to as unaudited as it is not included in the scope of the audit opinion of the independent

auditor on the Financial Statements, refer to section 5.6 ‘Independent Auditors’ reports’.

On 28 September 2018, BHP completed the sale of 100 per cent of the issued share capital of BHP Billiton Petroleum (Arkansas) Inc. and

100 per cent of the membership interests in BHP Billiton Petroleum (Fayetteville) LLC, which held the Fayetteville assets. On 31 October 2018,

BHP completed the sale of 100 per cent of the issued share capital of Petrohawk Energy Corporation, the BHP subsidiary which held the

Eagle Ford (being Black Hawk and Hawkville), Haynesville and Permian assets. The financial and non-financial impact of the Onshore US assets

is included in the supplementary oil and gas information presented below. The financial and non-financial impact of these assets has been

footnoted beneath each applicable table. Refer to note 28 ‘Discontinued operations’ in Section 5.1 for further information.

Reserves and production

Proved oil and gas reserves and net crude oil and condensate, natural gas, LNG and NGL production information is included in section 6.3.2

‘Production – Petroleum’ and section 6.4.1 ‘Petroleum reserves’.

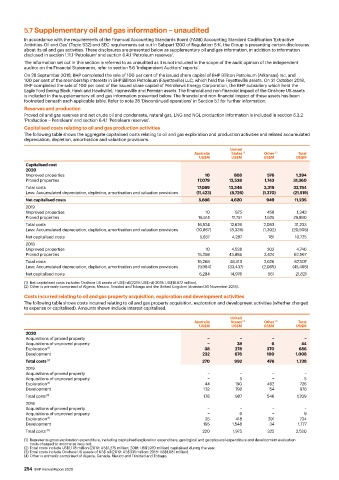

Capitalised costs relating to oil and gas production activities

The following table shows the aggregate capitalised costs relating to oil and gas exploration and production activities and related accumulated

depreciation, depletion, amortisation and valuation provisions.

United

Australia States (1) Other (2) Total

US$M US$M US$M US$M

Capitalised cost

2020

Unproved properties 10 808 576 1,394

Proved properties 17,079 12,538 1,743 31,360

Total costs 17,089 13,346 2,319 32,754

Less: Accumulated depreciation, depletion, amortisation and valuation provisions (11,423) (8,726) (1,370) (21,519)

Net capitalised costs 5,666 4,620 949 11,235

2019

Unproved properties 10 875 458 1,343

Proved properties 16,514 11,751 1,625 29,890

Total costs 16,524 12,626 2,083 31,233

Less: Accumulated depreciation, depletion, amortisation and valuation provisions (10,867) (8,339) (1,302) (20,508)

Net capitalised costs 5,657 4,287 781 10,725

2018

Unproved properties 10 4,528 202 4,740

Proved properties 16,258 43,885 2,424 62,567

Total costs 16,268 48,413 2,626 67,307

Less: Accumulated depreciation, depletion, amortisation and valuation provisions (9,984) (33,437) (2,065) (45,486)

Net capitalised costs 6,284 14,976 561 21,821

(1) Net capitalised costs includes Onshore US assets of US$ nil (2019: US$ nil; 2018: US$10,672 million).

(2) Other is primarily comprised of Algeria, Mexico, Trinidad and Tobago and the United Kingdom (divested 30 November 2018).

Costs incurred relating to oil and gas property acquisition, exploration and development activities

The following table shows costs incurred relating to oil and gas property acquisition, exploration and development activities (whether charged

to expense or capitalised). Amounts shown include interest capitalised.

United

Australia States (3) Other (4) Total

US$M US$M US$M US$M

2020

Acquisitions of proved property − − − −

Acquisitions of unproved property − 38 6 44

Exploration (1) 38 278 370 686

Development 232 676 100 1,008

Total costs (2) 270 992 476 1,738

2019

Acquisitions of proved property − − − −

Acquisitions of unproved property − 5 − 5

Exploration (1) 44 190 492 726

Development 132 792 54 978

Total costs (2) 176 987 546 1,709

2018

Acquisitions of proved property − − − −

Acquisitions of unproved property − 9 − 9

Exploration (1) 25 418 291 734

Development 195 1,548 34 1,777

Total costs (2) 220 1,975 325 2,520

(1) Represents gross exploration expenditure, including capitalised exploration expenditure, geological and geophysical expenditure and development evaluation

costs charged to income as incurred.

(2) Total costs include US$1,178 million (2019: US$1,275 million; 2018: US$1,970 million) capitalised during the year.

(3) Total costs include Onshore US assets of US$ nil (2019: US$331 million; 2018: US$1,081 million).

(4) Other is primarily comprised of Algeria, Canada, Mexico and Trinidad and Tobago.

254 BHP Annual Report 2020