Page 258 - Annual Report 2020

P. 258

5.7 Supplementary oil and gas information – unaudited continued

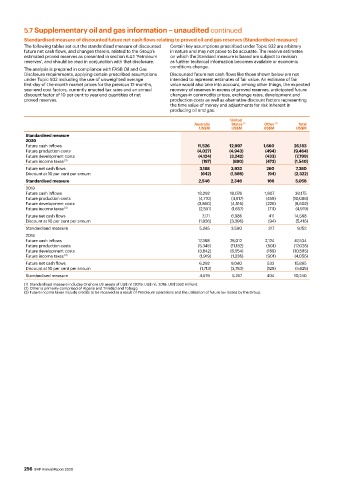

Standardised measure of discounted future net cash flows relating to proved oil and gas reserves (Standardised measure)

The following tables set out the standardised measure of discounted Certain key assumptions prescribed under Topic 932 are arbitrary

future net cash flows, and changes therein, related to the Group’s in nature and may not prove to be accurate. The reserve estimates

estimated proved reserves as presented in section 6.4.1 ‘Petroleum on which the Standard measure is based are subject to revision

reserves’, and should be read in conjunction with that disclosure. as further technical information becomes available or economic

The analysis is prepared in compliance with FASB Oil and Gas conditions change.

Disclosure requirements, applying certain prescribed assumptions Discounted future net cash flows like those shown below are not

under Topic 932 including the use of unweighted average intended to represent estimates of fair value. An estimate of fair

first-day-of-the-month market prices for the previous 12-months, value would also take into account, among other things, the expected

year-end cost factors, currently enacted tax rates and an annual recovery of reserves in excess of proved reserves, anticipated future

discount factor of 10 per cent to year end quantities of net changes in commodity prices, exchange rates, development and

proved reserves. production costs as well as alternative discount factors representing

the time value of money and adjustments for risk inherent in

producing oil and gas.

United

Australia States (1) Other (2) Total

US$M US$M US$M US$M

Standardised measure

2020

Future cash inflows 11,526 12,997 1,660 26,183

Future production costs (4,027) (4,943) (494) (9,464)

Future development costs (4,124) (3,242) (433) (7,799)

Future income taxes (187) (880) (473) (1,540)

(3)

Future net cash flows 3,188 3,932 260 7,380

Discount at 10 per cent per annum (642) (1,586) (94) (2,322)

Standardised measure 2,546 2,346 166 5,058

2019

Future cash inflows 18,292 18,076 1,807 38,175

Future production costs (4,710) (4,917) (459) (10,086)

Future development costs (3,860) (4,516) (226) (8,602)

(3)

Future income taxes (2,551) (1,657) (711) (4,919)

Future net cash flows 7,171 6,986 411 14,568

Discount at 10 per cent per annum (1,926) (3,396) (94) (5,416)

Standardised measure 5,245 3,590 317 9,152

2018

Future cash inflows 17,398 28,012 2,124 47,534

Future production costs (5,345) (11,182) (501) (17,028)

Future development costs (3,842) (6,554) (189) (10,585)

Future income taxes (3) (1,919) (1,236) (901) (4,056)

Future net cash flows 6,292 9,040 533 15,865

Discount at 10 per cent per annum (1,713) (3,783) (129) (5,625)

Standardised measure 4,579 5,257 404 10,240

(1) Standardised measure includes Onshore US assets of US$ nil (2019: US$ nil; 2018: US$1,932 million).

(2) Other is primarily comprised of Algeria and Trinidad and Tobago.

(3) Future income taxes include credits to be received as a result of Petroleum operations and the utilisation of future tax losses by the Group.

256 BHP Annual Report 2020