Page 296 - Annual Report 2020

P. 296

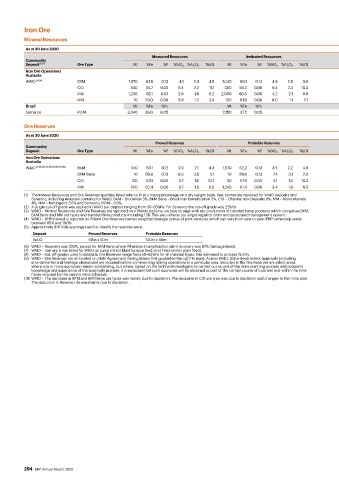

Iron Ore

Mineral Resources

As at 30 June 2020 As at 30 June 2019

Measured Resources Indicated Resources Inferred Resources Total Resources BHP Total Resources

Commodity Interest

Deposit (1) (2) Ore Type Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI % Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI

Iron Ore Operations

Australia

WAIO (3) (4) BKM 1,870 61.5 0.13 4.1 2.4 4.8 5,140 60.1 0.14 4.9 2.5 5.9 13,070 58.9 0.14 5.6 2.7 6.7 20,080 59.5 0.14 5.3 2.6 6.3 88 19,650 59.6 0.14 5.2 2.6 6.3

CID 540 55.7 0.05 6.4 2.2 11.1 360 56.3 0.06 6.4 2.3 10.3 920 54.9 0.06 6.7 2.9 11.0 1,810 55.4 0.06 6.6 2.6 10.9 1,850 55.4 0.06 6.6 2.6 10.9

MM 1,230 62.1 0.07 2.8 1.6 6.2 2,060 60.3 0.06 4.2 2.1 6.9 4,800 59.7 0.07 4.5 2.3 7.1 8,090 60.2 0.07 4.2 2.1 6.9 8,140 60.2 0.07 4.2 2.1 6.9

NIM 10 59.0 0.08 10.1 1.2 3.9 120 61.6 0.06 8.0 1.1 1.7 70 60.4 0.05 10.0 1.2 1.7 200 61.1 0.06 8.8 1.2 1.8 200 61.1 0.06 8.8 1.2 1.8

Brazil Mt %Fe %Pc Mt %Fe %Pc Mt %Fe %Pc Mt %Fe %Pc Mt %Fe %Pc

Samarco ROM 3,340 39.0 0.05 2,150 37.2 0.05 950 37.2 0.06 6,440 38.1 0.05 50 6,440 38.1 0.05

Ore Reserves

As at 30 June 2020 As at 30 June 2019

Proved Reserves Probable Reserves Total Reserves Reserve BHP Total Reserves Reserve

Commodity Life Interest Life

Deposit Ore Type Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI (years) % Mt %Fe %P %SiO 2 %Al 2 O 3 %LOI (years)

Iron Ore Operations

Australia

WAIO (1) (3) (4) (5) (6) (7) (8) (9) (10) BKM 910 63.1 0.12 2.9 2.1 4.3 1,570 62.2 0.13 3.5 2.2 4.8 2,480 62.5 0.13 3.3 2.2 4.6 15 88 2,710 62.3 0.13 3.4 2.2 4.6 17

BKM Bene 10 59.8 0.13 6.9 3.5 2.1 10 59.6 0.13 7.4 3.1 2.0 30 59.7 0.13 7.1 3.3 2.0 40 59.5 0.13 7.3 3.3 2.1

CID 120 57.0 0.05 5.7 1.6 10.7 30 57.9 0.05 5.1 1.5 10.3 150 57.2 0.05 5.5 1.5 10.6 300 56.7 0.04 6.4 1.5 10.6

MM 560 62.4 0.06 2.7 1.5 6.0 1,240 61.4 0.06 3.4 1.8 6.5 1,800 61.7 0.06 3.1 1.7 6.3 1,760 61.8 0.06 3.1 1.7 6.3

(1) The Mineral Resources and Ore Reserves qualities listed refer to in situ mass percentage on a dry weight basis. Wet tonnes are reported for WAIO deposits and

Samarco, including moisture contents for WAIO: BKM – Brockman 3%, BKM Bene – Brockman Beneficiation 3%, CID – Channel Iron Deposits 8%, MM – Marra Mamba

4%, NIM – Nimingarra 3.5% and Samarco: ROM – 6.5%.

(2) A single cut-off grade was applied in WAIO per deposit ranging from 50–55%Fe. For Samarco the cut-off grade was 22%Fe.

(3) WAIO – Mineral Resources and Ore Reserves are reported on a Pilbara basis by ore type to align with our production of blended lump products which comprises BKM,

BKM Bene and MM ore types and blended fines products including CID. This also reflects our single logistics chain and associated management system.

(4) WAIO – BHP interest is reported as Pilbara Ore Reserves tonnes weighted average across all joint ventures which can vary from year to year. BHP ownership varies

between 85% and 100%.

(5) Approximate drill hole spacings used to classify the reserves were:

Deposit Proved Reserves Probable Reserves

WAIO 50m x 50m 150m x 50m

(6) WAIO – Recovery was 100%, except for BKM Bene where Whaleback beneficiation plant recovery was 87% (tonnage basis).

(7) WAIO – Iron ore is marketed for WAIO as Lump (direct blast furnace feed) and Fines (sinter plant feed).

(8) WAIO – Cut-off grades used to estimate Ore Reserves range from 50–62%Fe for all material types. Ore delivered to process facility.

(9) WAIO – Ore Reserves are all located on State Agreement mining leases that guarantee the right to mine. Across WAIO, State Government approvals (including

environmental and heritage clearances) are required before commencing mining operations in a particular area. Included in the Ore Reserves are select areas

where one or more approvals remain outstanding, but where, based on the technical investigations carried out as part of the mine planning process and company

knowledge and experience of the approvals process, it is expected that such approvals will be obtained as part of the normal course of business and within the time

frame required by the current mine schedule.

(10) WAIO – The decrease in BKM and BKM Bene ore types was mainly due to depletion. The decrease in CID ore type was due to depletion and changes to the mine plan.

The reduction in Reserve Life was mainly due to depletion.

294 BHP Annual Report 2020