Page 257 - Annual Report 2020

P. 257

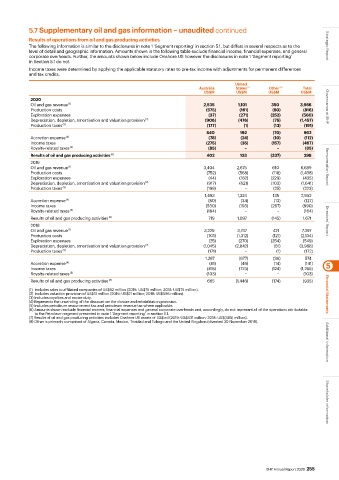

5.7 Supplementary oil and gas information – unaudited continued

Results of operations from oil and gas producing activities

The following information is similar to the disclosures in note 1 ‘Segment reporting’ in section 5.1, but differs in several respects as to the Strategic Report

level of detail and geographic information. Amounts shown in the following table exclude financial income, financial expenses, and general

corporate overheads. Further, the amounts shown below include Onshore US however the disclosures in note 1 ‘Segment reporting’

in Section 5.1 do not.

Income taxes were determined by applying the applicable statutory rates to pre-tax income with adjustments for permanent differences

and tax credits.

United

Australia States (7) Other (8) Total

US$M US$M US$M US$M

2020

Oil and gas revenue (1) 2,535 1,101 350 3,986

Production costs (575) (161) (80) (816) Governance at BHP

Exploration expenses (37) (271) (252) (560)

Depreciation, depletion, amortisation and valuation provision (2) (906) (476) (75) (1,457)

Production taxes (3) (177) (1) (13) (191)

840 192 (70) 962

Accretion expense (4) (78) (24) (10) (112)

Income taxes (275) (35) (157) (467)

Royalty-related taxes (5) (85) − − (85)

Results of oil and gas producing activities (6) 402 133 (237) 298

2019

Oil and gas revenue (1) 3,404 2,675 610 6,689 Remuneration Report

Production costs (752) (568) (118) (1,438)

Exploration expenses (44) (162) (229) (435)

Depreciation, depletion, amortisation and valuation provision (2) (917) (621) (103) (1,641)

Production taxes (3) (198) − (25) (223)

1,493 1,324 135 2,952

Accretion expense (4) (80) (34) (13) (127)

Income taxes (530) (193) (267) (990)

Royalty-related taxes (5) (164) − − (164)

Results of oil and gas producing activities (6) 719 1,097 (145) 1,671

2018 Directors’ Report

Oil and gas revenue (1) 3,229 3,747 421 7,397

Production costs (701) (1,312) (121) (2,134)

Exploration expenses (25) (270) (254) (549)

Depreciation, depletion, amortisation and valuation provision (2) (1,045) (2,842) (81) (3,968)

Production taxes (3) (171) − (1) (172)

1,287 (677) (36) 574

Accretion expense (4) (81) (46) (14) (141) 5

Income taxes (418) (723) (124) (1,265)

Royalty-related taxes (5) (103) − − (103)

Results of oil and gas producing activities (6) 685 (1,446) (174) (935)

(1) Includes sales to affiliated companies of US$62 million (2019: US$75 million; 2018: US$75 million).

(2) Includes valuation provision of US$12 million (2019: US$21 million; 2018: US$596 million). Financial Statements

(3) Includes royalties and excise duty.

(4) Represents the unwinding of the discount on the closure and rehabilitation provision.

(5) Includes petroleum resource rent tax and petroleum revenue tax where applicable.

(6) Amounts shown exclude financial income, financial expenses and general corporate overheads and, accordingly, do not represent all of the operations attributable

to the Petroleum segment presented in note 1 ‘Segment reporting’ in section 5.1.

(7) Results of oil and gas producing activities includes Onshore US assets of US$ nil (2019: US$431 million; 2018: US$(465) million).

(8) Other is primarily comprised of Algeria, Canada, Mexico, Trinidad and Tobago and the United Kingdom (divested 30 November 2018). Additional information

BHP Annual Report 2020 255 Shareholder information