Page 351 - Annual Report 2020

P. 351

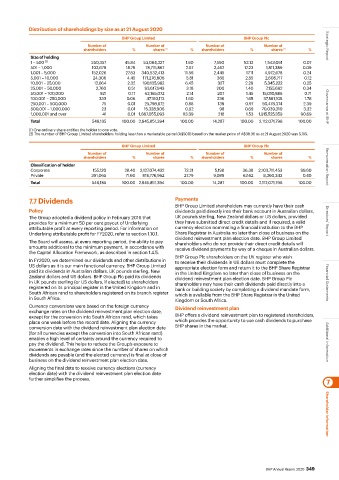

Distribution of shareholdings by size as at 21 August 2020

BHP Group Limited BHP Group Plc

Number of Number of Number of Number of Strategic Report

shareholders % shares (1) % shareholders % shares (1) %

Size of holding

1 – 500 (2) 250,357 45.84 53,064,327 1.80 7,590 53.13 1,543,091 0.07

501 – 1,000 102,679 18.79 78,715,867 2.67 2,462 17.23 1,811,389 0.09

1,001 – 5,000 152,026 27.83 340,532,413 11.56 2,445 17.11 4,972,678 0.24

5,001 – 10,000 24,306 4.45 171,276,806 5.81 365 2.55 2,608,717 0.12

10,001 – 25,000 12,664 2.32 190,135,982 6.45 327 2.29 5,345,222 0.25

25,001 – 50,000 2,760 0.51 93,617,943 3.18 200 1.40 7,155,662 0.34

50,001 – 100,000 921 0.17 63,165,072 2.14 207 1.45 15,010,886 0.71

100,001 – 250,000 333 0.06 47,160,113 1.60 236 1.65 37,581,108 1.78

250,001 – 500,000 75 0.01 25,798,872 0.88 139 0.97 50,478,374 2.39

500,001 – 1,000,000 23 0.01 15,328,906 0.52 98 0.69 70,039,310 3.32 Governance at BHP

1,000,001 and over 41 0.01 1,867,055,093 63.39 218 1.53 1,915,525,359 90.69

Total 546,185 100.00 2,945,851,394 100.00 14,287 100.00 2,112,071,796 100.00

(1) One ordinary share entitles the holder to one vote.

(2) The number of BHP Group Limited shareholders holding less than a marketable parcel (A$500) based on the market price of A$38.36 as at 21 August 2020 was 5,195.

BHP Group Limited BHP Group Plc

Number of Number of Number of Number of

shareholders % shares % shareholders % shares %

Classification of holder Remuneration Report

Corporate 155,120 28.40 2,127,074,432 72.21 5,198 36.38 2,103,711,453 99.60

Private 391,065 71.60 818,776,962 27.79 9,089 63.62 8,360,343 0.40

Total 546,185 100.00 2,945,851,394 100.00 14,287 100.00 2,112,071,796 100.00

7.7 Dividends Payments

BHP Group Limited shareholders may currently have their cash

Policy dividends paid directly into their bank account in Australian dollars,

The Group adopted a dividend policy in February 2016 that UK pounds sterling, New Zealand dollars or US dollars, provided

provides for a minimum 50 per cent payout of Underlying they have submitted direct credit details and if required, a valid Directors’ Report

attributable profit at every reporting period. For information on currency election nominating a financial institution to the BHP

Underlying attributable profit for FY2020, refer to section 1.10.1. Share Registrar in Australia no later than close of business on the

The Board will assess, at every reporting period, the ability to pay dividend reinvestment plan election date. BHP Group Limited

shareholders who do not provide their direct credit details will

amounts additional to the minimum payment, in accordance with receive dividend payments by way of a cheque in Australian dollars.

the Capital Allocation Framework, as described in section 1.4.5.

In FY2020, we determined our dividends and other distributions in BHP Group Plc shareholders on the UK register who wish

to receive their dividends in US dollars must complete the

US dollars as it is our main functional currency. BHP Group Limited appropriate election form and return it to the BHP Share Registrar

paid its dividends in Australian dollars, UK pounds sterling, New in the United Kingdom no later than close of business on the

Zealand dollars and US dollars. BHP Group Plc paid its dividends dividend reinvestment plan election date. BHP Group Plc

in UK pounds sterling (or US dollars, if elected) to shareholders shareholders may have their cash dividends paid directly into a Financial Statements

registered on its principal register in the United Kingdom and in bank or building society by completing a dividend mandate form,

South African rand to shareholders registered on its branch register which is available from the BHP Share Registrar in the United

in South Africa. Kingdom or South Africa.

Currency conversions were based on the foreign currency Dividend reinvestment plan

exchange rates on the dividend reinvestment plan election date,

except for the conversion into South African rand, which takes BHP offers a dividend reinvestment plan to registered shareholders,

place one week before the record date. Aligning the currency which provides the opportunity to use cash dividends to purchase

conversion date with the dividend reinvestment plan election date BHP shares in the market.

(for all currencies except the conversion into South African rand)

enables a high level of certainty around the currency required to

pay the dividend. This helps to reduce the Group’s exposure to Additional information

movements in exchange rates since the number of shares on which

dividends are payable (and the elected currency) is final at close of

business on the dividend reinvestment plan election date.

Aligning the final date to receive currency elections (currency

election date) with the dividend reinvestment plan election date

further simplifies the process.

7

Shareholder information

BHP Annual Report 2020 349