Page 235 - Annual Report 2020

P. 235

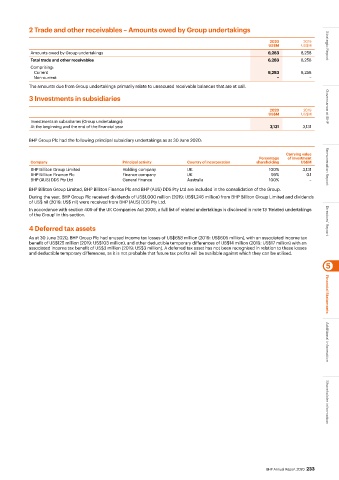

2 Trade and other receivables – Amounts owed by Group undertakings

2020 2019

US$M US$M Strategic Report

Amounts owed by Group undertakings 6,283 8,258

Total trade and other receivables 6,283 8,258

Comprising:

Current 6,283 8,258

Non-current − −

The amounts due from Group undertakings primarily relate to unsecured receivable balances that are at call.

3 Investments in subsidiaries

2020 2019 Governance at BHP

US$M US$M

Investments in subsidiaries (Group undertakings):

At the beginning and the end of the financial year 3,131 3,131

BHP Group Plc had the following principal subsidiary undertakings as at 30 June 2020:

Carrying value

Percentage of investment

Company Principal activity Country of incorporation shareholding US$M

BHP Billiton Group Limited Holding company UK 100% 3,131 Remuneration Report

BHP Billiton Finance Plc Finance company UK 99% 0.1

BHP (AUS) DDS Pty Ltd General finance Australia 100% –

BHP Billiton Group Limited, BHP Billiton Finance Plc and BHP (AUS) DDS Pty Ltd are included in the consolidation of the Group.

During the year, BHP Group Plc received dividends of US$1,000 million (2019: US$1,246 million) from BHP Billiton Group Limited and dividends

of US$ nil (2019: US$ nil) were received from BHP (AUS) DDS Pty Ltd.

In accordance with section 409 of the UK Companies Act 2006, a full list of related undertakings is disclosed in note 13 ‘Related undertakings

of the Group’ in this section.

4 Deferred tax assets Directors’ Report

As at 30 June 2020, BHP Group Plc had unused income tax losses of US$658 million (2019: US$605 million), with an associated income tax

benefit of US$125 million (2019: US$103 million), and other deductible temporary differences of US$14 million (2019: US$17 million) with an

associated income tax benefit of US$3 million (2019: US$3 million). A deferred tax asset has not been recognised in relation to these losses

and deductible temporary differences, as it is not probable that future tax profits will be available against which they can be utilised.

5

Financial Statements

Additional information

BHP Annual Report 2020 233 Shareholder information